SPAC Audits: SEC Fines Marcum for Quality Control Deficiencies

PCAOB audit partner transparency data provided a leading indicator of audit quality issues.

The US Securities and Exchange Commission (SEC) issued a press release yesterday that:

“Charged audit firm Marcum LLP with systemic quality control failures and violations of audit standards in connection with audit work for hundreds of special purpose acquisition company (SPAC) clients beginning at the latest in 2020. The SEC’s order also found that Marcum’s deficiencies were not limited to SPAC clients, but they reflected systemic quality control failures throughout the firm. Marcum agreed to pay a $10 million penalty to settle the charges.

“According to the SEC’s order, over a three-year period, Marcum more than tripled its number of public company clients, the majority of which were SPACs, including auditing more than 400 SPAC initial public offerings in 2020 and 2021. The strain of this growth, however, exposed substantial, widespread, and pre-existing deficiencies in the firm’s underlying quality control policies, procedures, and monitoring. These deficiencies permeated nearly all stages of the audit process and were exacerbated as Marcum took on more SPAC clients. Moreover, in hundreds of SPAC audits, Marcum failed to comply with audit standards related to audit documentation, engagement quality reviews, risk assessments, audit committee communications, engagement partner supervision and review, and due professional care. Depending on the audit standard at issue, violations were found in 25-50 percent of audits reviewed, with even more frequent, nearly wholesale violations found as to certain audit standards across Marcum’s SPAC practice.” (Emphasis added.)

Concerned by public reporting throughout 2021 that the two small accounting firms Withum and Marcum were conducting the vast majority of special purpose acquisition company (SPAC) initial public offering (IPO) audits, CFA Institute dug deeper into who within those firms was responsible for those audits.

As we have done for previous reports in 2018 and 2023, we used the Public Company Accounting and Oversight Board (PCAOB) Auditor Search Database to identify all the Form APs filed by Withum and Marcum. Form APs are required each time an audit opinion is issued1 and are an indicator of the workload of audit engagement partners. The SEC first required Form APs in 2017, so several years of data prior to the 2020–2022 SPAC boom are available for comparison purposes.

We pulled all Form APs for the two firms, not simply those related to SPACs, through mid-April 2022 when the SPAC market slowed substantially. Knowing that these firms have few public audit clients, we felt using all the Form APs would be a good indicator, yet would not require us to sift through the data to identify the SPACs. This exercise turned out to be even more relevant as the SEC found the audit quality issues were not simply related to SPAC audits — though the volume of SPAC audits stressed already weak audit quality controls.

