The SVB Collapse: FASB Should Eliminate “Hide-‘Til-Maturity” Accounting

“The purpose of financial reporting is to convey the results of the company. It is not to assure the company stays around.”

That’s what I told Floyd Norris in the 2009 New York Times piece, “Confronting High Risks and Banks.”

The Silicon Valley Bank (SVB) collapse recalls the tussle over the accounting for financial instruments after the global financial crisis (GFC) in 2009, particularly the debate about whether some financial instruments should be carried at amortized cost (held-to-maturity, HTM) rather than at fair value (available-for-sale, AFS), or what is referred to as the “mixed measurement model.”

The Post-GFC Financial Instrument Debate

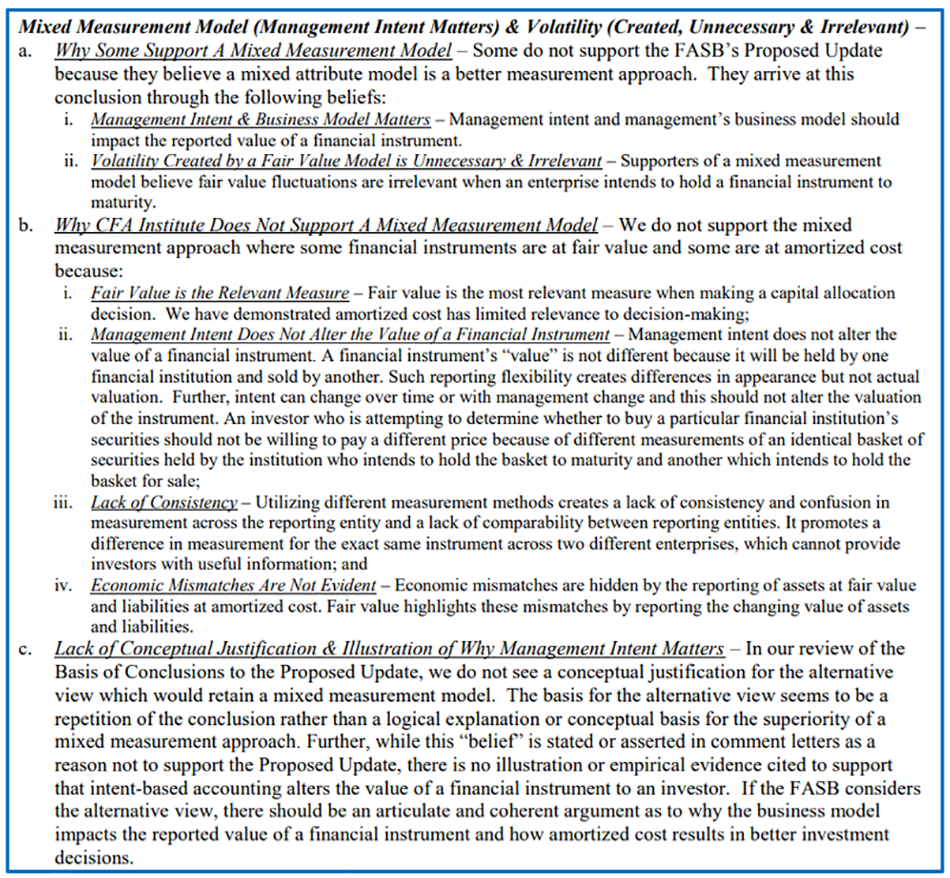

The Financial Accounting Standards Board (FASB)’s 2010 financial instruments proposal suggested that accounting for many financial instruments (including loans) should be at fair value. We commented on that 2010 proposal, noting our support for fair value of financial instruments and our opposition to the “mixed measurement model.” The excerpt below summarizes why some support the mixed measurement approach and why CFA Institute supported a fair value model. We included an appendix to that letter explaining in detail why fair value was a better measurement method.

Then-FASB chair Bob Herz understood the economics of financial instruments and how they should be reflected in financial statements, and he rightly advocated for a fair value approach. He recognized that masking fair value with a mixed measurement model, which allows some financial instruments to be reflected at their historical cost, only hides the impact of market risks on a bank’s financial stability and valuation.

