First Quarter 2020 Amid COVID-19: Big Banks Report

CECL Impairment Model Survives Despite Congressional Efforts

More Impairments Likely In 2Q

This morning JPMorgan Chase (JPMorgan) and Wells Fargo reported first-quarter results and investors got their first glimpse of the impact COVID-19 is having, or not having, on bank financial results. Despite the best efforts of Congress, the big banks retained the new impairment model, the Cumulative Expected Credit Loss (CECL) model. CECL survives politics and is the story of first-quarter earnings. Observations from JPMorgan’s earnings release and analyst call highlight the effects of CECL on banks’ first-quarter results. They also highlight the looming and potentially more dramatic effects to come in the second quarter.

First Quarter: A Tale of Two Quarters – As we noted in our prior first quarter and COVID-19 blogs (Non-GAAP Measures and US Quarterly vs. Global Half-Yearly Reporting), the first quarter does not yet show the results of the COVID-19 impact – other than for CECL – as it only includes a few weeks of unusual events brought about by the pandemic given the US only settled into quarantined beginning in mid-March. As we noted in our prior blogs:

For several reasons, earnings releases aren’t what investors are likely to be most focused on during this first-quarter reporting season. First, the first quarter will include two months, or slightly more, of “business as usual” results with only the month of March being “unusual”. As such, normalized measures such as EBITDA for the first quarter are not particularly useful in the predictive efforts of analysts and investors. Second, investors will be focused on the highly uncertain elements of future results, not the more certain historical results represented by non-GAAP measures of EBITDA. Third, investors will, or should, focus on balance sheets and cash flows. At this moment, communication to investors in earnings calls should be more focused on future viability rather than historic profitability.

JPMorgan’s CFO, Jennifer Piepszak, validates this statement and calls the first quarter the “tale of two cities” or more appropriately the “tale of two quarters” when she notes:

It might be an obvious point that the quarter was really a tale of two cities: January and February, and then March when the crisis started to unfold.

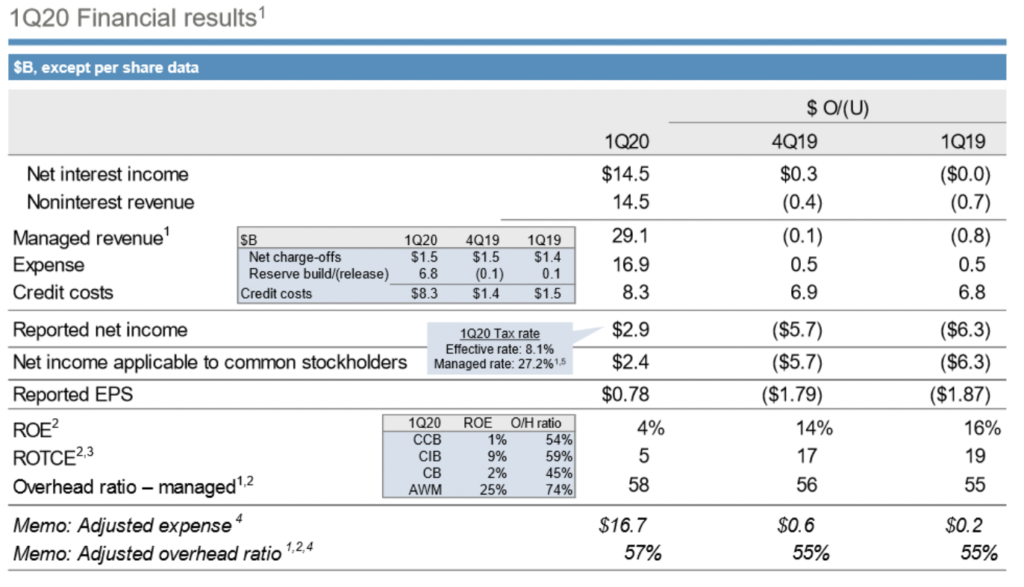

This is likely to be the case for many companies. A summary table of the first-quarter earnings (see below) shows that the results are all about the expected credit losses – and what their forward-looking nature portends. Absent the impairment charge there were no significant changes in year-over-year or quarter-over-quarter results. As JPMorgan’s CFO notes in response to an analyst question on the reserve build:

So, I would start by saying that we haven’t actually seen a stress emerge as of yet. So, I wouldn’t necessarily use the term mechanistic, but I would say that what we took in the first quarter is our best estimate of future losses.

