Ethics in Practice: Expenses Billable or Not Billable? Case and Analysis–Week of 23 July

Traveling for business is expected in many professions, and it is not unusual to make changes after the trip is booked, add on personal days, or bring along a companion. But the question is what expenses are appropriate to bill back to the client? Read about such a scenario in this week’s case and then join the conversation to share what you believe is the right choice.

Case

Braun and his firm are hired by a regional government to serve as its financial adviser for issuing general obligation bonds. The municipality conducts several bond offerings over a number of years for constructing a number of municipal facilities, including a maximum security detention facility and two school buildings. In connection with the bond issues, Braun makes a number of trips to New York City to meet with ratings agencies in connection with these offerings. The trips are typically planned for a Monday or Friday so Braun can obtain the cheapest travel costs. Braun’s wife accompanies him on the trips and they typically spend the weekend either before or after the meetings in New York City to enjoy sporting events, theater performances, and museums. Braun often makes a number of flight and hotel changes after a trip is booked to accommodate meetings with other clients. Braun submits his trip expenses to his supervisor who deducts trip costs she believes are unrelated to the business purpose of the trip and submits the bills to the municipality for reimbursement. Which of the expenses below can most likely be billed to the client—for example, the government entity issuing the bonds?

- Braun’s accommodation and meal expenses for the weekend days because the travel rates are cheaper over a weekend.

- Tickets to the sporting and theater events, as long as they do not exceed an amount for reasonable business entertainment.

- Flight and hotel change fees that result from the regular course of Braun’s business activities.

- The travel and accommodation expenses for Braun’s wife if he discloses to his supervisor that she is making the trips and receives written approval for her travel.

Analysis

This case relates to CFA Institute Standard III(A): Loyalty, Prudence, and Care, which states that members have a duty of loyalty to their clients, must act for their clients benefit, and must place client interests before their own interests. Under this standard, investment professionals, including municipal security dealers, must not engage in any deceptive, dishonest, or unfair practice when handling client accounts. Charging excessive or lavish expenses for the personal benefit of the investment professional at the expense of the client can constitute a deceptive, dishonest, or unfair practice that violates Standard III(A). All of the expenses incurred by Braun can, in some way, be considered personal or business-related expenses that should not be charged to the municipality seeking to issue the bonds.

In the context of conflicts of interests, the CFA Institute Code of Ethics and Standards of Professional Conduct allow members to accept or provide modest gifts and entertainment done in the ordinary course of business (a gift basket at the holidays from a vendor or to a client, for example). But that “ordinary course of business” does not allow investment professionals to charge clients for obviously extraneous entertainment expenses tangentially connected to a business meeting. Even if Braun notified and received permission from his employer for his spouse to accompany him on the business trip, that permission cannot extend to treating the client unfairly by charging the client for the spouse’s expenses. And although busy investment professionals may be forced, by other priorities, to change travel arrangements when a trip on behalf of a client has already been scheduled, additional expenses resulting in the change most likely must be borne by Braun as an overhead cost, not charged to the client. (Under some limited circumstances, those expenses might be charged to the client necessitating that the travel changes be made).

It is possible that the savings in travel fees for booking a weekend travel schedule is greater than the additional accommodation and meal expense for Braun to stay in New York City the extra days, making the cost to the client lower. If this is the case, Braun would be meeting his duty of loyalty to the clients by choosing the most inexpensive travel schedule overall, thus limiting costs to the client. Under these circumstances, choice A describes the expenses most likely to be able to be billed to the client.

This case is based on an enforcement action by the US Financial Industry Regulatory Authority (FINRA).

Have an idea for a case for us to feature? Send it to us at [email protected].

More About the Ethics in Practice Series

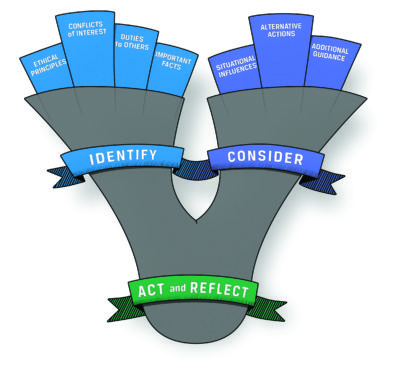

Just as you need to practice to become proficient at playing a musical instrument, public speaking, or playing a sport, practicing assessing and analyzing situations and making ethical decisions develops your ethical decision-making skills. The Ethics in Practice series gives you an opportunity to “exercise” your ethical decision-making skills. Each week, we post a short vignette, drawn from real-world circumstances, regulatory cases, and CFA Institute Professional Conduct investigations, along with possible responses/actions. We then encourage you to assess the case using the CFA Institute Ethical Decision-Making Framework and through the lens of the CFA Institute Code of Ethics and Standards of Professional Conduct. Then join the conversation and let us know which of the choices you believe is the right one and explain why. Later in the week, we will post an analysis of the case and you can see how your response compares.

Image Credit: ©CFA Institute

Expenses are a great subject. The SEC has fined a number of Private Equity firms for excessive flights spouses etc. in this vein.