Under political pressure, the FASB retreated from its initial 2010 proposal and Herz, unfortunately, resigned. The FASB then went on to retain the “mixed measurement model” wherein securities can be classified as held-to-maturity based upon “management intent” and “business model/strategy.”

What that means is that the financial statement carrying value of those financial instruments held-to-maturity is reflected at amortized cost, or what management paid for the asset sometime in the past plus amortization of the discount or premium from the face value. The fair value is only disclosed on the face of the financial statement and in the footnotes. Any unrealized loss is “hidden in plain sight.”

But management intent and business model do not change the value of financial instruments. The HTM classification only makes it harder for investors and depositors to see.

SVB’s Balance Sheet and HTM Portfolio

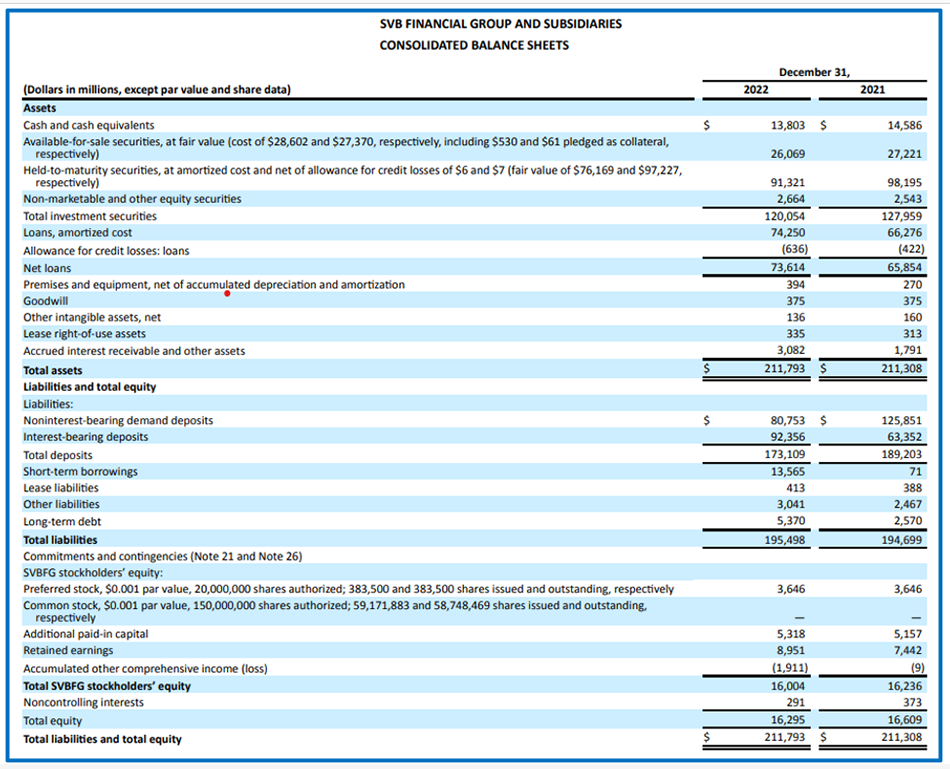

This is what SVB did. At 12/31/2022, SVB reflected $91.3 billion of HTM financial instruments, 43.1% of its balance sheet, at amortized cost. Their fair value was only $76.2 billion, or $15.1 billion less than their carrying value. With only $16.3 billion in book equity, this loss would have reduced equity, assuming the losses had no tax benefit, to $1.2 billion. Even with a tax benefit — if SVB could recoup all the tax benefit — this would amount to a $11.9 billion reduction in book equity. (See balance sheet below.)

Interestingly, SVB also had $74.3 billion of loans (net of $0.6 billion of accrued credit losses under the cumulative expected credit loss model), or 35.1% of its total assets at amortized cost. The fair value of those loans, as explained in Note 22 to SVB’s financials, was above fair value at $74.6 billion, because, as described elsewhere, most of the loans are variable rate.

