Heads Up Investors! The Implications of Evolving Audit Services

Auditors have a role in ensuring the reliability of information reported by companies. As such, their work contributes to the efficient functioning of capital markets. Nevertheless, many corporate outsiders perceive audits as behind-the-scenes, black-box activities to which beneficiaries including investors tend to pay close attention only when failures occur. It is similar to how consumers of a utility service take it for granted and give it little attention until there is service disruption. Consequently, there is typically an adverse market reaction to evidence or indications of audit failure — for example, when companies are discovered to have “cooked” their books (Enron, Toshiba, Tesco, etc.).

Putting aside cases in which there is irrefutable evidence of auditor culpability in company misreporting, criticism of auditors sometimes reflects a lack of clarity in the scope and intended purpose of specific audit methodologies. Basically, even after disclosure of the undertaken audit approach (i.e. coverage, scope, and selected procedures), it remains hard for a reader of financial statements to make precise inferences about the level of assurance on the reliability of reported financial information. Not to mention that information about audit approaches has only started to be communicated via the enhanced auditor report, which, incidentally, is only required in a few jurisdictions (e.g., the United Kingdom). The lack of clarity on the implications of scope and purpose of audit procedures can thus result in an “expectation gap,” based on a difference between the real and perceived role of auditors.

The Audit-Quality Imperative

The expectation gap notwithstanding, the long-term relevance and credibility of auditors depends on their ability to always exercise professional scepticism and to display competence in auditing the full spectrum of evolving and increasingly complex business models, financial transactions, and accounting standards, which are increasingly judgement intensive (e.g., revenue recognition) and include forward looking information (e.g., financial assets impairment) and line items with measurement uncertainty due to fair value accounting. In other words, it is increasingly challenging to ensure audit quality.

Investors have significant stakes in the question of relevance, evolution, and quality of audits. As such, investors should be alert to the evolution of audit services driven by the demand for broader services and by developments in technology and data analytics and assess whether these developments enhance audit quality.

Increasingly, auditors are expected to have a bigger and more effective role in ensuring the integrity of a wider array of company reported information that is material to investment decision making. For many investors, it is not always clear whether or to what extent information in corporate reports, but outside financial statements, has been audited.

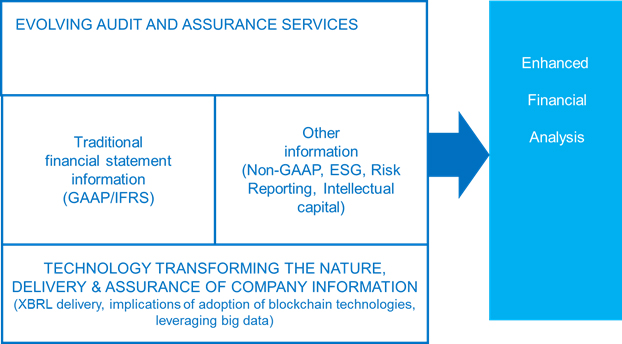

Unsurprisingly, the question of how to enhance the value of audit services and ensure audit quality is an ongoing consideration for both the audit profession and related regulatory bodies. As delineated in the figure below, there is an anticipation of an inevitable evolution of audit services that will have implications for the company information available to investors.

The following factors will likely shape future audit services:

- Increased scope: As noted in a recent blog, there is a widening spectrum of useful company information that investors can factor into their decision making. Correspondingly, there is an increasing investor appetite for the assurance of the useful information communicated outside of the main financial statements, including non-GAAP measures and environmental, social, and governance (ESG) information. CFA Institute member survey results reported in Bridging the Gap: Ensuring Effective Non-GAAP and Performance Reporting showed that 80% of respondents expected some form of assurance on non-GAAP measures. Similarly, our 2015 ESG investment guide and survey highlighted that 69% of respondents supported the need for independent verification of ESG information.

- Adapting to changing company information platforms: Technology-driven changes in company information architecture range from the enhanced delivery of structured data as reported in a recent CFA Institute report (Data and Technology: Transforming the Financial Information Landscape) to the adoption of blockchain technologies in the recording of company financial information, as discussed by EY’s Jeanne Boillet — Blockchain: Should CFOs Believe the Hype? If (and that is a big if) blockchain technologies are ultimately widely adopted in a radical, fundamental, and disruptive fashion, as suggested by many market commentators, there could be some revolutionary impact, including the need for continuous audit and for investors to have real-time access to company financial information.

