Poll: How Much Time Should Investors Have to Disclose Concentrated Stock Positions?

Debate about how quickly activist investors must disclose the acquisition of at least 5% of an issuer’s shares has raged bitterly since the takeover craze of the mid-1980s. Although improvements in modern information technology make near-immediate disclosure possible, it isn’t universally desired. Issuers, willing to tolerate lengthy delays in reporting results and insider trades, argue that activist investors should file 13D reports within one business day of accumulating 5% stakes to prevent larger covert accumulations. Investors who prefer shorter deadlines for financial reports and insider trades, however, see virtue in the 10-day grace period currently permitted under SEC Schedule 13D. Large institutional investors, often forced into index strategies by their size and diversification mandates, find themselves at times reliant on the actions of small, activist hedge fund investors if they want to see improvements at moribund companies that might boost returns for their beneficiaries. The proliferation of stewardship codes attempting to mandate investor engagement encourage this type of activism — or at least its support.

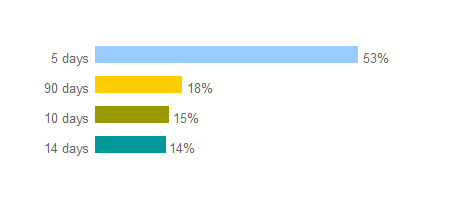

Typically, CFA Institute would opt for faster reporting in our policy positions, but we wanted to verify that inclination given the conflicting positions. We asked CFA Institute Financial NewsBrief readers how much time investors should have to disclose a 5% position to the market. Nearly 53% of the 503 respondents said that disclosure should come within five days — essentially cutting the current requirement in half. And why not? Longer disclosure delays could mean uninformed trades that hurt client returns.

How much time should an investor/firm have to disclose a concentrated position (5% or more) in a particular issuer’s shares?

If you liked this post, consider subscribing to Market Integrity Insights.