The Current Status of Women on Boards in 2016: A Global Roundup

The push for more women on corporate boards has gained steam in recent years. In the MSCI ESG Research global director universe, which is a compilation of companies from around the world and includes 4,218 companies, the percentage of women on boards globally stood at about 15% in 2015, up from 12.4% only a year earlier. Some countries have adopted quotas or passed legislation mandating more female representation on corporate boards, although many markets have not taken such steps. Here we summarize the progress made in placing more women on corporate boards to take stock of how things have progressed. Check out our blogs on the issue from 2014 and 2012 to read about the progress for yourself. [Editor’s note: This post references data from various organizations that each gather different groupings of data on the regional and global status of on women on boards, so the percentages will vary depending on the slice of data being considered.]

International

MSCI ESG Research released the Women on Boards: Global Tends in Gender Diversity on Corporate Boards report in November 2015. It highlights the current state of women on boards throughout the world.

- Among MSCI World Index companies (1,621 companies), women held 18.1% of all directorships as of August 2015, up from 15.9% in 2014.

- At MSCI USA Index companies, women held 19.1% of directorships as of August 2015, up from 17.9% in 2014.

- At MSCI Emerging Markets Index companies, female directors comprised 8.4% of boards, up from 7.1% in 2014.

- Among the 4,218 companies covered in MSCI’s global director reference universe, women held 15.0% of all directorships as of 15 August 2015, up from 12.4% in 2014 and an increase of 4.8% since 2009.

- The countries with highest percentage of board seats filled by women are Norway (40.1%), Sweden (33.7%), and France (33.5%) lead the way.

- Within the MSCI ESG Research global director reference universe at the time of the report, 73.5% of companies had at least one female director, although for boards with at least three women, that percentage drops to just 20.1%.

The report also presents the impact of greater gender diversity on boards, and highlights some interesting findings.

- Companies that had strong female leadership generated a return on equity of 10.1% per year versus 7.4% for those without (on an equal-weighted basis).

- Companies lacking board diversity tend to suffer more governance-related controversies than average.

- Strong evidence was not found that having more women in board positions indicates greater risk aversion

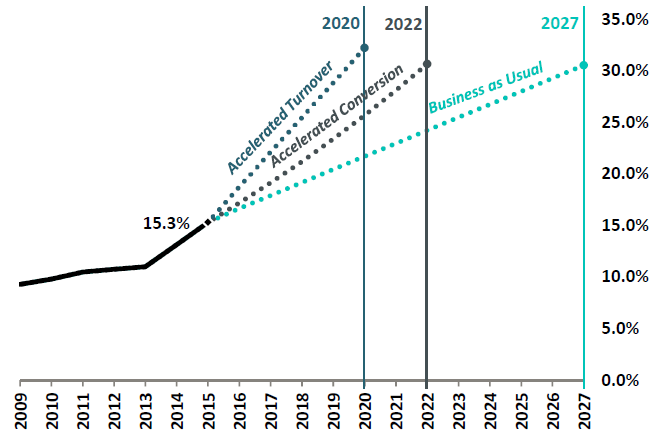

The report also shows the trends in board diversity and charts out how different scenarios could lead to 30% representation of women on boards, which, as shown in the following figure, could be achieved by 2020 with accelerated board turnover or not until 2027 under a business as usual scenario.

Projected Global Percentage of Women on Boards

Source: MSCI ESG Research Inc., November 2015.

Asia

In a recent working paper, Women’s Leadership and Corporate Performance, the Asian Development Bank reports that in the Asia-Pacific region, Australia has the highest boardroom diversity and the Republic of Korea (also known as South Korea) has the lowest. India and Malaysia are the only countries that impose mandatory quotas for gender diversity. The implementation, however, is not highly effective, particularly in India.

The People’s Republic of China has the least public emphasis on gender diversity, but the representation of women in boardrooms has grown the fastest. Also according to the report, the People’s Republic of China potentially has the most to lose in terms of economic losses because of the lack of gender diversity.

The bank also reports that the relatively low gender diversity found on many Asian corporate boards appears to be related to a limited supply of top-level candidates because of a lack of educational opportunities, lower wages, infant survival rates, and other broad societal disadvantages suffered by women in the region.

Europe

In April 2016, European Women on Boards (EWoB) published Gender Diversity on European Boards: Realizing Europe’s Potential: Progress and Challenges

In the study, they found that the percentage of women large company boards in Europe has almost doubled over the past five years from 13.9% to 25%. This trend is driven primarily by the addition of female directors on nonexecutive or supervisory boards as opposed to an increase in women in chair, CEO, and executive director positions.