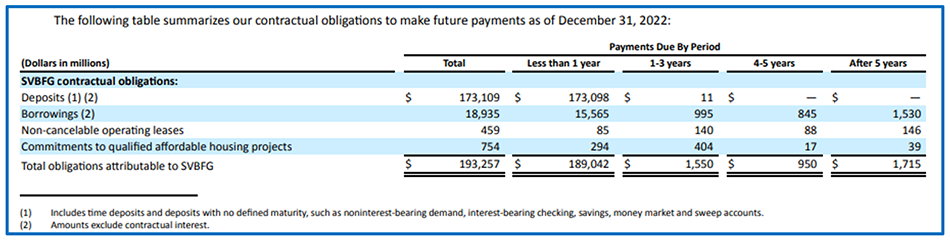

Overall, SVB’s total assets at 12/31/2022 were $211.8 billion of which only approximately $40 billion (cash and available-for-sale (AFS) securities) were at fair value and immediately available to pay the $173 billion in deposit liabilities — which are all due within the next year, according to SVB’s contractual obligations table.

Sales of the HTM securities would “taint” the portfolio and trigger fair value accounting. Said differently, the $15.5 billion unrealized loss would be recognized in the financial statements. The accounting effectively discourages management from making sales it may need to make to meet deposit commitments. Together, the cash, AFS, and HTM securities had a fair value of $115 billion, or 67% of the bank’s deposit liabilities at 12/31/2022.

This increase in unrealized losses emerged during 2022 with the rise in interest rates, but we didn’t first learn of it last week or when the 12/31/2022 financial statement was issued just a few days earlier in late February. At 9/30/22, the unrealized loss on the HTM securities was $15.9 billion — actually more than at 12/31/2022. So, there was a clue; it just wasn’t very obvious.

The Focus on Net Interest Margin (NIM) Rather Than the Fair Value Balance Sheet in Periods of Market Volatility

What makes things more challenging for investors and depositors is that amortized cost accounting — as we saw in the lead-up to the GFC — focuses banks and their investors and depositors on net interest margin (NIM). The problem with NIM is that it too is very static and focuses financial statement readers on the past rather than the present or the future, as is the case with the fair value of assets. NIM can look good while the market value of the assets on the balance sheet implodes.

Asset Liability Management and Cash Flow Characteristics of Financial Instruments

Further, the disclosures inside and outside the financial statements don’t give investors sufficient insight into the asset liability management (ALM) of the bank. In the case of SVB, investors and depositors didn’t have insight into the concentration of the deposits, their connection to the loans, or how fast they could flee given that concentration (i.e., other than the disclosure in the contractual obligations table which said everything is due immediately). Insurance companies are lucky as withdrawals happen more slowly. Policyholders have to die, become disabled, or pay extensive surrender charges to get their money back. Banks customers just need to log on and transfer the funds.

Circa 2012, the FASB also considered disclosures of the cash flow characteristics of financial instruments. The SEC pushed back on that, saying “financial analysis should not be done in financial statements.” The problem is the SEC never acted to provide better disclosures on ALM management for investors. Now might offer the opportunity to correct that.

A Run on the Bank Can’t Be Anticipated, Or Can It?