CECL losses include JPMorgan’s expectations of the impact that COVID-19 will, but has not yet, manifested itself in unpaid loans. For that reason, it was of keen interest to analysts on the earnings call.

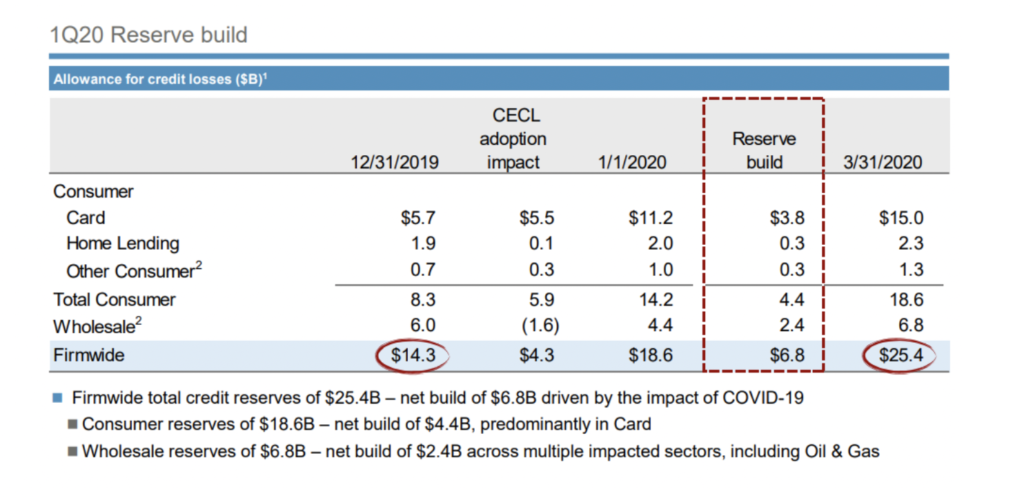

CECL, CECL, and more CECL – After providing an overview of JPMorgan’s customer and employee response along with a high-level overview of results as shown in the table above, JPMorgan provides the table below highlighting upfront the first-quarter increase to the CECL impairment reserve. Even before discussing segment results, JPMorgan discusses the growth in CECL by segment – because it is the beginning and ending of the story for the first quarter to analysts and it incorporates these expectations of future macroeconomic conditions.

A Bit of History on CECL & the Related Politics – The saga over how impairments on financial instruments recognized at amortized cost should be measured has been ongoing since the 2008/2009 financial crisis. The cruel irony is that the new impairment model, CECL, is effective – in the very quarter, the COVID-19 health and financial crisis has begun to emerge – after a decade’s worth of fierce debate and development, over which the FASB and IASB decided to go their separate ways. Despite being finalized by the FASB in 2016, and set for implementation in this first quarter of 2020 by large public companies, members of Congress have sought to repeal or defer the implementation of CECL since 2018. With a focus on this change for the regional and community banks, the lawmaker’s argument has been that the new CECL model is procyclical, will damage lending to their constituents and is a model requested by investors and therefore should not be applicable to non-public banking institutions. In January they called the Chair of the FASB in front of Congress to defend the standard. Of course, the claim during the 2008/2009 financial crisis by politicians and regulators alike was that the FASB incurred loss model, which CECL is meant to rectify, recognized losses “too little and too late.”

The COVID-19 pandemic and the CARES Act have afforded these members of Congress another at-bat on the topic of impairment. They negotiated the inclusion of a deferral of CECL in the CARES Act interfering with the independent standard-setting process of the FASB and short-circuiting deliberations of all stakeholders who engaged in the process over the last decade. CFA Institute, as an investor organization, supported a fair value model over an impairment model based upon CECL as we believed it was more economically relevant (i.e. booking all losses upfront does not result in a meaningful measurement of losses over the risk-bearing period that interest income is earned) and more anchored to observable inputs. We wrote prolifically about this in our numerous comment letters to the FASB and IASB since 2009. Regulators, not investors, sought the CECL model as they wanted to ensure the prudential concerns (“too little, too late”) from the last crisis were not repeated. While investors deeply care about financial institution solvency, we argued over the last decade that US GAAP, as set by the FASB, and regulator capital and reserving are two different types of reporting and that US GAAP is meant to serve investors, who unlike regulators, cannot require companies to provide information. Despite these efforts, CECL was put in place to satisfy regulator requests. Interestingly, however, the FDIC issued a letter to the FASB in March 2020 amidst the onset of the pandemic. This time they seemed concerned that CECL would result in impairments that were “too much, too soon.” This only fueled the efforts of those in Congress to push for inclusion of a CECL deferral in the CARES Act.

