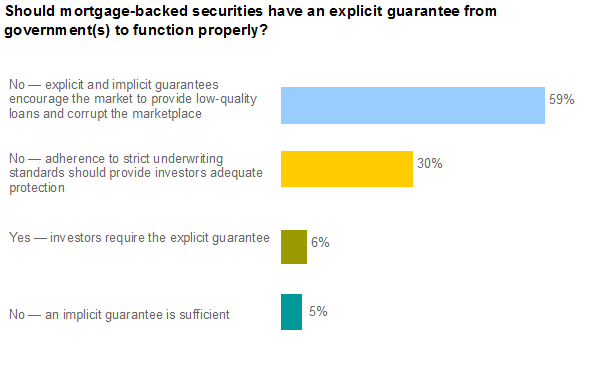

Poll: Should Mortgage-Backed Securities Have Explicit Guarantee from Government(s) to Function Properly?

One of the more enduring financial debates since the 2008 crisis is the role played by U.S. government guarantees — through Fannie Mae and Freddie Mac — in the mortgage market. In its 2011 report, the Financial Crisis Inquiry Commission concluded that although the role of the government-sponsored enterprises was contributory, it was not causal.

The government’s role is important because both the U.S. House of Representatives and the U.S. Senate are working on legislation to reform the mortgage market, a task that many in Washington, D.C. say will consume most of the time remaining on this year’s calendar. To aid their efforts, we recently asked CFA Institute Financial NewsBrief readers whether the mortgage-backed securities market needs an explicit or implicit guarantee from the U.S. government to recover the investor interest that it lost in 2008.

The response? A resounding no! About 94% of 1,023 respondents said no guarantees are needed. This might be a case of naysayers in the sovereign market suggesting that a government guarantee would do more harm than good. But few markets are more tied to the credit of their sovereigns than mortgages. Rather, as a majority (59%) of respondents said, it is the corrupting influence of government intrusion into the marketplace that “encourages” poor underwriting and, consequently, less trust in the mortgage market.