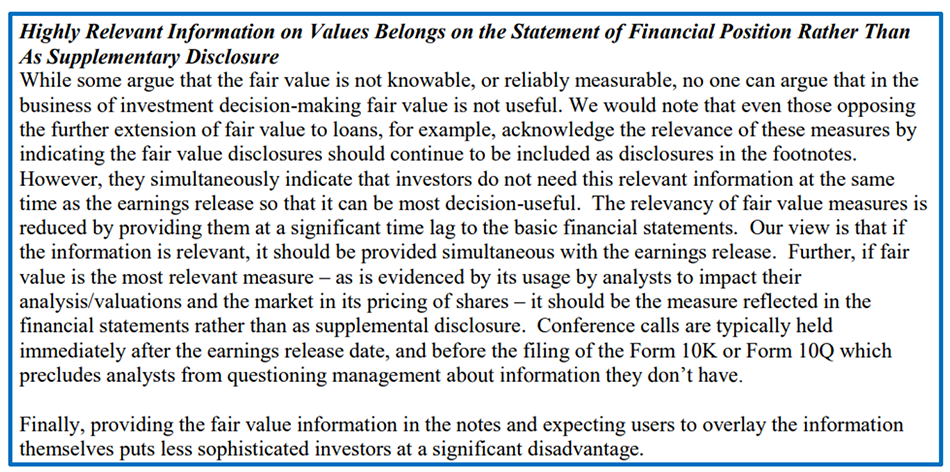

So, while some argue the SVB bank run couldn’t be predicted, the unrealized losses were there for investors and depositors to understand. It just required some digging. This is why, as we noted in the appendix to that 2010 FASB letter, “highly relevant information” belongs in the measurement of financial instruments in the financial statements not simply in the disclosures.

Sophisticated investors adjust the value of a bank’s balance sheet for fair values, and in periods of stress, more attention should be paid to the balance sheet and cash flows.

HTM only delays the recognition of these realities and — as I noted in the above 2009 quote — helps investors see the value of the company rather than ensure it stays around because of an inability to discern the real economics. Hence, held-to-maturity becomes hide-until-maturity — until the jig is up and an SVB-style bank run breaks out.

Essentially, SVB’s “mid quarter update,” last Wednesday — when management advised investors and depositors that they had sold nearly all of their AFS securities — hastened the race to the exit, just as interest rates peaked. Maybe SVB should have sold its HTM securities as well.

The Fed Raised Rates and All HTM Securities Losses Were Masked

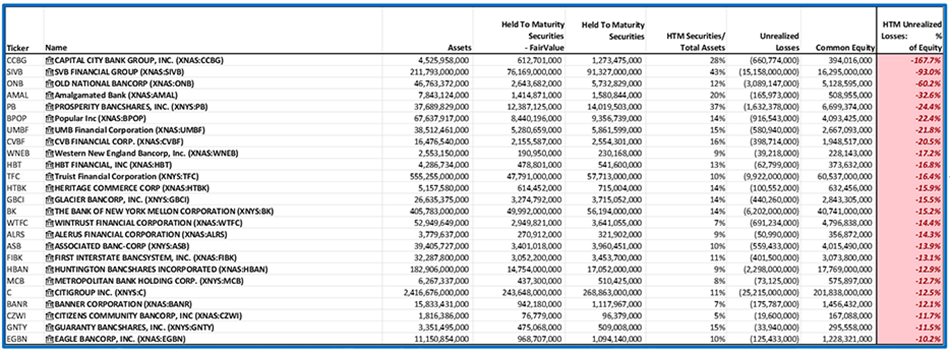

Short-term interest rates have risen steadily over the last year as the US Federal Reserve moved borrowing rates from near zero to nearly 5% last week. Many financial institutions have sizeable unrealized losses on these HTM securities tucked away in the footnotes to financial statements. Depository institutions (SIC 6000) with large unrealized losses on HTM securities, as a percentage of their equity, as of their latest SEC filing, raises questions.

The Fed’s own actions should have alerted banking regulators to the emergence of such losses and their impact on bank business models. Unfortunately, the information in the financial statements was not as obvious as it needed to be. This should have been predictable since the value of fixed instruments always declines when rates rise. Even SVB’s financial statements showed significant unrealized losses back in September. It seems SVB’s “mid-quarter update” last Wednesday alerted SVB’s customers and they headed for the exit, or the computer.

FASB Needs to Act to Eliminate Held-to-Maturity and the Mixed Measurement Model

We believe the FASB needs to eliminate the HTM classification to reflect all financial instruments properly at fair value in the financial statements. Further, we believe the FASB and SEC need to work together to provide greater transparency into bank business models and the cash flow characteristics of financial instruments (both assets and liabilities). The puzzle is too complicated for depositors to piece together from a 200-page set of financial statements. Depositors understood the implication of “mid quarter update” when SVB said it had moved all its saleable assets to cash. The news spread among its depositors, resulting in a $42-billion run on cash.