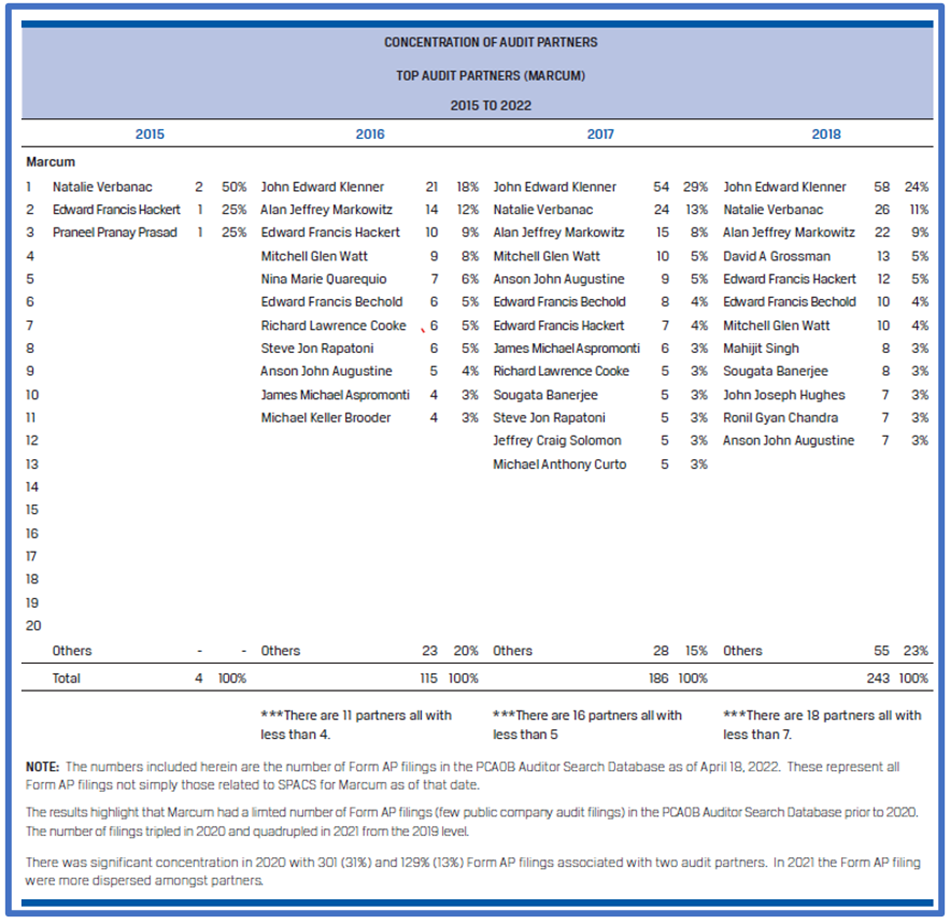

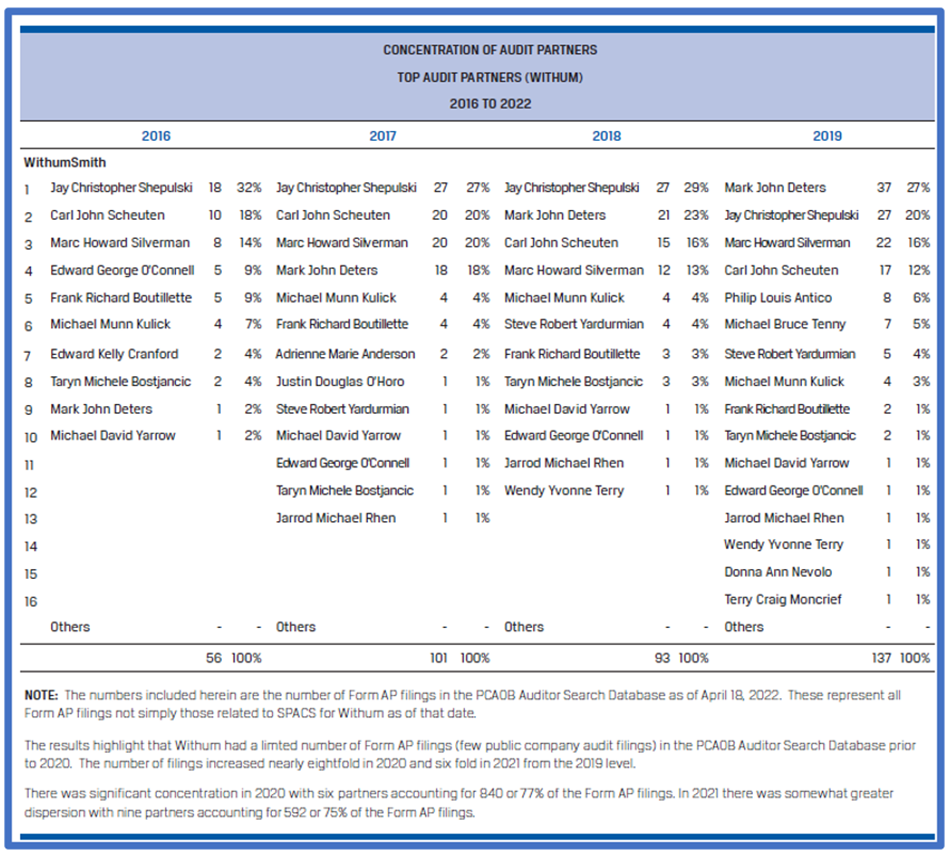

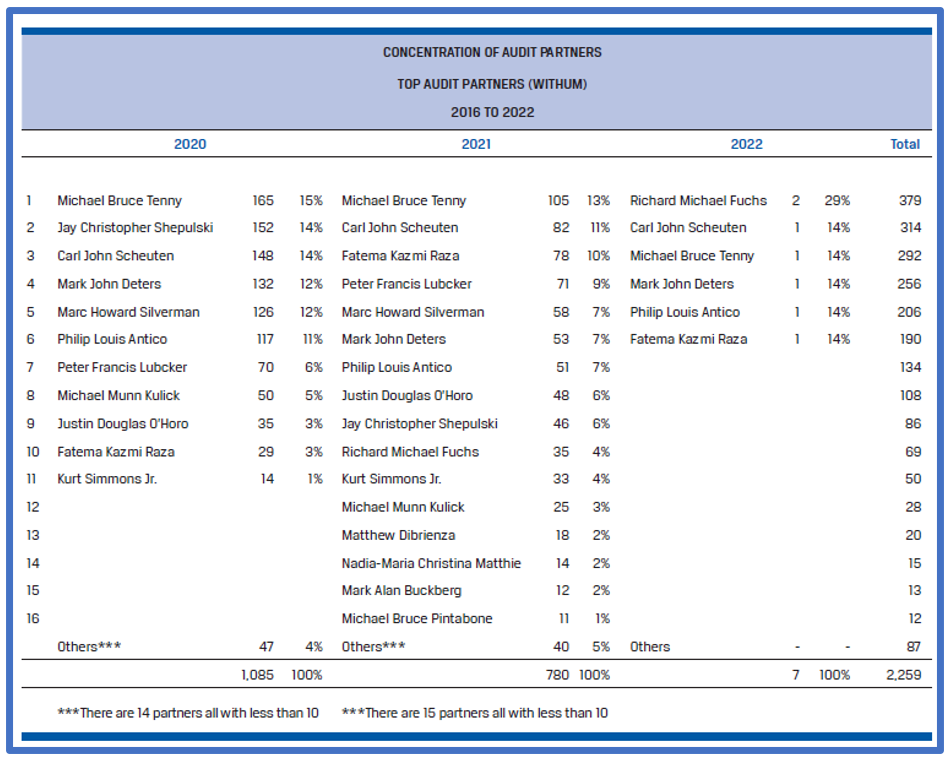

What the Form AP Data Tells Investors

The tables below present the engagement partner (Form AP) data for Marcum from 2015 to 2022 and Withum from 2016 to 2022 and are split to enhance readability. They demonstrate the substantial increase in total audit reports issued by both firms during the SPAC boom. Marcum had 186 and 243 Form APs in 2017 and 2018, respectively, and 323 in 2019. Those numbers jumped to 983 in 2020 and 1,365 in 2021.

Withum’s Form AP filings showed an even bigger bump in 2020, going from 101 in 2017 to 1,085 in 2020 and 780 in 2021.

While these total numbers are compelling in and of themselves, the principal issue we sought to investigate by looking at the data was the concentration of Form APs by audit engagement partner. We found, for example, that one partner at Marcum was named in 301 Form APs in 2020, and many partners at both firms were named on more than 100 in a given year. Also several partners had a significant number of Form APs in the years 2019, 2020, and 2021.

Form APs are required each time an audit report is first filed with the SEC — not each time the report is reissued, unless there is a change in the audit report. There could be multiple issuances of the same audit report: Even changing the date of the report requires auditors to perform down-to-date procedures to ensure nothing has surfaced that would change their opinion. The number of Form APs by audit partner serves as an indicator of audit partner workload, a metric that clearly impacts audit quality.

Accounting issues emerged from the audit of SPACs — specifically, accounting for warrants. What the data shows is that responsibility for resolving that accounting issue was concentrated in the hands of several individuals.

PCAOB Auditor Transparency Data: A Leading Audit Quality Indicator

After the global financial crisis (GFC), investors advocated for the auditor transparency reforms that led to the disclosure of audit engagement partners as well as other transparency metrics, such as auditor tenure.

