Impact of European Short-Selling Regulation: Mixed Effects on Markets

The European Securities and Markets Authority (ESMA) recently published its evaluation of the impact of the European Union’s short-selling regulation, which came into effect on 1 November 2012. The regulation imposes transparency requirements on the reporting of net short positions in stocks, sovereign debt, and sovereign credit default swaps (CDSs). It also prescribes a mandatory “locate” rule for short sales and bans uncovered or “naked” sovereign CDS transactions.

Although the regulation has only been in place for a short period of time (a caveat acknowledged in the report), ESMA’s evaluation reveals some interesting findings. On the positive side, the incidence of settlement fails has fallen. However, the regulation appears to have had a mixed effect on market liquidity, and a negative effect on the efficiency of price discovery. There have also been mixed effects in sovereign CDS markets. All in all, these findings are unlikely to satisfy either the political factions who pushed to introduce this regulation in an effort to curb market instability, or the cacophony of discontent from the hedge funds and financial institutions impacted.

The transparency provisions of the short-selling regulation require market participants to notify the regulator of net short positions in a stock of 0.2% or more of the issued share capital. The notification threshold for reporting net short positions to the market is 0.5%. Notifications are also triggered for every 0.1% change in net short positions within these parameters.

ESMA Report Findings

Between 1 November 2012 and 28 February 2013, ESMA’s report identifies the following facts:

- There were 12,603 notifications reported to regulatory authorities on 970 different shares in 18 countries.

- 74% of notifications were within the 0.2% and 0.5% thresholds; the other 26% of notifications stood above 0.5% and were therefore publicly disclosed.

- Only a few market participants shorted a large number of shares, with 75% of participants shorting on seven different shares or less.

- Short position holdings were quite concentrated: 10 entities held more than 28% of all the positions reported in the period. Approximately 83% of all the reported short positions were held by entities domiciled in the U.K. or the U.S.

- The shares most subject to short selling belonged to the industrial goods and services sector with 18.2% of all reported short positions, followed by the technology sector with 9.7% of all reported short positions. Financials and banks accounted for 3.6% each and insurance for 2.1%.

More significantly, ESMA notes that only 14.5% of the positions held below the 0.5% threshold moved above this threshold, among which half crossed it back. Similarly, only one quarter of the positions that reported close to 0.5%, and above 0.4%, crossed the public disclosure threshold. This suggests some reluctance from market participants to disclose their short positions to the public.

Further, quantitative analysis performed by ESMA suggests that the regulation has led to a reduction in bid-offer spreads, but no clear impact on volumes or the price impact of trades. ESMA finds a slight decrease in volatility, but also notes a negative impact on the speed of price discovery. So overall, the impact of the regulation on stocks is very much mixed.

For sovereign debt and sovereign CDSs, net short positions are required to be reported only to the regulator, and the notification thresholds depend on the amount of debt issued. The threshold is 0.1% if the total outstanding debt is less than €500 billion, and 0.5% if the amount is greater than €500 billion or if there is a liquid futures market. Positions in sovereign bonds in the cash market are adjusted by their duration, while positions held through derivatives are required to be delta-adjusted.

Compared to shares, a very low number of notifications were received on sovereign debt over the measurement period compared to shares: only 148 notifications were made on 13 sovereign entities in 11 countries. ESMA therefore suggests that an adjustment might be needed to the notification thresholds, as well as an adjustment to the methodology used to calculate positions.

Slowdown in Securities Lending, Settlement Discipline Improves

Regarding the impact of the mandatory locate rule, ESMA finds that activity in securities lending markets has been lower since the regulation was implemented. Further, there has been a significant reduction in the quantities of stocks on loan in the EU compared to the control group (U.S. stocks). The securities lending market does appear to have recovered, however, since January 2013.

According to the regulation, the locate rule should improve settlement discipline and lead to a decrease in settlement fails on EU equities. The evidence gathered by ESMA supports this assertion. For around half of the countries, there were fewer settlement fails after the regulation while the others saw no significant changes. Therefore, ESMA concludes that the regulation was followed by an increase in settlement discipline.

Sovereign CDS: Mixed Evidence

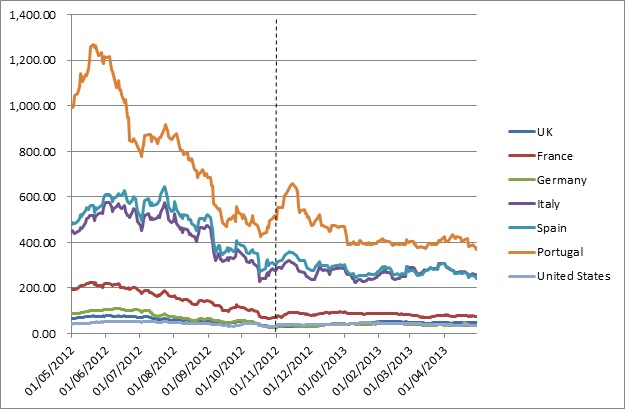

The restrictions on uncovered sovereign CDS transactions are perhaps the most contentious aspect of the regulation. For its statistical analysis, ESMA examined sovereign CDS spreads for 20 EU countries before and after the application of the regulation. To control for the impact of other market developments, ESMA compared these spreads against the spreads for a control group of non-EU Organisation for Economic Co-operation and Development (OECD) countries.

The findings show only weak evidence of slightly lower EU sovereign CDS spreads after the introduction of the ban on naked sovereign CDS transactions (see chart below). Specifically, ESMA estimates the ban has led to a slight reduction of approximately 26 basis points in the CDS spread of countries subject to the regulation, but this reduction is statistically significant only at the 10% confidence level. Similarly, there appears to have been no statistically significant effect of the regulation on sovereign debt yields.

Overall, it is difficult to properly evaluate the impact of the ban on naked sovereign CDSs given the relatively short measurement period and the coincidence of easing of market tensions in the eurozone in the period since the ban was introduced. This is illustrated in the chart below, which shows CDS spreads for a selection of sovereigns before and after the implementation of the regulation.

Source: Bloomberg

The Regulation also allows competent authorities to impose temporary restrictions on short selling of stocks in case of significant price falls. Since the regulation came into force in November 2012, bans were introduced by the Italian regulator, Consob, on seven stocks on the Italian market. There were also temporary short-selling bans in place in Greece and Spain before the regulation came into force, which were partially lifted (Greece) or expired (Spain) in February 2013.

ESMA reports that the short-selling restrictions introduced during trading sessions tend to be imposed with a non-trivial delay. By the time the regulator announces the restriction and market participants receive the information, the sell-off has typically already ended, prices have stabilized, and transaction volumes have started to normalise.

Moreover, transaction volumes tend to decrease during temporary short-selling bans relative to the pre-ban sell-off. After a short-selling restriction is imposed, average transaction volumes fall by 71.8% relative to pre-ban averages. Temporary bans, however, do not seem to have a significant impact on the efficiency of price formation, or on price volatility either.

So what should be made from all these findings? Clearly, the jury is still out as to the overall effect of this regulation. But this merely underlines that the clamour for more regulation, as well as the industry push-back, is all too often overdone.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: ©iStockphoto.com/richterfoto

Good afternoon

Hope you’re doing well

my question is:

what will be the impact of new European union regulation on Bahrain market in terms of Pharmaceutical, Medical devices and biologicals.?