EWoB examined the participation of women directors on the boards at STOXX 600 companies over the period of 2011–2015 as well as such related topics as the inclusion of women directors on board committees and the promotion of women into board leadership positions.

The following are some of the other highlights in the report:

- Women now comprise a quarter of all board members at large European companies, an even greater percentage of audit and remuneration committee members (28.7% and 26%, respectively), and a slightly lower percentage of nomination committee members (22.%).

- Appointments of women to board and committee chair positions have tended to lag, with women now accounting for 4% of board chairs, 16% of audit committee chairs, 22.3% of remuneration committee chairs, and 8.8% of nomination committee chairs.

- Only 3.5% of European CEOs in the study universe are women, compared with 3.0% in 2011.

- A pay gap does exist between male and female CEOs, nonexecutive chairs, and nonexecutive directors. The results identify trends occurring at company, country, and sector levels concerning board gender diversity.

- The number of companies without a female director has fallen consistently over the years covered, and stands at 5.4% (represented by 32 companies) in 2015, down from 21% of companies in 2011.

Australia

In October of 2015, the Australian Council of Superannuation Investors (ACSI) announced that it will consider recommending against the re-election of directors in companies that perform poorly on board gender diversity.

In 2014, ACSI announced a policy target of 30% women on each ASX 200 board by the end of 2017. That target recognizes that a properly structured board needs skilled directors who add diversity of thought to board decision making, which is more likely to occur when directors have sufficiently diverse backgrounds.

At the time of the 2015 announcement, there were 40 (20%) ASX 200 companies that had met ACSI’s gender diversity target.

Canada

In October 2015, the Canadian Securities Administrators (CSA) published a staff notice that summarized CSA’s review of corporate governance disclosures of 722 non-venture-capital issuers listed on the Toronto Stock Exchange.

The CSA found that among the issuers in the sample group, 49% have at least one woman on their board and 60% have at least one woman in an executive officer position. The most significant indicators of whether issuers adopted initiatives to increase the representation of women on their board or in executive officer positions were issuer size and industry. For example, the CSA found that

- 62% of issuers with a market capitalization of less than C$1 billion had no women on their board, and 48% of such issuers reported having no women in executive officer positions.

- 60% of issuers with a market capitalization of more than C$2 billion had at least two women on their board, and 59% of such issuers disclosed having at least two female executive officers.

- 60% or more of issuers in each of the mining, oil and gas, and technology industries had no women on their board.

- 57% and 43% of issuers in the utilities and retail industries, respectively, had two or more women on their board.

A June 2016 report commissioned by the government of Ontario, Gender Diversity on Boards in Canada, found that Canada continues to lag behind other developed nations in terms of gender balance on corporate boards. Although more women than men graduate annually from Canada’s universities and colleges, Canadian women continue to be underrepresented on boards and in senior management.

The report reveals that slightly more than 20% of board members in Canada are women compared with more than 35% in Norway, nearly 30% in France, 29% in Sweden, and 23% in the United Kingdom. The paper offers a number of detailed recommendations for improving the diversity of Canadian boards, including setting a target of 30% women on boards, using either earlier retirement ages or term limits to increase board refreshment, and improving the recruiting of women to boards.

France

French companies in the CAC 40 index must meet a quota of 40% women on boards by a 2017 deadline, and many are rushing to do so. At the beginning of 2016 the level of female representation on CAC 40 boards was about 35%. Companies that do not meet the quota will not be allowed to make any board-level changes that do not contribute to fulfilling the mandate.

Germany

A law that requires the largest companies in Germany to have 30% of their directors be women went in to effect at the beginning of 2016, but a recent study (in German) found that most companies are not meeting the quota. Female representation on German supervisory boards has more than doubled in the past decade, but still stands at only about 22%.

Hong Kong

According to Community Business’s annual research report, Women on Boards Hong Kong 2016, two-thirds of companies showed no improvement in the last year in board diversity, and the average female board representation on boards remained stagnant at 11.1%

India

An online study conducted in early 2016 found that only about 7% of board seats at public companies in India are filled by women. According to a law that took effect in 2015, companies are supposed to have at least one women on their board. However, compliance has been uneven, with a number of companies appointing company insiders and even the wives of CEO’s to the board in order to comply.

Japan

In April of 2016, the Female Employment Promotion Legislation was passed that requires large private and public sector companies in Japan to disclose gender diversity targets, accompanied by detailed action plans. Less than 5% of Japan’s board members are currently women, as shown in the graph in the next section.

