As the SEC Turns Its Attention to Human Capital, Investors and Accountants Need to Pay Attention

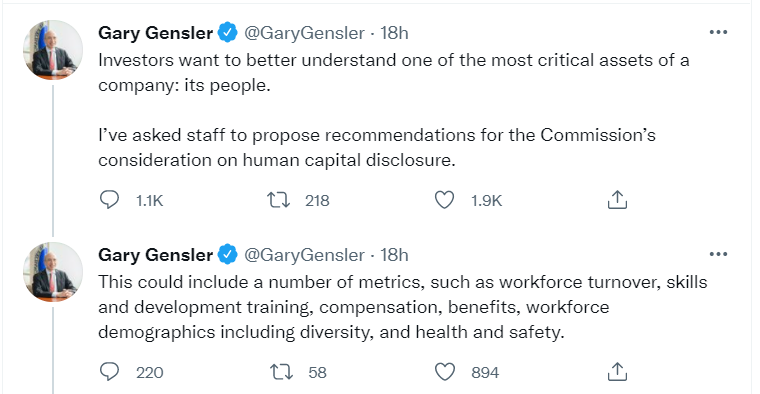

Although much of the focus on environmental, social, and governance (ESG) disclosures has been on climate risk disclosures, Chair Gensler’s tweet on 18 August highlights the fact that the SEC may be turning its attention to human capital disclosures.

In our 2019 comment letter to the SEC on proposed changes to modernize Regulation S-K Items 101, 103, and 105, we made the following comment with respect to human capital in the context of our discussion of intangible assets:

Perhaps most interesting about human capital relative to climate risk is that the financial statements are already supposed to provide some degree of information on human capital, such as compensation expense, but financial statements do not always do this. If you listen closely to what investors are asking for on this clearly financially value relevant information, much of what they are saying suggests that they need better disclosures not only outside the financial statements on the “intangible of human capital” but also within the financial statements. The cost of human capital is included within the financial statements – and my differ by segment – but those costs may need to be made more transparent with improvements inside and outside of the financial statements simultaneously.

The SEC’s final rule on Modernization of Regulation S-K Items 101, 103, and 105 included little on human capital disclosures and certainly did not meet the investors’ request. This SEC seems to be changing direction.

This is a tweet that investors, and the Financial Accounting Standards Board, should pay attention to.

[1] At a minimum, we believe that companies should provide a breakdown of their total employees such as by employees and independent contractors; full-time and part-time or seasonal employees; or domestic or foreign employees, where relevant. We are supportive of universal disclosures proposed by the Human Capital Management Coalition.