Ethics in Practice: Longtime Customers Can Be Trusted, Right? Case and Analysis

How does your answer choice for this week’s case (2 July) compare with the analysis? Check it out below.

If a bank also has an associated investment group, it would not be unusual for a customer to open accounts with both. And if it is a longtime customer, then it seems that customer would have an established track record of legitimate transactions. In this week’s case, an investment group CEO faces this type of situation. Read on and then join the conversation to let us know whether you think his actions were appropriate and what CFA Institute Standard of Professional Conduct applies.

Case

Smith-Pelley is president and CEO of Capital First Investment Group (CFIG), an investment adviser that is a wholly owned subsidiary of Capital First Bank. CFIG uses the 25 branch offices of the bank for its business locations. One client of CFIG, a longtime bank customer and personally known by Smith-Pelley and the board members of the bank, opened an investment account at CFIG with the stated investment objective of income. Although the client did make a few investments over the course of a year, the client engaged in almost exclusively banking activity in the account that involved hundreds of transactions and consisted of $90 million in deposits and $84 million in withdrawals.

The transactions included electronic transfers to and from individuals and entities located in bank secrecy havens or countries identified by the government as presenting a money laundering risk. In addition, Smith-Pelley understood the client to be engaged in a type of international business activity that presented an increased risk of transactions being tainted by corruption or bribery. But because of the client’s longstanding relationship with the bank, Smith-Pelley presumed that the transactions had a legitimate business purpose. Smith-Pelley accepted vague descriptions of the transactions as “for services provided,” “consulting fees,” or “commissions,” and he approved the daily anti money laundering (AML) reports (required by law when transactions trigger red flags of potentially suspicious activity) without further investigation. Smith-Pelley’s actions are

- appropriate because the non-securities activity in the client’s CFIG account was consistent with the type of transactions he had engaged in at the bank for many years.

- appropriate because Smith-Pelley is protecting the confidentiality of client information.

- appropriate because Smith-Pelley can rely on the clearing firm to report suspicious activity for the account.

- inappropriate.

Analysis

The facts presented in this case should have raised a number of questions for Smith-Pelley regarding the legitimacy of the client account at CFIG. The high velocity of money movement and low volume of investment activity was inconsistent with maintaining a securities account for the purpose of generating income, as stated in the account documents. The transactions in the account were high-risk transactions for money laundering activity and should have raised a greater level of scrutiny. Rather than investigate as required by law, Smith-Pelley did not ask questions because of the client’s long-standing relationship with the bank.

Smith-Pelley cannot rely on the clearing firm to meet CFIG’s independent obligation to review the transactions for suspicious activity. Duty of loyalty to clients and preservation of confidentiality of client information cannot be used as a shield to allow clients to violate the law or otherwise damage the integrity or viability of global capital markets. Smith-Pelley’s actions violated Standard I(A): Knowledge of the Law which states that CFA Institute members and candidates must understand and comply with all applicable laws, rules, and regulations covering they professional activities. Smith-Pelley’s failure to adequately comply with the anti-money laundering requirements imposed by law violates this standard. The best choice is D.

This case is based on a June 2018 enforcement action by the US Financial Industry Regulatory Authority.

Have an idea for a case for us to feature? Send it to us at [email protected].

More About the Ethics in Practice Series

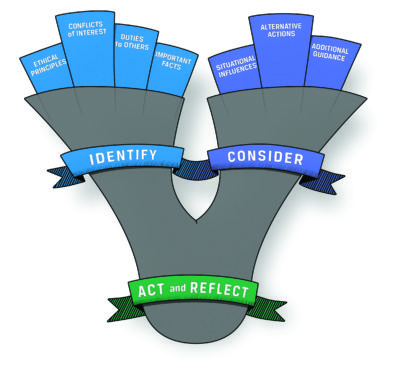

Just as you need to practice to become proficient at playing a musical instrument, public speaking, or playing a sport, practicing assessing and analyzing situations and making ethical decisions develops your ethical decision-making skills. The Ethics in Practice series gives you an opportunity to “exercise” your ethical decision-making skills. Each week, we post a short vignette, drawn from real-world circumstances, regulatory cases, and CFA Institute Professional Conduct investigations, along with possible responses/actions. We then encourage you to assess the case using the CFA Institute Ethical Decision-Making Framework and through the lens of the CFA Institute Code of Ethics and Standards of Professional Conduct. Then join the conversation and let us know which of the choices you believe is the right one and explain why. Later in the week, we will post an analysis of the case and you can see how your response compares.

Image Credit: ©CFA Institute