How the Investment Industry Can Facilitate SME Access to Finance in Europe

Commissioner Barnier’s recent speech on long-term investment at a CFA Institute event in Brussels represents one of the last initiatives under his tenure as European commissioner for internal market and services, and it reflects a switch in stance from financial stability to promoting European growth. The financial sector has been subject to major reform and there is no question that the EU economy is in need of measures to relaunch economic growth and encourage more long-term sustainable investment. These measures are expected to focus on supporting the small and medium-sized enterprise (SME) sector as well as providing finance for innovation-led sustainable projects and activities.

One of the most widely discussed issues besetting the economic revival has been the difficulties EU companies face in gaining access to finance. Access to finance, particularly for SMEs, remains the single-biggest impediment to growth and, despite national interventions, obtaining new borrowings from banks remains a challenge. Furthermore, with so many companies seeking expansion capital, competition for available funds — from whatever source — remains intense. There is an expectation that the investment industry will provide some of the means that SMEs are looking for; however, due consideration needs to be given to the barriers for raising capital and attracting investors’ interests in funding these enterprises in the first place.

A recently conducted pan-European CFA Institute member poll asked respondents for their views on this issue as well as any viable solutions that could be put forward as a means to help overcome the hurdles and encourage economic recovery. The results point to a clear need for new initiatives to open up channels of financing — both by tackling existing barriers and by encouraging alternative sources of funding.

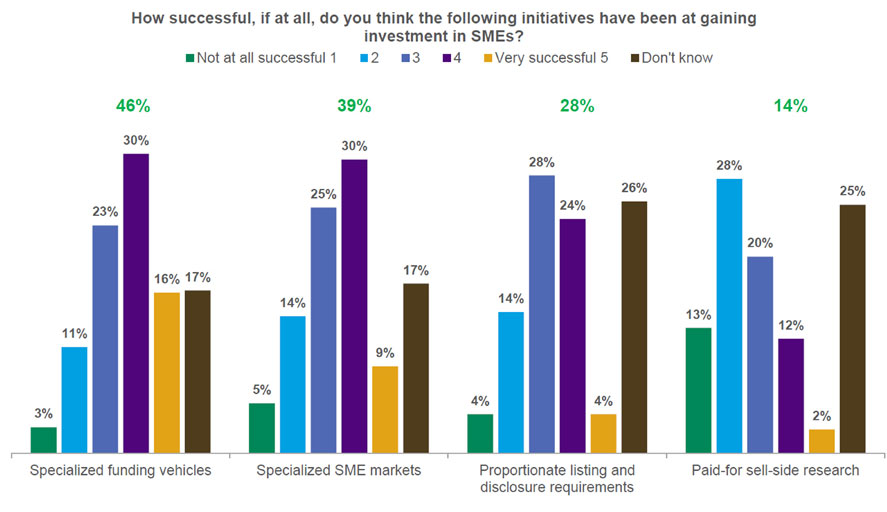

- Investors viewed initiatives developed thus far for SMEs to access funding — such as specialised funding or proportionate listing and disclosure requirements — as having been met with mixed success.

- Barriers to investing in SMEs remain high: 74% believe the lack of liquidity is a barrier, 52% are concerned by the lack of research coverage, and 38% point to differences in accounting standards or poor quality of financial disclosure.

- To come up with the right mix of policy measures and incentives, a multi-dimensional approach is needed. Providing further tax relief on investing in SMEs was supported by 67% of European respondents, and 40% believed reducing capital adequacy requirements would facilitate investors’ interest in SMEs. Others pointed to the creation of European social entrepreneurship funds, mentoring programmes, and furthering EU aid programmes for SMEs.

Respondents were also asked what steps would ensure a sustainable, healthy EU SME economy. Once more responses were wide-ranging, although many touched upon the fact that the burdens of regulation, tax, and administration were damaging creativity and innovation from the grass-roots level upwards. Flexibility was called for in terms of credit provisions, state aid programmes, and labour markets as well as a switch to long-term policies that favour SMEs and investment incentives.

Obviously small companies should be afforded access to capital markets to fund their growth and development, but they should provide investors the transparency and quality of information required for informed decision making and appropriate protections.

Photo credit: @iStockphoto.com/richterfoto