Hospira: a Case Study for Strategic Valuation

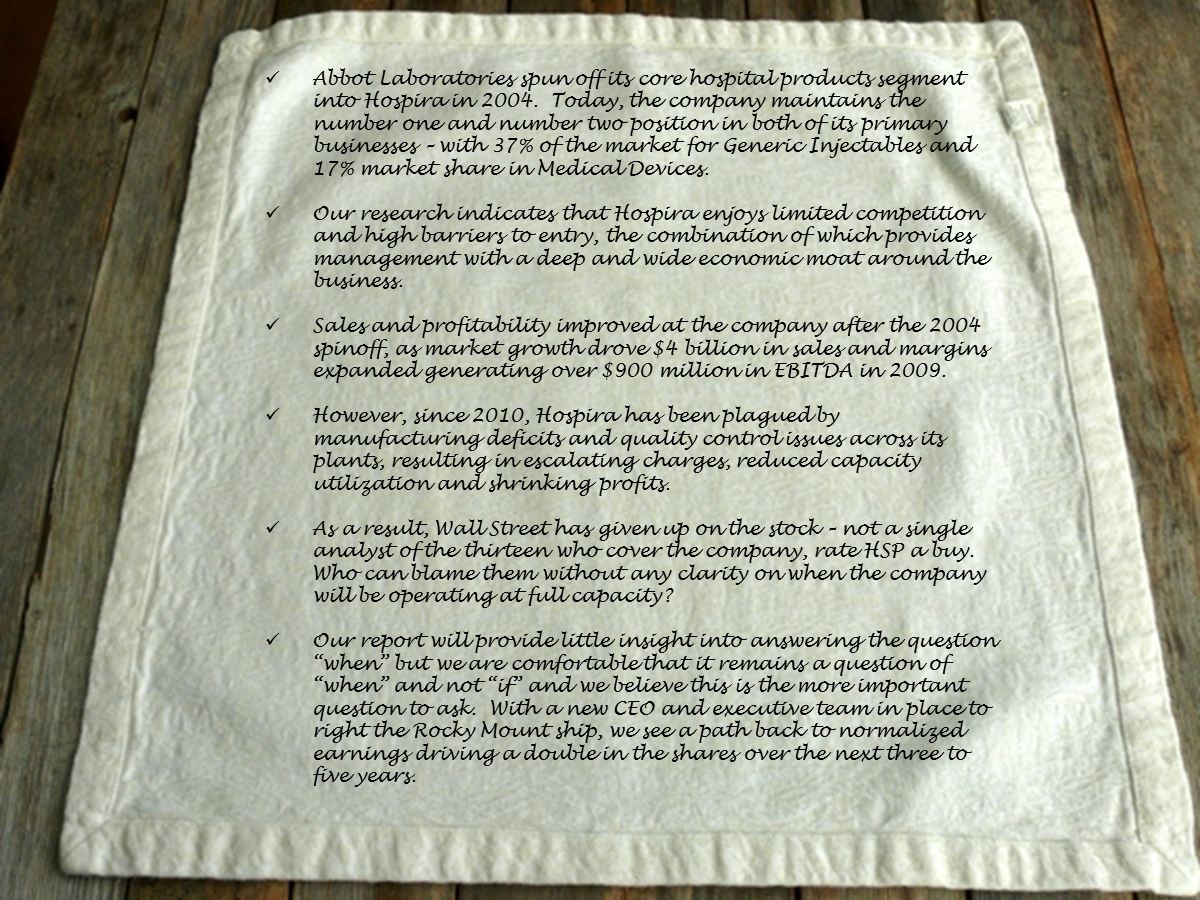

Earlier this month, we outlined our investment thesis in shares of Hospira (HSP) on a napkin, which is illustrated below. Feel free to roll up your sleeves, wipe your hands and have a look at the full report, which is available by clicking on our napkin below.

Since publishing our report, HSP has appreciated rapidly over the past few weeks on light news flow. While we are pleased with the recent action in the shares, we see far greater upside potential in this high quality business as the company’s true earnings power, currently depressed by temporary regulatory issues, is discovered by investors over the next few years. By this time, HSP is likely to be changing hands at significantly higher levels, so we would encourage investors to do their work up front. As Michael Price presented at this year’s London Value Investing Conference, “An investor should spend all of his or her time working on calculating intrinsic values, waiting for the market to throw out an opportunity. The definition of luck is preparation meeting opportunity.”

Coincidentally, Price appears to agree with us that Hospira’s recent struggles – which took the stock from a high of $60 to a low of $27 seemingly overnight – have created an opportunity for the prepared investor. He thinks the company will have completely recovered in two years. We hope he’s right, but with intrinsic value significantly greater than today’s price, we are comfortable waiting for a natural rebound in earnings power once the company’s current regulatory hurdles are cleared. As we discussed in our report, we believe HSP shares can offer investors very attractive returns even assuming a three to five year recovery. In our view, timing is more uncertain than value, but patient investors should do well by accumulating shares while Mr. Market obsesses over the company’s short term troubles.

Our initial estimates of intrinsic value were based on EBITDA multiples that sophisticated, prudent buyers have paid to purchase similar businesses as well as what multiples those similar businesses are trading at today. Said differently, if current management is unable to address Hospira’s difficulties, we believe that any number of management teams in the industry would be happy to do so.