While it was widely expected that big banks would not avail themselves of the deferral because of their previous communications regarding, and preparedness for, adoption of CECL, it was reported last week by BNA, that because of interpretations regarding the application of the deferral afforded in the CARES Act and regulatory concessions regarding the application of CECL on bank capital, few banks were expected to avail themselves of the CARES Act deferral.

JPMorgan was the first company to report results for the first quarter under the new CECL model. Wells Fargo did the same just hours later. So, despite the massive political wrangling CECL took effect this quarter and in the case of JPMorgan was the focus of the earnings call.

We would expect investors, in banks that choose the CECL deferral, to look at the size of impairments taken under CECL and adjust such banks reserves, using rough approximations, to a reserve level based upon CECL. Investors will want to make institutions comparable and determine the expected rather than incurred losses.

The Impact of CECL on JPM – As it relates to the increase in the CECL reserve, below are select impacts to the income statement and balance sheet of JPMorgan:

- Income Statement – The increase in credit losses was $8.3 billion, up $6.8 billion from the prior year, driven by expectations incorporated into the CECL model that the macro-economic environment as a result of the impact of COVID-19 and continued pressure on oil prices will deteriorate. The consumer reserve build was the largest portion at $4.4 billion, predominantly in credit cards, and the wholesale reserve build was $2.4 billion across multiple sectors, with the largest impacts in the oil & gas, real estate, and consumer & retail industries. The $6.8 billion reserve build resulted in a $1.66 decrease in earnings per share.

- Balance Sheet – The loan loss reserve of $25.4 billion represents approximately 2-2.5% of the approximately $1 trillion of loans. Notably, with the adoption of CECL as of 1 January 2020 the reserve increased $4.3 billion, or a 30% increase, with another increase in first-quarter related to the COVID-19 pandemic of $6.8 billion, an increase of 47% over the last year-end, to cover the COVID-19 pandemic, the overall loan loss reserve has nearly doubled since the filing of the 31 December 2019 Form 10-K.

As it relates to book value, the CECL based loan loss reserves are approximately 10% of shareholders’ equity at 31 March 2020 up from 5% of shareholders equity at 31 December 2019.

So, while a small portion of total loans a very large percentage of income and equity for, and at the end of, the first quarter.

The Assumptions Around CECL – The earnings release and investor presentation do not include a written description of JPMorgan’s expected severity or duration of the pandemic nor the corresponding CECL assumptions. JPMorgan’s CFO, Piepszak, notes:

As a firm, we are focused on being there for our employees, customers, clients, and communities, in what is an unprecedented and uncertain environment. And while we don’t know how this will play out, we will be transparent here about our assumptions and what we know today.

Much of the Q&A on the earnings called was focused on CECL. The most interesting exchange was with well know bank analyst Mike Mayo. It included a discussion of key economic assumptions, both those used in the first quarter and some outlook for the second quarter. We highlight the key points below:

So, Mike, as we closed the books for the first quarter, just to give a context, we were looking at an economic outlook that had GDP down 25% in the second quarter, unemployment above 10%. It’s just important to note that that kind of gives you a frame of how to think about it, but there’s a lot more that goes in to our reserving, including management judgment about some — like, world-class risk management and finance people and also other analytics. And so, that just kind of gives you a frame of reference. But there, we did think about a number of other scenarios that we should contemplate in reserving and we also thought about the impact, what’s our best estimate of the impact of these extraordinary government programs as well as our own payment relief programs.

Since then, as I noted in my prepared remarks, our economists have updated their outlook and now have GDP down 40% in the second quarter and unemployment 20%. That’s obviously materially different. Both scenarios though do include a recovery in the back half of the year. And so, all else equal, and of course, the one thing, probably the only thing we know for sure, Mike, is that all else won’t be equal when we close the books for the second quarter. But all else equal, given the deteriorated macroeconomic outlook, we would expect to build reserves in the second quarter. But again, a lot will depend on the ultimate effect of these extraordinary programs and how effective they can be in bridging people back to employment. And we’re going to still have a number of unknowns, I would say, at the end of the second quarter, but we’re going to learn a lot through these next few months that will inform our judgment for second quarter reserves.