A reminder from the SEC might be a good idea right now as the first quarter of 2023 approaches its close.

The good news — or bad news — today is that the two-year Treasury has dropped 100 bps from 5% last Wednesday to 4% this morning. So those financial instruments are less underwater.

For more insights from Sandy Peters, CPA, CFA, check out “The Audit Gender Gap: Has It Narrowed?”

If you liked this post, don’t forget to subscribe to Market Integrity Insights.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Image credit: ©Getty Images/ RapidEye

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Market Integrity Insights. Members can record credits easily using their online PL tracker.

Why wasn’t liquidity raised by repos instead of sell the bond portfolio?

As they say all the liquidity you will ever have is the liquidity you bring to a crisis. They could have done several things in advance…most importantly better risk management.

Excellent question by Francisco. is there a restriction on pledging HTM bonds for repo transactions? If SVB could have funded via repos, they could have kept the game going for long enough for rates to come down or bonds to mature, right?

This is such a brilliant write up!

Thanks

Agreed!

Thanks

Brilliant!

Thanks

100% Agreed- In India, we need an annual fair valuation of fixed tangible assets also like Factory Building, Machinery Plant- Banks were/are giving loans based on initial projections, estimates the Building factory Values- Not bothered about annual fair value of those factory machinery, latest technologies, obsolescence- Finally it ends up as Insolvency Bankruptcy Mess

I agree on tangible assets. These are financial instruments which are mostly Level 2.

All round brilliant!

Thanks

Nice write up. Beneficial

Thanks

Very standard and solid take. I hope the right actions are taken to protect depositors.

Can’t agree more!

Jay Glacy

My comment related to the change in rates was related to the economics of the bonds not how they were accounted for. My economic point was that the fair value of the securities has improved since the fair value when they were taken over.

HTM would not reflect the changes in the financials but AFS would reflect in equity.

Yes, and the real economic problem is that they did not manage interest rate risks by buying swaps or holding shorter duration instruments. The problem with HTM is also that management does not want to sell when they need to as they taint the whole portfolio and have to recognize all the losses at once which in the case of SVB meant they had no book value.

You say: “The good news — or bad news — today is that the two-year Treasury has dropped 100 bps from 5% last Wednesday to 4% this morning. So those financial instruments are less underwater.”

Doesn’t HTM act to remove this kind of whipsawing on the balance sheet, Sandy? Didn’t it perform correctly? Real prob is that SVB didn’t put the swaps on. True?

See comment above. I responded to the wrong reply tab!

A truly excellent excellent article. So elucidating. So clear. More articles by Sandy please !

Thanks

Good article but changes in accounting treatment may not be an appropriate solution. If all HTM assets are required to be Marked to Market, long end of the YC may become much more volatile & steep. Higher return will be demanded to own long-term maturities of all asset classes. B/S & income flows will reflect much higher volatility, making most asset classes illiquid with lower risk adjusted return/ sharpe ratio.

Stable bank Loans & v.c investment valuations may be misleading as they may not be reflecting true credit & other risks. They may be marked to their own models & can be dangerous as we saw during dot.com bubble, 2008 meltdown etc.

In my opinion, changes in accounting treatment won’t help. What is needed is the investment risk management irrespective of AFS or HTM. One such example could be to put limit on maximum NET interest rate sensitivity on assets acceptable as % of its own Capital. Remaining net volatilty must be hedged through fixed-floating swaps & other derivatives. Certain strong regulations are also needed on credit risk management.

Agree. We want better cash flow characteristics, ALM and interest rate risk management.

“ The fair value is only disclosed on the face of the financial statement and in the footnotes.”

Only?

Fair value of HTM securities are required to be disclosed on the face of the balance sheets. This easily allows investors and readers of the financials statements to compare their cost and fair value bases. If fair value is less than cost then there is an unrealized loss. Nothing is hidden.

This is disclosed on the face of the financials, Note 9 (Investment Securities), and Note 22 (Fair Value of Financial Instruments.

