EU Capital Markets Union: What Do Investors See as Hurdles to Forming Single Market?

What can be achieved in European Union (EU) politics in less than four years? The European Commission certainly has ambitious plans. In February 2015 the Commission published a Green Paper (a public consultation) on building a Capital Markets Union (CMU) in Europe, with the aim of making it functional by 2019. The goal of the CMU would be to enhance growth and jobs in the EU and to increase the role that capital markets play in the financing of the economy, for example, by increasing the funding of small and medium-sized enterprises (SMEs) through safe and transparent securitisation. The Commission is also looking into means to increase cross-border investments between the Member States so as to deepen and better integrate EU capital markets.

The Commission’s CMU plans consist of reviewing current EU legislation, such as the Prospectus Directive (watch this space for an upcoming blog post devoted to the revision), and harmonising the implementation of existing rules among the Member States. The Commission may also scale back some existing laws and potentially create new pieces of legislation, though further details will be clarified only in the autumn once the Commission has processed the responses it received to the Green Paper.

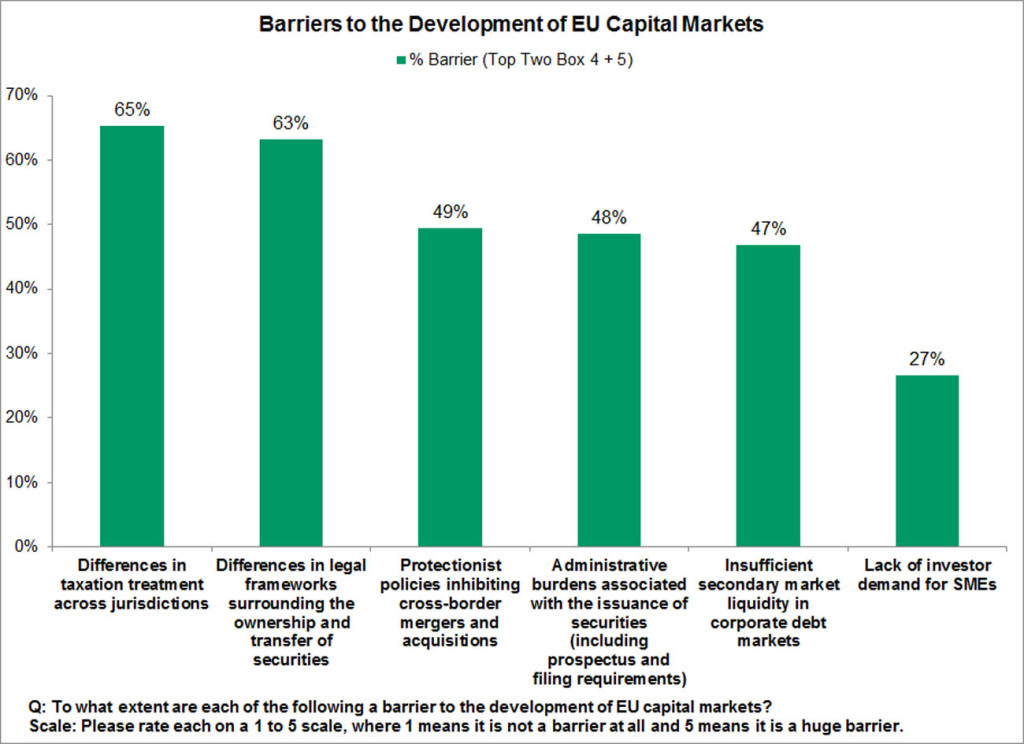

View from CFA Institute Members: Barriers to EU Capital Market Development

Following the publication of the Green Paper, CFA Institute launched a survey to hear what our European members think about the CMU plans. Between March and April 2015 we received almost 700 responses from our members who work as investment professionals across the EU and in Switzerland. We also sought specific feedback from the EU CFA society leaders. These information channels guided our response to the Green Paper. One of the most notable takeaways from the survey was that our members consider differences in taxation treatment and in the legal frameworks surrounding the ownership and transfer of securities as the biggest barriers to the development of EU capital markets.