In a question about the incorporation of government assistance, JPMorgan’s CEO Jamie Dimon notes that the programs are unprecedented so their impacts are unprecedented and unknown and that they have done their best to incorporate the impacts. He notes the following on the call:

This is such a dramatic change of events, so there are no models that have done — dealt with GDP down 40%, unemployment growing this rapidly, and that’s one part. And also, no models have ever dealt with a government which is doing a PPP program which might be $350 billion and might be $550 billion. Unemployment, it looks like 30% to 40% of people on unemployment were of higher income than before they went on unemployment.

So, what does that mean for credit card or something like that, or that the government is going to make direct payments to people? So, this is all in the works right now. The company is in very good shape. We can serve our clients and we’re going to give you more detail on this, but it’s happening as we speak. And I think people are making too much of mistakes trying to model it. When we get to the end of the second quarter, we’ll know exactly what happened in the second quarter. Like, you got to expect that credit card delinquencies and charges will go up. But we see very little of it so far. But by the end of the second quarter you’ll see more of it. And then we’ll also know if there’s a fourth round of government stimulus. We’ll know a whole bunch of stuff and we’ll report it out. We hope for the best, which is you have that recovery, and plan for the worst so you can handle it.

Overall, Dimon was realistic in saying that these are unprecedented times and that the estimates are the best they can make with the information available. Frustrated by the plethora of questions on CECL Jamie Dimon noted that the analysts were focusing on CECL like they focused on Level 3 fair values in the last crisis. He noted that the macroeconomic assumptions and impacts informing their judgments and estimates – specifically those incorporated into the CECL model – would be included in the Form 10-Q.

And, Jen, remind me, when we do the 10-Q for the quarter, we’re going to lay out lots of these various assumption about CECL. And one of the problems of CECL is this precisely. We’re going to spend all day on CECL, which was $4 billion and it’s kind of a drop in the bucket, but it’s a lot of data. It’s like all the data we did after the last crisis, we give you on Level 3 and all these assumption and stuff like that. No one ever looks at it anymore.

Second Quarter: Will Provide More Insight into What is Happening – As noted above, JPMorgan rightly validates in the earnings call that non-payments and the most damaging economic effects of the COVID-19 hadn’t yet manifested in the loan portfolio as of the 31 March 2020 results – as the majority of the country was only two weeks into the crisis. That said, throughout their discussion, they highlight the importance and consequence of events in the second quarter.

Form 10Q: Investors Need to Review Disclosures – As we highlight above, Dimon notes that many of the assumptions will be included in the Form 10-Q. Many times, the Form 10-Q can be an afterthought for investors, but as we have articulated in previous blog posts, the Form 10-Q will be especially important in this environment. The Form 10-Q will not only include the assumptions and judgments related to CECL. It will also provide additional information on fair values. And, the Form 10-Q disclosures outside the financials necessitate a more forward-looking assessment of the impact of current events on a company’s business description; risk factors; liquidity and capital resources; and management, discussion, and analysis. Essentially, with dramatic events like COVID-19, companies must evaluate nearly all sections of their Form 10-K to assess whether they need to be updated in their Form 10-Q.

Fair values of financial instruments were not included in the earnings press release, investor call presentation, or earnings supplemental reporting package. They will be included in the Form 10-Q and they will provide insight into the market’s assessment of the value of loans upon which the CECL impairment was taken. For loans and other assets measured at amortized cost, the fair value will provide insight into the market’s assessment of credit losses relative to the company’s assessment of credit losses in CECL. These fair values will provide an important forward-looking assessment of JPMorgan’s credit risks and will be something investors will want to compare to loans less CECL loan impairment reserves

Dividends Policy Unchanged – What we also learned from the call is that JPMorgan earnings were sufficient to cover dividends and that they have no immediate plans to suspend the dividend as they note below:

We currently also have capacity and intend to continue to pay the $0.90 dividend, pending Board approval. And as you can see in the CET1 walk on the bottom left, it is a small claim on our capital base.

Share Price Update – Upon the release of earnings, JPM shares rose 2.9% from the prior day close of $98.19 to $101.02. Shares rose to $102 early in the day and declined to $95.63, or down 2.6%.

Image Credit: © 2020 CFA Institute

Hi Sandy, I wanted to point out that you have a typo where you referenced CECL as Cumulative Expected Credit Loss rather than Current Expected Credit Loss. For the past three and a half years my job was to lead CECL implementation for a mid-sized bank. CECL is such a hot topic for banking and I appreciate your informative article and hope to see more about CECL from you. Thank you.