Steven Elseroad, CFA, CPA

I am referring to the fact that the fair value not reflected in the financial statements, they are only disclosed. They are certainly disclosed in the footnotes in the investment and fair value notes.

Insightful

Thanks

I generally tie to your numbers on SIVB… i do not tie to some of the others. For example, on ONB – you have unrealized losses of 3,089.147mm – according to their ’22 YE financials they have exactly 3,089.147mm of securities HTM. This table is saying that’s entirely the loss?

Steven Elseroad, CFA, CPA

I am referring to the fact that the fair value not reflected in the financial statements, they are only disclosed. They are certainly disclosed in the footnotes in the investment and fair value notes.

Thanks

A good article however I do not think that the mark to market of the HTM is an appropiate solution. On the one hand, the least liquid assets namely loans to customers are not really marked to market but marked to model. On the other hand, what do you propose for the liabilities side? How are you valuing deposits: at face value or due to their structural stability (excluding in banking panics moments) with a 5/10yrs maturity? In Spain in the 90s we did not have a HTM portfolio and there was a bad pricing of the treasuries curve as banks used to focus on the short end to avoid losses in their portfolios. However, further supervision is required it terms of the matching in durations of assets and liabilities and in terms of liquidity managmente. LCR ratios should be calibrated and maybe they should take into account the possibility of a bank run.

Excellent analysis which I agree with wholeheartedly. While I recognize this is written with an investor focus there is an additional consideration which further supports the argument:

Being accountable encourages self governance.

SVB took excessive Interest Rate Risk. Deferring the impact on current earnings through this arcane rule encourages precisely this form of risk taking. Very similar to loan losses which finally are going to get recognized properly through CECL, which should encourage more prudent lending.

I am a CPA-CA accountant, not a CFA so my interest is how accounting rules affect management behavior as well. Loss deferral rules are totally contrary to promotion of good management. Accountability is a far more efficient discipline mechanism than regulation.

Great analysis on a well thought out position. I circulated this article among my investment team. Thanks very much. More of this please!

This is a fantastic write up, and I think it would also be prudent to mention how these losses, realized or unrealized, go on to affect future profitability of the industry. There is a great paper written up on the topic of OCI (understandably not including HTM marks, but still the effects are arguably the same) affecting future earnings: https://www0.gsb.columbia.edu/mygsb/faculty/research/pubfiles/5626/USEFULNESS%20BCK%20Final.pdf

Missing half the story. FV discussions always seem to focus on the asset side. What about liabilities, specifically non-maturity deposits, highly relevant for banks profitability and stability. Franchise value.

Agreed. But even within the existing framework, I think they probably could/should have been challenged on the “ability” to hold to maturity, and liquidity risk assessment model should have been at the core of that challenge.

I absolutely loved this clear article. I manage a government cash fund and we have to adhere to GASB 31 (Government Accounting Standards) and we report:

1) Purchase price 2) Book Value (principal + accreted discounts – amortized premiums) and 3) Market Value on our quarterly reports. So all of our statement readers can see and calculate Net Asset Value and unrealized gains (losses) if they wish.

This article presumes that the fair value of an inherently illiquid instrument is obtainable. As someone who had spent many years obtaining “marking quotes” to price out end of day high yield bond portfolios, fair market value can easily have 5 to 10 point bid ask spread–and high yield bonds are much, much more liquid than bank loans. And during times of market stress, you will obtain no bids on lower rated high yield bonds. What then?

We tried fair market value accounting 20 years ago and it was –to put it charitably–an abject failure. It contributed to the Global Financial Crisis precisely due to the activities I described above. The financial markets did not stabilize until March of 2009–when fair market value accounting was suspended.

Banks in Sri Lanka, If there are liquidity issues in the bank, the bank has the opportunity to borrow at a standing lending facility and cover the short position. Why US banks don’t do that? they had 91.3 mn HTM portfolio and also, why Federal Bank intervenes to this kind of situation?

Hello Sandra,

would love to hear your thoughts in light of the recent fiasco at NY community bancorp.

thanks!