Changes to Taxation Policy Unlikely

Almost two thirds (65%) of all the survey respondents believe that differences in taxation treatment across jurisdictions are a significant barrier to the development of pan-European capital markets. Several respondents noted that there are varying levels of taxation of similar instruments in different countries, and only a few Member States provide tax incentives for long-term investments. CFA Institute believes that tax reforms could help incentivise long-term investment in Europe, for example, by granting tax incentives to investors in start-ups, venture capital, and SMEs, and by reducing or eliminating the favourable tax treatment of debt capital (whereby interest costs are tax deductible) vis-à-vis equity capital.

Nonetheless, as taxation is purely a national Member State competence in the EU, it will be challenging for the Commission to push through any changes to taxation policy. Not only would it be politically sensitive to propose any harmonisation in taxation, but any proposal to such extent would likely meet severe resistance from the national governments.

Consistent Implementation of Current Laws Needed

Moreover, 63% of the respondents to the CFA Institute member survey believe that the current securities ownership rules are a significant barrier to the development of EU capital markets. In our response to the Green Paper, we maintain that further measures could be taken to increase the availability of products on fund platforms outside of investors’ home markets. Our members noted, for example, that it is almost impossible for a German investor to buy Italian government bonds due to registration challenges.

Similar obstacles and the perceived home bias could be overcome, for example, through the consistent implementation of UCITS Directive (Undertakings for Collective Investment in Transferable Securities) provisions so as to provide more confidence and certainty when investing outside of the home Member State. This would include improving the visibility and transparency of underlying risks in the context of fund reporting and disclosure rules. While the UCITS Directive is soon going to face its sixth revision, many of our members believe that the implementation of the law has been uneven in the Member States. As the practical application of the UCITS rules and the treatment of UCITS funds differ for example from Luxembourg to France, many find it too burdensome to invest across borders.

In addition, over half (58%) of the respondents to the member survey considered the divergence of national insolvency frameworks a considerable barrier to investment. CFA Institute thus broadly supports the harmonisation of insolvency laws in the EU. That would include harmonising the filing and verification of claims and by facilitating the enforcement of cross-border claims and collateral. The lack of certainty over the outcomes of insolvency cases in the different Member States was one of the most cited issues in our survey’s open comment section.

