CFO Article on Buffett Garners Comment from Prominent Investor. We Argue Mr. Graham’s View is Minority Among Investment Professionals

[Editor’s Note: In Buffett Rebuffed, which ran in CFO.COM, this author noted that Warren Buffett said in a 2017 letter his intentions were to hold securities forever, and therefore short-term fluctuations were essentially irrelevant. However after he sold his stakes in the four largest US airlines earlier this year, he transformed the unrealized losses in the March 31 income statement to realized losses appearing in June 30 in accordance with Financial Accounting Standards Board’s ASU 2016-01— the 2016 accounting for equity securities passed in 2016. The CFO.COM elicited a pointed objection from prominent investor Don Graham to its premise. This article responds to the protestations put for by Mr. Graham.]

One thing on which Mr. Graham and I can absolutely agree is that published financial statements are meant to inform investors about the business results of a company.

Majority of Investors Support Equities at Fair Value

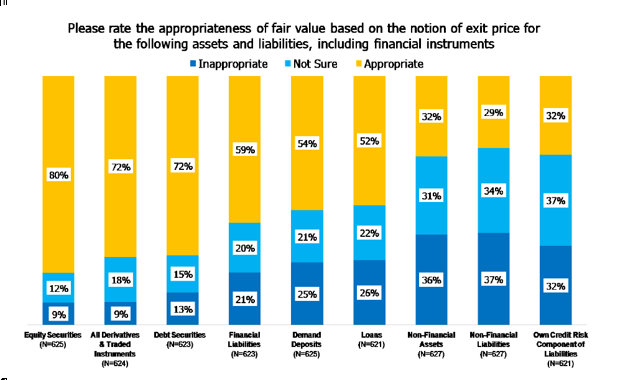

To ensure that we keep our finger on the pulse of what investors want, CFA Institute routinely surveys investment professionals regarding accounting policy preferences. For example, in 2009, in the run-up to accounting rulemaking by the IASB (IFRS) and FASB (USGAAP), we surveyed our investor members for their preferences regarding the accounting measurement of all financial instruments – not just equities. The results were as follows:

this is a test

So, while we have not—as Mr. Graham suggests in his response to my article in CFO, Buffett Rebuffed —surveyed Berkshire shareholders about their views on the accounting change, we have surveyed and spoken with thousands of investment professionals on the matter over the multiple surveys and direct outreach we have conducted on this topic over at least the last three decades. What we found in this survey, and continue to find, is that demand for fair value accounting for equity securities is supported by a substantial majority (80%) of investment professionals. Investors want to understand the risks inherent in a business, as these equity security risks are experienced by the business, not just when they are realized, or sold, as Mr. Graham supports. So, on this question, Messrs. Buffett and Graham are definitely in the minority.

A Good Fit for Berkshire’s Business Model

In fact, we believe the FASB’s accounting for equity securities is well suited for Berkshire Hathaway’s business model – a model that uses its insurance float to act as an investment holding company. Specifically, for those equity securities where Berkshire:

- has no control, fair value through net income appropriately reflects Berkshire’s susceptibility to the price market participants are willing to pay;

- exhibits significant influence – as is the case for Kraft Heinz and, from review of historical financial statements, the accounting for Graham Holdings – the equity method of accounting where Berkshire “picks up” a percentage of the investee company’s results reflects their ability to influence but not control outcomes; and

- controls a majority interest in a company Berkshire appropriately consolidates the results from the date of acquisition – reflecting the new basis in assets and liabilities – and the historical basis from that point forward.

It is our view that the US GAAP model for equity investments that differentiates the accounting based upon Berkshire’s ability to influence outcomes appropriately distinguishes for Berkshire’s investors the business model and Mr. Buffett’s ability to influence outcomes at these investee companies. Mr. Graham’s complaint is with the accounting for those securities over which Berkshire has no control.

Mr. Buffett explains at the annual shareholders’ meeting why he views all of these equity investments as “partnerships.” The problem with his analogy is that Mr. Buffett is not a partner in those entities – such as the airlines – where he exhibits no influence. He is a price taker like all other non-controlling shareholders. He is subject to the whims of the market – as the market showed him in March and April. His, or any management’s intent, does not alter the value of the securities. That intent is, in fact, not relevant. That is why the accounting for these equity securities – over which Mr. Buffett has no influence – being reflected in the income statement is the most appropriate for Berkshire’s, and all, investors. The accounting communicates what the securities are worth. Mr. Buffett’s exit price is the market price – just like small individual investors experience in their 401(k) each period. This is the value of the securities irrespective of Mr. Buffett’s intent and the change in value each period is the gain or loss Berkshire’s investors experience each period. This is why it is most appropriate to reflect such gains and losses (realized or not) more prominently in the income statement of Berkshire Hathaway.

Simply A Presentation Change to More Prominently Display Investment Risks

It is also important to remember that the accounting Mr. Graham disagrees with is simply a reclass of the valuation of these securities market fluctuations from equity to net income. The change is simply a presentation change – moving these unrealized gains/losses out of “other comprehensive income” to “net income” to make sure investors focus on the true bottom line (“comprehensive income”) for Berkshire. There is no change in the true bottom line. This change was made by the FASB to ensure investors had a more prominent display of the equity market risks they face. An appropriate result for investors.

Berkshire’s Warning Contradicts the Purpose of the Change

Berkshire’s warning – affixed at the bottom of the press release income statement – that the accounting change produces results that are “usually meaningless” is, in our view, a disservice to investors. It is this prominence and investor attention that was the basis for the FASB’s change. Results at March 31, 2020 proved highly meaningful for investors – just before Berkshire divested its interest in airline stocks in April. This new presentation simply demonstrates the market volatility Berkshire has agreed to assume – and to which it investors should be aware – through these investments. Review of Berkshire’s equity security holdings – listed in Mr. Buffett’s Annual Letter – over the last ten years demonstrates sales of such securities are not infrequent. As such, these fluctuations are very meaningful to investors.

Our Long Standing, Investor Informed Position

Our outreach and investor engagement tells us this accounting – a position we have had for over thirty years – is preferred by investors as it more prominently and transparently displays investment market risks. If an investor does not prefer this accounting, they can easily adjust to remove these unrealized gains or losses – having been fully informed by this more prominent presentation.

Photo Credit: ©Getty Images