Excess Reserves at the Fed: Lazy Money or Potential Hazard?

It wasn’t so long ago that bankers were embarrassed to keep excess reserves at the Federal Reserve. Explaining to investors why they were hording a ton of money in the Fed’s vault where they earned nothing couldn’t have been an easy discussion come quarter end. Moreover, keeping too much at the Fed was almost an admission that things were “unsettled” at your bank.

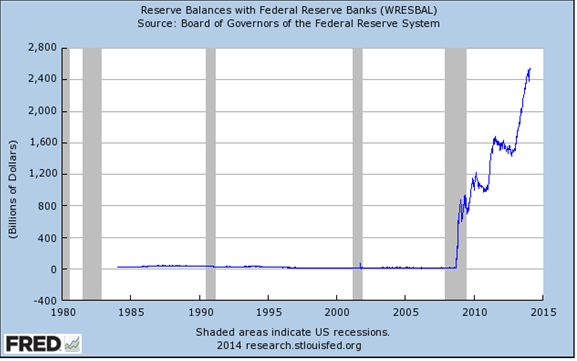

But that was before the Fed became the easiest, no-risk 0.25% a banker could earn anywhere, anytime. Launched in the days of fog and fright in 2008, the Fed’s decision to pay interest on excess deposits was a way to enable banks to earn on their excess funds overnight without having to put their money at risk on the solvency of their fellow bankers. That solvency was in question due to the lack of transparency into what they all held in on-balance-sheet loans and mortgage-backed securities, and in off-balance derivatives and securitization trusts. Weeks after introduction of the Fed’s deposit program, deposits climbed from a mere $9 billion to more than $800 billion. The sum topped $1 trillion in October 2009, and currently stands at more than $2.5 trillion.

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: Reserve Balances with Federal Reserve Banks (WRESBAL); http://research.stlouisfed.org/fred2/graph/?s[1][id]=WRESBAL; accessed February 10, 2014.

That $2.5 trillion amounts to a lot of what my fourth grader’s science class would call “potential energy,” i.e., energy that is ready for release under the right circumstances. It is part of the adjusted monetary base noted in this post from October 2012.

The big question is whether the Fed can keep this energy at bay until it wants it released without creating the financial equivalent of a nuclear reaction. No one really knows because these are unchartered waters and reaching heights that are at the least rare, if not first-time-ever economic circumstances.

The Fed under former Chairman Ben Bernanke expressed confidence that it could “sop up” the excess liquidity in the marketplace without any difficulty. If it were so easy, and considering that the banks have had so little use for the reserves — why else would they leave them on deposit for a mere 0.25% per annum — then why didn’t the Fed do something about it before now? It wasn’t like those reserves were fueling a robust economic recovery. One could make the case that the interest on those deposits would go a long way toward rebuilding bank balance sheets, bruised and battered from the bungled mortgage lending in the last decade.

Yet, the balances at the Fed have continued to grow, even as those balance sheets have recovered. Since January 2013, alone, banks added more than $1 trillion to their Fed balances, a 67% increase in one year.

I have my doubts about the Fed’s ability, let alone its willingness, to engage in “sop up” ops, now or in the medium term. But I don’t know what to make of this huge pile of bank cash sloshing about in the Fed’s vault. It doesn’t look like the old greed shibboleth accorded to bankers. After all, the 0.25% may be easy money, but it is anything but greedy.

Does it mean, as the Austrians would say, we will see inflation in the future? Is it (the hording of funds at the Fed) the reason small and medium-sized enterprises are fishing the crowdfunding markets for capital? Is this a cause or an attribute of the “tapering” growth in the economy?

I’d like to open the forum to readers to see what you think this means.

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: ©iStockphoto.com/FaberrInk

Updated 24 February 2014 to correct error in second paragraph

It means stagflation (business stagnation accompanied by inflation). The introduction of the payment of interest on excess reserve balances had the initial effect of destroying the non-banks & NB lending/investing. This in turn, collapsed the turnover of existing savings (represents the non-use of savings). So aggregate monetary purchasing power fell (nominal-gDp).

Insofar as the Fed maintains an interest rate differential in favor of the commercial bankers (i.e., allows the CBs to outbid the NBs for loan-funds), economic growth will be slower & interest rates higher than they otherwise would be. Thus the Fed will be forced to follow an easier money policy.

