To Regulate or Not to Regulate: That Is the Question

The introduction of blockchain technologies generally is considered to be conducive to improving efficiency and stability of the finance industry, with practical applications spanning from more efficient fund transfers, to trade settlements, to voting. With the invention and popularization of blockchain technology, HSBC Holdings PLC has noted that a broad network of international financial institutions now is executing cross-border payment transactions using such technology. According to Pricewaterhouse Coopers, participants in a blockchain can confirm transactions without a need for a central clearing authority, which can increase transparency and lower transaction costs between parties involved in transactions.

Issues related to cryptocurrencies

Notwithstanding the benefits of blockchain technologies, skepticism has been raised around the application of blockchain technologies in cryptocurrencies (cryptos). Among this skepticism, the meteoric volatility of blockchain technology – backed cryptos has arguably garnered the most attention as a source of instability.

For instance, according to the US Securities and Exchange Commission, features of cryptos that enable owner anonymity and the lack of oversight and regulations could induce “illicit trading and financial transactions.” In a report prepared for the European Parliament’s Special Committee on Financial Crimes, the anonymity nature of cryptos has been flagged as a major concern because it could prevent “cryptocurrency transactions from being adequately monitored, allowing shady transactions to occur outside of the regulatory perimeter and criminal organizations to use cryptocurrencies to obtain easy access to ‘clean cash’.” Similarly, given its anonymous nature, taxation authorities would face difficulty in identifying taxable transactions, detecting tax evasion activities, and sanctioning parties involved. These concerns may explain the growing demand for regulations over cryptos.

Although regulations on certain crypto-related activities exist, efforts have been uneven and observers are casting doubts about these cryptos because of the frequency and severity of relevant frauds. Recently, investors in QuadrigaCX, the largest crypto exchange in Canada, were denied access to their funds after the founder of the exchange, Gerald Cotton, reportedly died at the age of 30, taking the password to gain access to the platform to his death. According to CipherTrace, investors and crypto firms lost more than US$1.7 billion in 2018, of which US$950 million was stolen from crypto exchanges and related platforms (i.e., 3.6 times more than 2017). These findings are in line with those of Chainalysis’ Crypto Crime Report, which pointed out that crimes related to cryptos jumped in 2018, with hacking activities dwarfing other forms of crimes (i.e., around US$1 billion). Against this background, investors are calling for more effective regulations to enhance investor protection.

The need for regulation and challenges for regulators

The Financial Stability Board suggests that although cryptos may not pose systemic risk at this juncture, the evolution of the use of cryptos could challenge financial stability in the future. The Organisation for Economic Co-operation and Development has pinpointed that, despite the potential benefits of blockchain and other technologies to the larger society, risks are brought about by such technologies involving consumer and investor protection, cybersecurity, and privacy. In response, it calls for appropriate regulatory frameworks that could avoid “knee-jerk reactions” to events.

The Asian Securities and Industry and Financial Markets Association alerts that when rules and regulations are put in place, policy makers should ensure that such rules are technology-neutral and “do not unduly impede technologies.” For example, it suggests that the establishment of laws to, say, store data outside of a blockchain, would contradict the intention of creating distributed ledger technologies. As such, regulations would lead to higher complexity of fetching and storing data and potentially would bring even higher risk to data security and integrity.

Having said that, coming up with a holistic and forward-looking regulatory framework is easier said than done, in part because of the proliferation of cryptos and the rapid development of the underlying technologies. According to data tracked by CoinMarketCap, some 2,082 types of cryptos have a US$134 billion market capitalization (as of 22 February) with different sizes, underlying technologies, and functions. This value explains why both the European Banking Authority and the European Securities and Markets Authority have suggested that a one-size-fits-all regulatory approach would be inappropriate.

Regulatory response

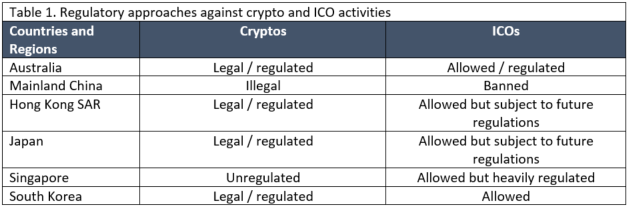

In light of the rising prevalence and severity of fraud cases, governments and regulators have been prompted to issue announcements to, at the minimum, remind potential investors of relevant risks (e.g., US Securities and Exchange Commission, Financial Services and Markets Authority of Belgium). Other regulators have either launched or considered launching regulatory sandboxes for crypto companies (e.g. United Kingdom, Hong Kong). No consensus approach to such issues has been taken, however, as, in the Asia-Pacific region alone, a variety of approaches are being adopted.

For instance, in mainland China, a blanket ban of crypto trading and initial coin offerings (ICOs) has been in place since 2017. In Hong Kong, the Securities and Futures Commission recently made an attempt to regulate “funds and unlicensed trading platform” with an aim to enhance investor protection. As for Japan, where cryptos can be used as a medium of exchange, crypto exchanges with an operating presence in Japan are subject to the Payment Services Act since 2017 as well as other money-laundering regulations.

For some other markets in Asia, crypto exchanges have been asked to comply with anti–money laundering (AML) regulations, for which they are responsible for identifying and reporting suspicious activity and mitigating money laundering and terrorism financing risks. In Singapore, the deputy prime minister raised a point that intermediaries should be subjected to AML regulations. As for Australia, an AML program has been put in place that requires crypto-related businesses to register with authorities and follow various reporting and identity-checking procedures.

Source: Bitcoin Market Journal, CFA Institute.

Notwithstanding the fact that different markets have launched domestic crypto regulations, the International Organization of Securities Commissions notes that regulators are challenged with the task of delivering consistent regulatory frameworks across borders. While markets and investors are operating globally, any regulatory inconsistencies could lead to potential regulatory arbitrage. The border-bounded regulations also make market supervision and regulatory enforcement highly difficult. Therefore, regulators should seek cooperation and should exchange information among international peers to come up with a delicate balance.

The way forward

Despite the crash of crypto prices since 2017, blockchain technologies will continue to make waves in the financial space and their evolution will continue to influence regulatory perimeters in different jurisdictions.

Uncertainty and speculation bring volatility to financial markets. The Bank for International Settlements found that the ever-changing regulatory landscape has shaken investment sentiment in cryptos and has been one reason for the volatility of crypto prices, such as that of Bitcoin (see Chart 1). With the potential for more and stricter regulations, which could lead to additional volatility of crypto prices, potential investors must be educated about the probable shocks.

Source: CoinMarketCap, CFA Institute.

Given the global – and often anonymous – nature of funds and integration of markets, coordination and cooperation among different stakeholders, including international organizations, consumer groups, regulators, and standard setters, should be encouraged. Such an effort will curb regulatory fragmentation and lower the likelihood of regulatory arbitrage. This coordination also will help formulate a harmonized set of clearly defined regulations that will encourage the realization of the full potential of the associated technologies and strengthen cross-market operability.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo Credit: ©Getty Images/TarikVision

Good share!

Thanks for sharing.

Thanks for sharing!

thanks for sharing this content