The SEC’s recent action emphasizes the utility of the auditor transparency standards issued by the PCAOB in 2016. Through the Auditor Search database, we as investors could see the auditor concentration as a leading quality indicator. We could see this coming from the work we performed last year.

Investors continue to seek transparency on other audit quality indicators — or key performance measures — and the Marcum situation illustrates the usefulness of greater audit transparency in enabling investors to assess emerging audit risk.

1. General. Each registered public accounting firm must provide information about engagement partners and accounting firms that participate in audits of issuers by filing a Form AP, Auditor Reporting of Certain Audit Participants (“Form AP”), for each audit report issued by the firm for an issuer.1 Form AP is due by the 35th day after the date the audit report is first included in a document filed with the Securities and Exchange Commission (“SEC” or “Commission”), subject to the shorter filing deadline that applies when the audit report is first included in a Securities Act registration statement (described below).

Audit Report First Included In A Document Filed With The Commission. Rule 3211 requires the filing of a report on Form AP regarding an audit report only the first time the audit report is included in a document filed with the SEC. Subsequent inclusion of precisely the same audit report in other documents filed with the SEC does not give rise to a requirement to file another Form AP. In the event of any change to the audit report, including any change to the audit report date, Rule 3211 requires the filing of a new Form AP the first time the revised audit report is included in a document filed with the SEC.

For more insights from Sandy Peters, CPA, CFA, check out “The SVB Collapse: FASB Should Eliminate ‘Hide-‘Til-Maturity’ Accounting.”

If you liked this post, don’t forget to subscribe to Market Integrity Insights.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Image credit: ©Getty Images / Iryna Kushniarova

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Market Integrity Insights. Members can record credits easily using their online PL tracker.