Hontex IPO: How Did It Happen and Who’s to Blame?

“You may face difficulties in protecting your interests because we are incorporated under Cayman Islands law and Cayman Islands law may provide different protection to minority shareholders than the laws of Hong Kong and other jurisdictions”. This is a quote from the IPO prospectus of Hontex International Holdings Company Ltd., a manufacturer of fabrics for sports and leisure apparel from internationally renowned labels, such as Decathlon, Kappa, and Mizuno. As a multi-national firm it has been incorporated in the Cayman Islands, has its manufacturing assets in mainland China, has board members from Taiwan, and was listed on the Hong Kong Stock Exchange (HKEX) on Christmas Eve in 2009.

After just three months of trading, shares of Hontex were suspended following an application by Hong Kong’s Securities and Futures Commission (SFC) for a court order to freeze the roughly 1 billion in Hong Kong dollars (approximately 130 million in U.S. dollars) Hontex had raised. Now, two and a half years later, the SFC won a court order for Hontex to repurchase the shares held by its minority shareholders.

Overstatement of Sales and Profits

According to a press release issued by the SFC last week, Hontex acknowledged that it had been reckless in allowing materially false and misleading information to be included in its prospectus. It agreed that the amounts for turnover and profit before tax, as well as cash and cash equivalents and the number of franchise stores stated in its IPO prospectus were materially false and misleading. It was this acknowledgement that helped end a lengthy legal process involving the SFC and Hontex.

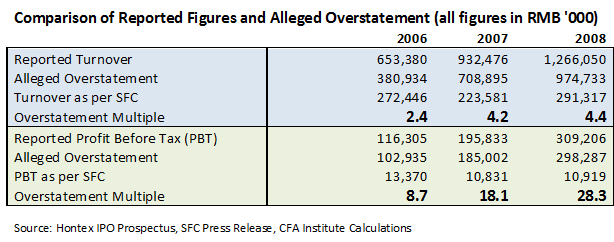

The magnitude of the alleged misrepresentation is presented in the table below. It shows the degree of inflation of turnover and profit before tax, as presented in the IPO prospectus, which is the most important document available to an investor considering whether or not to participate in a public share offering.

As can be seen in the above comparison, the alleged overstatement of its financial status by Hontex at the time of the public offering was a multiple of actual values. Profit before taxes, for example — a widely used figure by financial analysts for corporate valuations — was allegedly overstated by a factor of over 28 in 2008.

Who Is Responsible?

The directors of the company, the auditors who prepared the three-year financial information leading to the IPO, and the sponsors who are responsible for due diligence each have a role to ensure that the information disclosed in the prospectus is fair and accurate.

During the court proceedings there were a number of noteworthy developments involving various parties. In May 2010, for example, Hontex announced that it had accepted the resignation of auditor KPMG, which incidentally was Hontex’s auditor during the IPO preparation process. In December 2011, Morison Heng, which replaced KPMG as auditor, resigned as well.

Hontex’s sole IPO sponsor, Mega Capital, was the major casualty, however. The SFC fined it the record sum of 42 million in Hong Kong dollars, and revoked its license due to inadequate and substandard due diligence work, failure to act independently and impartially, and other failures to discharge its sponsor duties. In addition, in June 2012 the SFC announced that it had revoked the license of a former managing director at Mega Capital for a variety of failures, including the filing of an untrue declaration with the HKEX.

This is a landmark case in Hong Kong where proceeds from an IPO have to be returned to shareholders by court order, following acknowledgement by Hontex that it had contravened section 298 of the Securities and Futures Ordinance (SFO). This section is a market misconduct provision, and it prohibits the distribution of materially false or misleading information that is likely to induce another person to subscribe or buy securities if the distributor of that information knows or is reckless as to whether the information is false or misleading. The unprecedented outcome is the result of intensive efforts by the SFC to protect investors from being misled by untrue information in IPO prospectuses. In the process, the SFC faced numerous challenges, and the judge questioned whether the Court of First Instance has jurisdiction to determine whether a person has violated provisions of the SFO and the Hong Kong Companies Ordinance before it has gone to the Market Misconduct Tribunal.

The court ruling will provide shareholders an opportunity to vote on a resolution to make the repurchase offer in the next few weeks. Hontex will buy back shares from around 7,700 eligible shareholders at a price of 2.06 Hong Kong dollars, the final traded price of the stock, but is subject to shareholder approval as required by Cayman Islands law. The repurchase offer will not be made to the controlling shareholders who have agreed to abstain from voting on the repurchase resolution. The SFC, in its press release, thanked the China Securities Regulatory Commission (CSRC), which signifies the importance of cross-border cooperation in enforcement when multi-jurisdictional listings are a common feature of Asian stock markets.

If you liked this post, consider subscribing to Market Integrity Insights.