Norway

The OECD Economics Department posted a blog in March of 2016 — Gender Quotas for Corporate Boards – Do They Work? Lessons from Norway — that highlights some findings from the OECD 2016 Economic Survey of Norway.

Norway has instituted high quotas for women on public company boards. The country first introduced gender quotas in some public sector entities in the 1980s and extended them in 2003 under legislation requiring at least 40% of women on boards of public limited companies (known as ASA), inter-municipal businesses, and state-owned enterprises.

The brief report draws some interesting conclusions:

- Norway’s gender board quotas worked only with sanctions.

- As of 2005, only 17% of board members were women. To reach the target, enforcement of the quotas was tightened in 2005 by legislating sanctions, including a threat of dissolution of noncompliant companies, which led to a rapid change: the 40% target was reached in 2008. The coverage of the quota was extended to cooperative companies in 2008 and to municipal companies in 2009.

- Fears by businesses of a lack of competent female managers were unjustified.

- Attitudes have changed and gender board quotas are now widely supported.

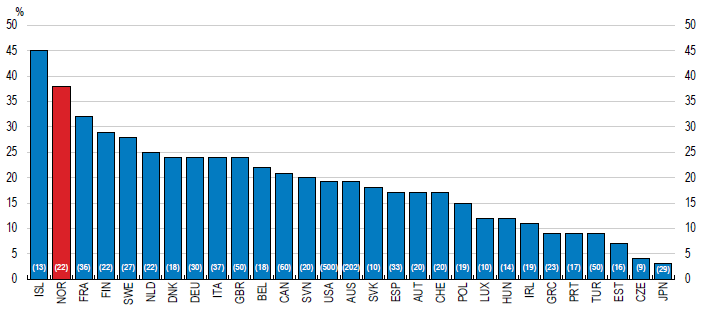

The following chart shows the percentage of women board members in the largest publicly listed companies in the OECD in 2014. For EU countries, Iceland, Norway, and Turkey, the companies are a selection of those included in the Primary Blue-Chip Index, which is an index that includes large companies headquartered in each country based on market capitalization and/or market trades. For Australia, Canada, Japan, Switzerland, and the United States, the companies are selected from various stock markets (S&P/ASX 200, S&P/TSX 60, TOPIX Core 30, SMI index, and S&P 500 Index, respectively).

Percentage of Women Board Members at Companies in the OECD, 2014

Note: Number in parentheses indicates the number of companies on which the data are based for each country.

Source: OECD EcoScope Blog (8 March 2016).

Singapore

An updated report by the Diversity Action Committee of Singapore found that female representation on boards is slowly improving — from 8.8% in 2014 to 9.5% in 2015 — but remains at a relatively low level. The following are some other highlights from the report:

- The number of women directorships increased, and the number of men directorships decreased. Overall, the number of directorships declined in 2015 and the reduction was entirely in male directorships.

- The increase of 78 women directorships was lower than the previous year’s 90 additions, whereas the number of women directorship exits remained about the same.

- Of the women appointments in 2015, 38% were first time directors. In comparison, 32% of the male appointments were first time directors.

- Women made up 14% of all directorship appointments, the highest proportion for the past 15 years of data available.

United Kingdom

An updated review of women on the boards of FTSE 100 companies was published in October 2015: Improving the Gender Balance on British Boards. The authors note that there has been real progress on women filling the seats of British boards since 2011, when the original review was published. As of October 2015, 26.1% of FTSE 100 company board positions were filled by women, up from just 12.5% in February 2011. Female representation on FTSE boards decreased slightly at smaller companies, with women making up 19.6% of FTSE 250 boards.

But, according to the report Responsible Capitalism and Diversity, released by Hermes Investment Management also in October 2015, the number of women holding executive-level positions has only increased from 5.5% to 8.6% in five years. The report also points out significant gaps in pay, citing that female bosses earn about three-quarters of what their male counterparts earn. The report also reveals that the majority of investors do not consider a lack of diversity to be very important: Around only a quarter (23%) see gender diversity at board level as important or vitally important. Equally, the majority resist any sort of regulator-imposed diversity criteria, with just 19% believing it would be a good idea. Yet, 53% of those surveyed believe that diversity of experience is important, and 69% believe that board independence is important.

The Female FTSE Board Report 2016, released in July, confirmed that more than one-quarter of FTSE 100 board seats are now filled by women, and that 19% of FTSE 100 company boards are composed of at least 33% female directors. The report notes that the vast majority of the new appointments going to women are for nonexecutive directorships. Little progress has been made in the number of executive directorships going to women; only 9.6% of executive directorships were held by women in October 2015 compared with 5.5% in 2010.

