Are ESG factors relevant only for investors with long-term investment horizons?

During the joint CFA Institute–Principles for Responsible Investment (PRI) workshop series on ESG integration, participants from around the world made similar observations about the nature of ESG factors. Here are some summaries of those insights.

- ESG factors are long-term drivers of return.

- ESG factors can influence market prices over the long term and can add value.

- ESG factors are more material the longer a company is held in a portfolio.

- ESG events are low-probability, large-impact events that are difficult to predict but that increase in likelihood as the time frame of the investor increases.

These observations suggest that ESG integration is less relevant to investors with a short investment horizon. In fact, some workshop participants suggested that ESG factors come into play when the investment horizon is a minimum of five years, making them material to long-term investors only. But is that true?

Why long-term factors not short-term factors?

Several reasons are often given when investors state that ESG factors are long-term factors and not short-term factors. One point often made is that traditional financial factors (e.g., quarterly earnings, interest rates, inflation) have an overriding influence on prices, especially in the short term.

A participant of our workshop in France stated that returns are less likely to be driven by long-term ESG factors and are more likely to be driven by short-term factors, such as supply and demand, sentiment, financial news, quarterly results, broker recommendations, political factors (e.g., stability of government), and economic indicators.

Workshop participants across several jurisdictions, however, believe that ESG factors are positively influencing share prices and bond prices in the short term as well as in the long term. During the Frankfurt workshop, a participant said that ESG effects on the upside tend to materialize through a series of incremental upticks that individually contribute to long-term investment return. Sudip Hazra, head of sustainability research at Kepler Cheuvreux, points out that “sometimes what we are looking at in the long-term is a series of constructive short-term decisions, not just one long-term decision which is static, that will lead to a longer time frame and can lead to short-term and long-term outperformance.”

Even with the downside, there can be short-term incremental impacts on market prices. Benjamin Yeoh, senior portfolio manager at RBC Global Asset Management, highlights Carillion as an example,

Carillion, which went bankrupt, you actually died a death of 1,000 cuts over the three years preceding that. You could talk about whether it was culture or all of those other things, but if you crystallize a lot of the problems as being on the ESG risk side of the matter, then actually you had a long, drawn out, multi-year destruction of value before we had a very abrupt complete destruction of value.

Long-term factors turning into short-term factors

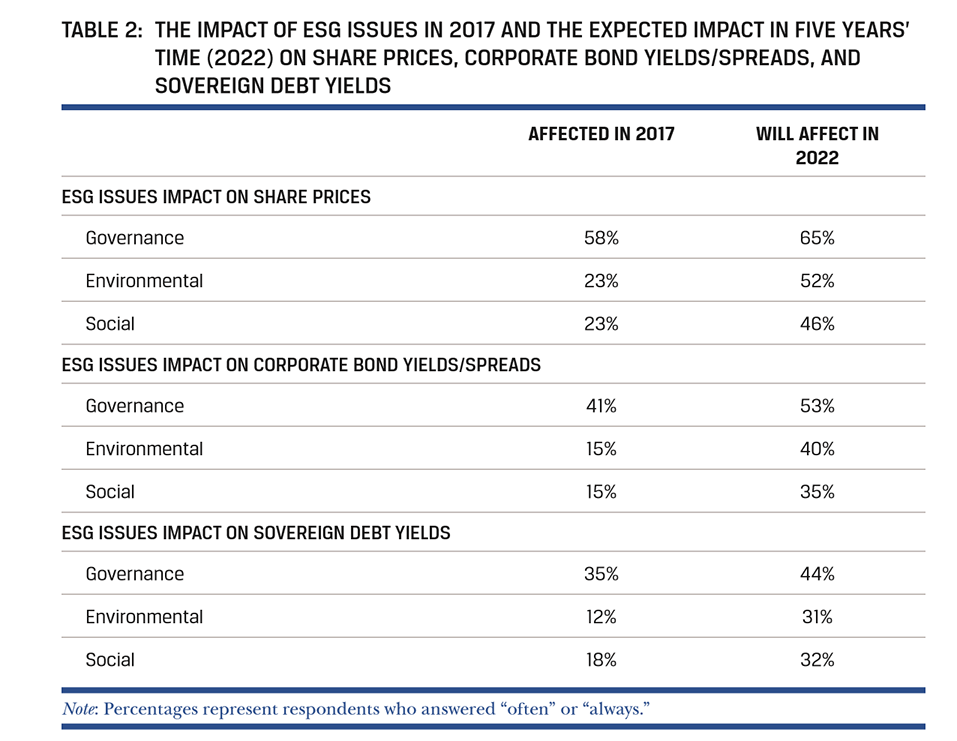

Another argument often made to explain why ESG factors are long-term factors is that ESG factors, ultimately environmental and social (E&S) factors, are not material now, but they may influence market prices in three years, five years, or longer. This argument is slowly being eroded as ESG investments now have moved into the mainstream arena and as more practitioners have identified ESG factors that they already are analyzing. According to a survey of 1,100 CFA Institute members, 23% of respondents believe that both E&S issues had often or always affected share prices in 2017 (see Table 1).