Currently the fed is paying 25 bps, most banks cannot find a place to sell funds that can compete with that. You can basically turn a profit by leveraging yourself with short term borrowings at special rates through the FHLB (1-3 mo borrowings can net you a free 7 or 8 bps currently) which is what I suspect many banks that are lacking in core deposits are doing for their funding. If you think about it it’s almost as though we are masking a negative short term interest rate this way.

Last I knew, it was 0.25%, not 1%. Factual error of this magnitude could be quite misleading. Secondly, without understanding nature of reserves and calling it potential energy ..well, a little knowledge is a dangerous thing. Banks are not reserve constrained, they are capital constrained & by the demand for credit. Even if they wish, they cannot ‘unleash’ this energy as the author calls it. Banks don’t and can’t lend reserves out. CFA institute and the Author should apologize for this misleading article.

No one likes to be wrong, and especially in a public forum like this. But wrong I was, as Rajiv, points out, and I apologize for the error. The rate the Fed paid was around 1% for a brief period at the end of 2008 and the beginning of 2009, but has been 0.25% since.

Not to diminish the error regarding the rate paid, the main question about what all this excess liquidity means remains relevant. Is it potential energy for the banking system and the economy or, as Rajiv suggests, is it made irrelevant by higher capital requirements?

The letter spurred some additional research into the issue. It seems some smart people have been asking similar questions for some time. Gara Afonso of the New York Fed authored this article on the bank’s site, pointing out that the rate paid by the Fed has a near one-to-one effect on the federal funds rate. Lowering the rate, then, would push interest rates toward zero.

This blog post in Washington Outside by former Treasury careerist Norman Carleton was uncertain about why the Fed was paying that rate of interest when the banks were earning less on three-month Treasury bills. (The same factors hold true today, with two primary exceptions. First, it is the one-year note rather than the three-month bill that is yielding less than the Fed’s rate. The one-year note is now yielding 0.107%. And second, the balances on deposit are nearly twice as high today as they were when Mr. Carleton wrote this passage in 2011.

And finally, Martin Feldstein, former chair of the President’s Council of Economic Advisers, suggests that the high level of deposits, a byproduct of the Fed’s paying interest that is greater than is available elsewhere for short-term funds, is helping the Fed keep inflation in check. Over time, then, it could lead to inflation if the Fed isn’t judicious in its policymaking and lets the banks lend too much, too quickly. The threat of this happening, he says, is that high unemployment could lead Congress to pressure the Fed in this direction. Again I ask, what do you think this massive amount of excess reserves means?

Dear James, Thank you for taking my slightly ‘harsh’ comment in your stride, correcting the factual error of 1% at one place (I think it still appears at 2 more places in the article ) and trying to ask the question again.

However, I am afraid that you haven’t been able to appreciate my point that Banks don’t lend out Reserves and hence saying that they can have alternate use for this money/ ‘potential energy’ etc. is misplaced. They have only got these reserves due to asset swaps and has thus only improved the strnegth of their balance sheets ( Reserves with Fed are zero risk, and if they were able to offload some higher risky assets – read, with threat of possible impairments – it helped. ). Suggest you look at this nice paper from S&P and redirect your research to similar stuff to have a better ‘conceptual’ understanding. All the best! http://www.standardandpoors.com/spf/upload/Ratings_US/Repeat_After_Me_8_14_13.pdf

We all saw that mistake (it was beside your point).

The DIDMCA’s provision allowing “pass thru accounts” for correspondent member & non-member banks (S&Ls, CUs, & MSBs), & then 1/3 reduction in reserve requirements in the early 1990’s, provided all the “grist for the mill” necessary to create the housing boom.

As the Fed and Congress have now eliminated the distinction between money creating depository institutions & financial intermediaries (non-banks), we will see that future financing will largely be accomplished by the creation of new money. That spells slower rates of real economic growth & higher rates of inflation to offset the damping effect of further bottling up existing savings within the framework of the commercial banking system. I.e., CBs don’t loan out existing deposits (saved or otherwise). From a system’s standpoint, CBs always create new money when the lend/invest.

Contrary to the Gurley-Shaw thesis, impounding savings within the CBs decreases the non-inflationary supply of loan-funds and raises long-term interest rates (where savings can’t be matched with real-investment). We have now shot ourselves in the foot.