Liquidity Challenges

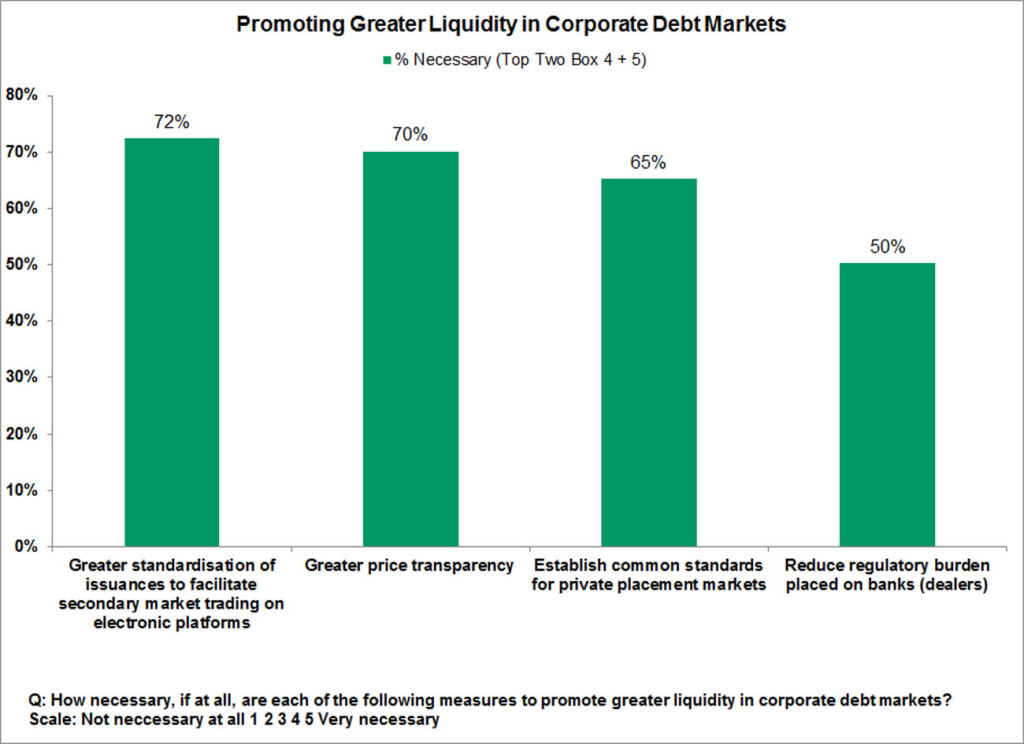

Almost half of the respondents (47%) further noted that insufficient secondary market liquidity in corporate debt markets is a significant barrier to the development of EU capital markets. Most of the survey respondents believe that the best way to promote liquidity in corporate bond markets would be through greater standardisation of issuances, the facilitation of secondary market trading on electronic platforms, and increased price transparency in the corporate debt markets. CFA Institute recently published a report on shadow banking, where we examined issues related to securitisation and securities financing transactions in particular. These findings also underline the importance of the MiFID II (Markets in Financial Instruments Directive) reforms in the area of nonequity market transparency.

Other topics covered in our response to the Green Paper include alternative financing, such as crowdfunding and peer-to-peer lending; long-term investments; and the potential for a standardised, pan-European pension product.

According to our survey respondents, a great deal remains to be done in the EU before the CMU shifts from words into reality. With such a wide range of issues to be addressed, the Commission will have to ensure that its approach to the CMU is well structured and consistent. CFA Institute looks forward to further details on the plans in September when the Commission is due to publish its roadmap on the initiative. Whether or not the CMU will materialise in the next four years, CFA Institute will continue to actively follow the topic on behalf of our members — up to and beyond 2019.

If you liked this post, consider subscribing to Market Integrity Insights.

Image credit: iStockphoto.com/FrankyDeMeyer

Maiju,

Enjoyed reading your overview of the forces that will impact the formation of a single EU capital markets union. The trend however might actually be the reverse, a retreat back to local markets. Banks, especially in the EU have been in retreat to their home markets since the financial crisis, and we can expect this to continue. Historical advantages such as economies of scale may very well be overcome by local regulatory constraints such as US-driven foreign bank regulation, the Vickers rule in the UK and Switzerland’s FINMA proposal for rules governing non-Swiss banks. I also found PwC’s conclusion that countries with relatively large institutions will have shrunk their banking sectors relative to their GDP. To quote “focus will shift away from global proprietary trading to client-driven businesses, which will increasingly also be more local.” (if interested see Capital Markets study).

Dear Jeff,

Thank you for your comments and observations. Personally, I think that the most interesting part of the European Commission’s CMU initiative is the potential for harmonising some of the key financial services legislation across all the EU Member States. This could include a number of laws from the UCITS Directive to insolvency proceedings to some aspects of corporate governance rules. I agree that to some extent the tendency so far has been towards home bias in the Member States, and that is partially due to the fact that the relevant EU legislation has traditionally been in the form of Directives, which give the Member States more leeway/flexibility in implementing EU laws. However, if further EU legislation is issued in the form of Regulations, which are more binding and become enforceable in all the Member States simultaneously, we can expect some of the key issues within the CMU initiative to become further harmonised across the EU. We look forward to the European Commission’s detailed plans in the autumn and will continue active engagement on the topic.