Table 1: Guidance and case studies for ESG integration: equities and fixed income

Respondents acknowledged that E&S factors are likely to be more material in three years’ time, which was demonstrated by 52% and 46% of respondents believing that E&S issues, respectively, will often or always affect share prices in 2022, an increase of 29% and 23%, respectively, on 2017 figures.

Investors, however, also are demonstrating the short-term impact of ESG factors on their portfolio holdings. Investors regularly point out that securities can be exposed to different material ESG factors over the short term, medium term, and long term. In the case of Argentinean sovereign debt, governance issues such as political stability and institutional strength are key long-term drivers of returns, whereas in the short term, extreme weather, such as the drought in 2017–2018 may have had a significant influence on sovereign debt prices through the impact on net exports and therefore the trade balance[JS1] [MO2] . (A more in-depth analysis of ESG integration and Sovereign debt, look at PRIs Sovereign Debt Guide).

ESG factors also can move from the long term to the short term and vice versa. Additionally, multiple ESG factors can be at play — for example, a company can be exposed to an ESG factor that is an underlying long-term driver of returns but another ESG factor suddenly may materialize as a low-probability, high-impact event that produces an immediate sell signal. Masja Zandbergen-Albers, head of sustainability integration at Robeco, reveals that “the whole idea of doing your investment analysis with a long term perspective is because you never know when the long-term factors turn into short-term factors and therefore you never know when ESG factors are going to hit — it can be tomorrow.”

Rob Wilson, research analyst at MFS Investment Management, explains that, in the past, he often was amazed at how quickly some of these E&S factors became investment relevant,

We did some more work on drug pricing due to their exposure to certain ESG issues, for example H1B visa issues in the United States and outsourcing. I thought back in 2014 that over the next ten years, these ESG issues were going to become important. All over a sudden, within in a year and a half, these topics were big news from both a political and regulatory standpoint and in terms of just the social conscious.

Falling holding periods

One possible consequence of ESG factors becoming more short term in nature is that more investors with short-term strategies will embrace ESG integration for alpha generation. As Wilson demonstrates:

Let’s say you want to play the semiconductor cycle so you’re going back to analog devices six times in a five year time period, which probably means you own analog devices for three or three and a half years. The probability that you’re going to be impacted by one of these “long term ESG issues” is still actually relatively high.

Another consequence is that while you may have a long-term investment horizon, in some incidences, you could have a shorter holding period than you anticipated. As Yeoh puts it, “This is the interesting thing about the time-frame horizon analysis period versus holding period. At a security level, all of a company’s value may have crystallized within three months. So, you might have been looking at it in a longer view horizon but only holding it for a short term period.”

Why does it matter?

This begs the question: why does it matter that ESG factors are not considered to be short-term factors? Investment horizons can prevent investors from considering material ESG factors that can build up investment risk within a portfolio, especially those with a short investment horizon. As Aaron Ziulkowski, CFA, ESG integration manager at Boston Trust and Investment Management Company highlights, “one’s judgment around materiality is definitely impacted by your investment time horizon. As long-term investors, ESG issues are important to our fundamental analysis whereas for others, these issues might fall off the page.”

In the pursuit of alpha and risk mitigation, investors are spending a lot of time identifying which ESG factors are material and predicting when they will be material — will it be in within one year’s time, two years’ time, or five years’ time? Although investors do find it difficult to identify when an ESG event will happen, this is the same for non-ESG factors. For example, the market doesn’t always correctly predict when a central bank will increase or decrease its overnight rate.

Because the timing of ESG influence is difficult to predict, investors argue that ESG integration is invaluable for all investors, especially as ESG factors are considered to increasingly affect market prices in the short term and long term. As participants agreed during the France workshop, “ESG events are often low-probability, large-impact events that are difficult to predict but increase in likelihood as the time frame of the investor increases. Such extreme events therefore lend themselves to ESG analysis which is an essential component of strong risk management.”

Final Summary Points

- Some workshop participants suggested that environmental, social, and governance (ESG) factors comes into play when the investment horizon is a minimum of five years, making them material only to long-term investors.

- Workshop participants believe that ESG factors can materialize through a series of short-term, incremental upticks that individually contribute to long-term, investment return.

- A possible consequence of ESG factors becoming more short term in nature is that more investors with short-term strategies may embrace ESG integration for alpha generation.

- Investors argue that ESG integration is invaluable for all investors, especially as ESG factors are considered to increasingly impacting market prices in the short-term and long-term.

Image Credit: ©boonchai wedmakawand