United States

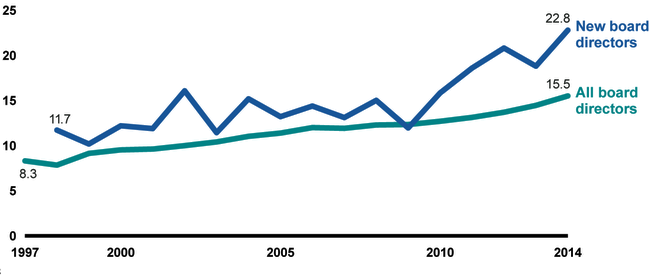

In a 2016 report by the US Government Accountability Office (GAO), the GAO reported that representation of women on the boards of US publicly traded companies has been increasing, but greater gender balance could take many years. As shown in the following figure, in 2014 women held about 16% of board seats of companies in the S&P 1500 Index, up from 8% in 1997. This increase was partly driven by a rise in women’s representation among new board directors. But even if equal proportions of women and men joined boards each year beginning in 2015, the GAO estimates that it could take more than four decades for women’s representation on boards to be on par with that of men’s representation.

Percentage of Women on Corporate Boards and among New Directors, 1997–2014

Source: GAO analysis of Institutional Shareholder Services data for the S&P 1500.

Analyzing interviews with stakeholders, board director data, and relevant literature, the GAO identified various factors that may hinder women’s increased representation among board directors:

- Boards not prioritizing recruiting diverse candidates

- Few women in the traditional pipeline to board service, with CEO or board experience

- Low turnover of board seats

In May, Bloomberg launched a Financial Services Gender-Equality Index that provides investors and organizations with standardized aggregate data across company gender statistics, employee policies, gender-conscious product offerings, and external community support and engagement.

The inaugural 2016 index recognizes 26 financial services firms with strong commitments to gender equality, including dedicated social disclosure policies and practices. Firms that were interested in participating submitted a social survey created by Bloomberg in partnership with third-party experts, including Women’s World Banking, Catalyst, and Working Mother Media. Those included on this year’s index scored at or more than 60 points, a global threshold established by Bloomberg and their partners to reflect disclosure and the achievement or adoption of best-in-class statistics and policies.

Also in May 2016, the Thirty Percent Coalition called on chief legal officers to help achieve more diversity on boards by doing the following:

- Take steps to ensure that board committees responsible for director recruiting (typically, nominating and governance committees) routinely include female candidates in the pool from which director nominees are chosen for every board search.

- Encourage director searches to go beyond CEOs as director nominees and include such candidates as C-suite officers and individuals from diverse environments and backgrounds, such as former government, academia, and non-profit organizations.

- Assist CEOs with identifying senior executive women within the company who are potential board candidates and help to develop and sponsor these women for membership on corporate boards, consistent with company policy.

- Ensure that the search firms engaged by boards understand that corporate leaders are committed to recruiting women, people of color, and individuals from various ethnic backgrounds as candidates.

In June, 2020 Women on Boards, which is a national campaign to increase the percentage of women on US company boards to 20% or greater by the year 2020, released a report titled Boardroom Diversity: When Women Lead. The following are some of the key findings of the report:

- Boards with female CEOs, board chairs, or nominating committee chairs are significantly more gender diverse than boards with male leadership.

- Of the Fortune 1000 companies with a female CEO or board chair, 88% of those with a female CEO and 86% of those with a female board chair have already met or surpassed the group’s goal of having 20% or more women on the board. This percentage compares with 42% of all Fortune 1000 companies meeting that goal.

- Contrary to popular belief, Fortune 1000 board seats held by women are not monopolized by an elite subset of individuals. Seventy-five percent of female directors devote their attention to a single Fortune 1000 company board, although many may also be on smaller company boards.

- Twelve women serve on four or more Fortune 1000 boards and come from a variety of professional backgrounds, including law, politics, academia, and non-CEO executive positions as well as the C-suite. This “Amazing Dozen,” as 2020 Women on Boards calls them, shows that there are a multitude of paths to the boardroom and that top US companies value a diversity of experience.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: ©iStockphoto.com/Rawpixel Ltd

Canada’s gender focused 3/22/17 budget had many aspects focusing on women – except getting the number of women on boards increased – an economic driver and enhancer! If getting more women on boards is truly an economic enhancer, why is there not a concerted effort to make this happen asap – especially in the extraction sector?

CecureUs trains employees in a workforce to promote equality, diversity, and inclusion at the workplace and to curb the occurrence of sexual harassment.