Protecting Older Investors a Growing Concern of Firms and Regulators

As our population ages and life expectancy continues to advance, the number of “senior” investors is becoming more and more significant. This demographic trend coincides with the shift of retirement planning away from employer plans and towards individually directed options where investors remain in control of their retirement assets. These converging circumstances bring increasing emphasis on issues relating to managing money for elderly or “senior” investors.

In the US, state and federal regulators have made protecting senior investors a priority. According to the North American Securities Administrators Association, 34% of all enforcement actions taken by state securities regulators since 2008 have involved senior victims. On 15 April, the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) issued a report that discusses key observations and industry practices identified during a joint examination in 2013 of 44 broker-dealers that focused on how firms conduct business with their elderly clients.

The examinations focused on the types of securities purchased by senior investors, the suitability of recommended investments, training of brokerage firm representatives, marketing, communications, use of designations such as “senior specialist,” account documentation, disclosures, customer complaints, and supervision. Some key conclusions of the report:

- 34% of the firms made one or more potentially unsuitable recommendations of variable annuities.

- 77% of firms incorporate training specific to senior issues into their training plans and that the same percentage of firms maintained supervisory procedures specific to supervision of firm representatives who deal with senior investors.

- In general, firms appeared to be providing appropriate disclosure to investors with regard to recommended securities, and inaccurate or incomplete disclosures primarily related to nontraditional securities such as variable annuities and REITs.

- It is unclear how well investors understand the disclosures they receive on recommended securities.

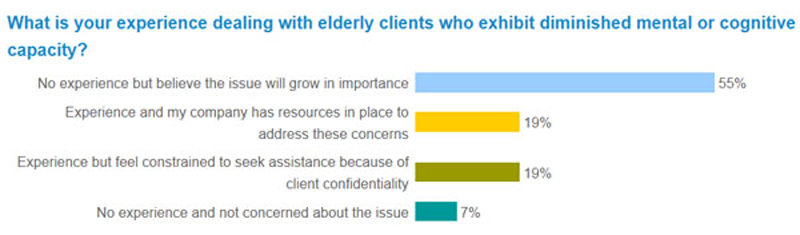

The SEC/FINRA report’s conclusion, that firms are paying increased attention to the accounts of senior investors, is reflected in results of a recent readership poll question on senior investors in the CFA Institute Financial NewsBrief. Almost 93% of the approximately 400 readers who responded indicated that they have had experience with elder fraud issues or think it’s an issue of growing importance.

Source: CFA Institute Financial NewsBrief

All too often, unscrupulous individuals are willing to take advantage of investors, who, because of their advanced age may be particularly susceptible to fraud as the fraudsters believe their actions will go unnoticed by those with diminished capacity or increasing dependence on others.

Meanwhile, the vast majority of investment professionals diligently work to safeguard the interests of all clients, including senior investors, and faithfully exercise their professional responsibilities. Yet providing investment services for senior investors pose some unique challenges that investment professionals must be prepared for when fulfilling their responsibilities to clients. Understanding one’s obligations and how to recognize the red flags of diminished capacity and financial exploitation by others is critical to protecting the interests of this potentially vulnerable group of investors.

The CFA Institute Code of Ethics and Standards of Professional Conduct incorporate several principles that address the special elements of client engagement relating to working with senior investors. The standards on Loyalty Prudence and Care – III(A), Suitability – III(C), and Preservation of Confidentiality – III(E), in particular, are implicated when dealing with elderly clients.

For instance, Standard III(E ) – Preservation of Confidentiality, establishes a duty for investment professionals to keep client information confidential from third parties. This can become problematic if the adviser suspects that the client’s faculties are failing and the adviser believes it is necessary to consult with outside parties. Investment professionals wanting to protect client interests by interacting with a caregiver, family member, or physician may feel stymied and frustrated by their responsibility to maintain client confidentiality in the absence of clear client, legal, or professional guidance about the circumstances under which they can consult with others about the client’s account.

At a recent meeting, the Standards of Practice Committee, the volunteer group responsible for drafting, revising, and interpreting the CFA Institute Code and Standards, expressed support for a change to Standard III(E) to include a provision that would allow members and candidates to disclose confidential client information to third parties should the client’s diminished mental or cognitive capacity make them vulnerable to financial exploitation. The committee will require that any future change to the Standard be accompanied by significant guidance elaborating on a number of issues including how to spot potential capacity problems, what circumstances would trigger potential disclosure, who should be contacted, what information should be disclosed, and addressing the parameters of disclosure due to capacity issues with clients in the client agreement before they arise. What do you think? Is a change to the Code and Standards necessary to allow investment professionals to consult with outside individuals when they suspect that their clients may be susceptible to financial exploitation because of age or infirmity?

If you liked this post, consider subscribing to Market Integrity Insights.

Image Credit: iStockphoto/Jello5700