While an understanding of private market values can be helpful in analyzing investment opportunities, investors should use several methods to value a business in order to obtain a conservative range of values. Accordingly, we will present a different perspective on Hospira’s business valuation in the remainder of this post.

Simply stated, to be successful, value investors must buy securities at a discount from intrinsic value. Unfortunately, this is easier said than done. Different investors have different opinions and any attempt to value businesses with exact precision will produce values that are exactly wrong. Valuation is an imperfect science made more difficult by decisions made solely on optimistic forecasts for future growth. When future cash flows are accurately predicted and an appropriate discount rate is used, NPV analysis is one of the most precise methods of valuation. But the NPV approach has three fundamental shortcomings as noted by Bruce Greenwald in Competition Demystified:

First, it does not segregate reliable information from unreliable information when assessing value. Calculating the characteristics of an enterprise seven and more years in the future is a very inexact exercise. Experience indicates that it is the terminal value that typically accounts for by far the greatest portion of net present value. With terminal value calculations so imprecise, the reliability of the overall NPV calculation is seriously compromised, as are the investment decisions based on these estimates. The problem is not the method of calculating terminal values. No better method exists. The problem is intrinsic to the NPV approach. An NPV calculation takes reliable information (i.e. near term cash flows) and combines it with unreliable information (i.e. estimated cash flows from a distant future) that makes up the terminal value. It is an axiom of engineering that combing good information with bad information does not produce information of average quality. The result is bad information because the errors from the bad information dominate the whole calculation.

A second practical shortcoming of the NPV approach is its dependence on assumptions about the future that must be reliably and sensibly made today. Otherwise, the value calculation is of little use. It is possible to make strategic assumptions about competitive advantages with more confidence but these are not readily incorporated into an NPV calculation. The NPV approach’s reliance on assumptions that are difficult to make and its omission of assumptions that can be made with more certainty are a major shortcoming.

A third difficulty with the NPV approach is that it discards much information that is relevant to the calculation of the economic value of a company. The NPV approach focuses exclusively on cash flows. But if the resources of a firm are not sued effectively, then the value of the cash flows they generate will fall short of the dollars invested. The crucial point is that in a competitive environment, resource requirements carry important implications about likely future cash flows and the NPV approach takes no advantage of this information.

A Strategic Approach to Valuation

Greenwald proposes a more strategic approach to valuation, which we often use as confirmation of our assessment of intrinsic value. The starting point in determining a company’s Earnings Power Value (EPV) is current cash flow. But even current cash flow may differ from the sustainable cash flow that can be extracted from a company’s normal operating condition. And in Hospira’s case, current cash flow is severely depressed by ongoing remediation efforts and costs which we expect to taper off over time. As a result, we make a number of adjustments to ascertain the company’s normalized earnings power:

- First, in order to eliminate the effects of financial leverage, we begin with operating earnings, EBIT, rather than net earnings. This allows us to disregard the interest payments a company makes and the tax benefits it gets from using debt financing. Current earnings are also adjusted for any cyclical variation that may cause them to be either above or below their sustainable level. The simplest way to make this adjustment is to calculate the average operating margin over a period of years and apply that margin to current sales. Margins tend to fluctuate more severely than sales over the business cycle. However sales are not immune to the cycle and have been greatly affected by FDA sanctions at Hospira, so we have adjusted revenues by grossing up production at the company’s Rocky Mount facility and estimated a reversion in operating margins towards the company’s 5-year average. This results in our estimate of normalized operating income of $800 million.

- Second, “nonrecurring items” are incorporated into our calculation. We think a sensible way to treat them when they appear regularly is to calculate the average level over a period of years. Hospira has reported “nonrecurring items” in the past related to restructuring efforts like Project Fuel, in addition to ongoing remediation expenses. At the same time, management recently announced a new “initiative” for their device segment, which should increase near term costs. Our investment thesis is grounded in the assumption that current FDA issues are temporary in nature, so we remove related costs from our estimate of normalized earnings. Conversely, “nonrecurring” restructuring charges appear to be somewhat recurring in nature so we assume a normalized level of charges of $50 million. This produces our estimate for adjusted operating income of $750 million.

- Third, we note that accounting depreciation, as calculated for financial statements, may diverge widely from true economic depreciation, which is best estimated by maintenance capital expense, and omits capital expenditures for growth. As Hospira has been building out new production facilities in India as well as making significant improvements to modernize current facilities, we add back 25% of growth capital expenditures.

- Finally, taxes charged for accounting purposes may vary widely from year to year. Pretax operating earnings should be converted to after-tax earnings using an average sustainable tax rate. After taking out 30% in taxes, we estimate the firm should generate almost $600 million of adjusted income, on a 12.5% normalized margin versus current margins below 7.0%.

Bottom Line

Earnings power is an annual flow of funds, which represents the value of the ongoing operations of the firm assuming no growth and no future deterioration. Because growth has been excluded from this valuation, and because it uses normalized cash flow, EPV is far less subject to error than valuations dependent on estimating a terminal value many years into an uncertain future. We calculate Hospira’s Earnings Power Value (EPV), by capitalizing our adjusted income estimate above at the company’s WACC, which generates a total enterprise value of $10.9 billion. Netting out debt and cash brings our total EPV to $9.9 billion, nearly $50 per diluted share and 35% above the current stock price. In other words, Hospira offers investors a significant margin of safety based on current earnings power, with additional upside potential in biosimilars and emerging market growth opportunities.