- Leveraging technology while conducting audits: An excellent Journal of Accountancy article by Jon Raphael lays out the possibilities and enhancements in audit methodology and audit evidence that are driven by the development of different strands of technology and data analytics, which includes artificial intelligence and machine-language programming, workflow automation, enhanced analytics (descriptive, predictive, diagnostic, and prescriptive analytics), and mobile technologies. The possibilities that enhanced technology and data analytics present to auditors include enhancing business-risk assessment, a potential to focus on providing companies with value-added business insights, scope to extend the level of audit testing with a more effective identification of anomalies, and the opportunity to eliminate several routine and manual aspects of gathering audit evidence (e.g., dispensing of the need to conduct physical, in-person counts of company inventory and eliminating the need for auditors to pore over huge volumes of complex contractual documents, such as leases and derivatives contracts). In effect, developments in technology and data analytics can be a driver of enhanced audit quality.

Making Sense of the Prospective Changes

Although there is a demonstrable appetite for widening the scope of audit services, questions revolve around the appropriate framework for nontraditional engagements, such as ensuring the reliability of non-GAAP and ESG information. There is also a question of whether it is appropriate to extend the scope of audit services while there are still significant deficiencies in current audits of financial statement information, as highlighted by the recently released International Federation of Audit Regulators (IFIAR) report on audit inspection findings. The report reveals 42% of 855 public interest entities’ audits had at least one inspection finding.

Similarly, commentary on prospective technologies, including those discussed in this article, carry the risk of overhyping the enhancement possibilities; it is often sensible for investors to take a “wait-and-see” approach. But this should not mean burying heads in the sand and just assuming a business-as-usual stance either. The following are questions that investors should continually consider:

- How mainstream and globally widespread will be the adoption of the anticipated technology-driven changes in reporting and ensuring reliability of company information? Will there be multiple tiers of audit offerings (“New World” versus “Old World” audits) depending on the technological capabilities of companies?

- With the potential disruption arising from blockchain technologies possibly increasing investors’ access to company financial information and transforming the type of audit that is required, how will such changes, if they ever occur, impact the provision of the contextualized, periodic, and relatively standardized information that is currently communicated/filed by companies and which investors find useful?

- If real-time access to company transaction information is granted and investors can generate reports at whatever frequency suits their needs, is such a shift in responsibilities for preparing the annual report — from companies to investors — desirable for the broad universe of capital market participants?

- Will companies’ concerns about disclosing proprietary information and incentives to manage the perception of performance vanish, or will these factors present an impediment to the adoption of these technologies?

- If, how far, and when will the regulatory model for financial and nonfinancial information and audit services need to change?

- What skills will auditors of the future need to ensure audit quality in a transformed, technology-driven landscape?

Skills of Future Auditors

There is increasing consensus that it is unlikely computers will fully take over the role of humans in conducting audits. Instead, auditors need to retool themselves by enhancing their data analytics and artificial intelligence competencies to tap into the ongoing technological innovation. But increasing skills needs to go beyond refining the already existing computer assisted audit interrogation tests (CAATs) — as highlighted in a recent blog post: The DAWG and CAATS: Incorporating the Use of Data Analytics in Audit Standards.

Interestingly, as reported in a recently released CFA Institute study on the Future State of the Investment Profession, there are analogous conversations being held with respect to the skills future investment professionals will need — particularly in regard to the interplay between technology, data science, and financial analysis skills. The study shows that although the acquisition of enhanced data science skills is recognized as important, and computers could replace portions of the workforce engaged in routine activities, the notion of robo-investment advisers fully replacing investment professionals is most likely hype. The most important skills will still be human-based judgment, strategic thinking, and relationship-building skills.

To summarize, we are likely at an inflection point or on the cusp of a revolution in the provision of reported company information. Correspondingly, audit services will likely change, and investors will need to be alert to, adapt to, and capitalize on these changes.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/Monty Rakusen