Bad Apple?

The bear case on Apple is well known and widely accepted today. As a reformed Apple short, I understand the thesis well. The company’s profits are largely driven by one or two products and its future success largely dependent upon management’s ability to consistently reinvent itself, without the help of Steve Jobs, the man whose vision led the company to cult status. Sales are slowing, margins are compressing and competition is gaining ground. The technology sector is a graveyard littered with past consumer icons from Palm to Blackberry to the more distant childhood memories of Polaroid and Sonly Walkman. With shares of Apple in free fall since their peak near $700 per share last October, sentiment on the stock has quickly soured. A decline in the price of a stock approaching 40% will challenge all but the strongest hands, leading those still holding the stock to question their initial thesis and wonder if they are left holding a bad apple.

Analysts tend to herd. In a recent New York Times article author James B. Stewart highlighted Wall Street’s tendency to extrapolate recent trends into perpetuity. This behavioral flaw is widely acknowledged by investors today despite desperate attempts to prevent it. But most investors may not realize that portfolio managers are just as likely to make the same grave mistake. I struggle to recall a more one-sided trade, than the herds of mutual fund and hedge fund managers long Apple last year. As the largest and one of the most rapidly growing stocks in the benchmark, how could you afford not to own it? At its peak, the stock was worth more than the entire retail sector and a website was dedicated to Things Apple Is Worth More Than. The truth is you couldn’t afford not to own it without accepting significant career risk. It’s okay to be wrong when everyone else is wrong too. It’s not okay to be wrong by yourself. That’s how you get fired in this industry, but it’s also what creates some of the best opportunities for brave investors with the confidence and the stomach to take a contrarian stance.

Apple Was Bigger Than The Entire 1977 US Stock Market

Follow the Herd

Market sentiment is highly cyclical. Investor psychology swings back and forth between the extremes of greed and fear. Both the timing of these shifts in sentiment and the catalysts that trigger them are always clear in hindsight, but impossible to predict with any consistency. When something goes up, everyone assumes it will continue to do so…until it doesn’t. When something goes down, investors assume it will continue to fall…until the last holdout throws in the towel and the selling is exhausted. The speed at which this shift in psychology can occur is fascinating, and the sequence is precisely the same during each cycle, yet it almost always catches us by surprise. All it takes is a marginal change in price in the opposite direction. The average investor has an extremely difficult time differentiating price from value.

For years, it was impossible to convince an Apple customer that Apple stock was a high-risk position, given the growing group-think surrounding the shares. The loyalty of “Macophiles” was unwavering and challenging conventional wisdom often generated extremely emotional responses. I know. I tried. In April 2012, after the stock first cleared $600 per share, I posted a brief piece titled The Mini Tech Bubble. At the time, we were constantly ridiculed by friends and colleagues for missing Apple’s spectacular rise to growth stock stardom. Yes, shares appeared cheap on a forward earnings basis for most of the stock’s run, but what if those forward earnings didn’t materialize? What if the company’s iProfits reverted towards those of its mortal competitors? And with more than 50 analysts covering the stock, what value could we possibly add? We doubt our model would have looked any different from the rest of them, so what was the point in attempting to justify owning the largest stock in the market when every portfolio manager and analyst on the street was head over heels for Apple?

Fast forward a few months and those same analysts are trampling over one another to slash their estimates of the company’s earnings. Wall Street’s estimates for both 2013 and 2014 fiscal year earnings have declined by double digits in the past three months. Sentiment on the stock has quickly soured, once again, catching most investors off sides. We’ve seen more than 20 firms cut their numbers in just the past sixty days. And seemingly overnight, Google and Samsung have become the “obvious” winners in mobility. How could Apple possibly compete with Android’s open platform and technological expertise without the leadership of Steve Jobs?

The Book of Jobs

Let’s be perfectly clear. The chance of Apple ever coming close to the success it achieved under the genius of Steve Jobs is somewhere between slim and none. Apple fans may have difficulty accepting this reality. To those fans, I highly recommend reading Walter Isaacson’s biography of Jobs, which is one of the most fascinating and motivating books I’ve read in years. I’d also recommend reviewing the series of posts by The Brooklyn Investor illustrating why Polaroid’s lesson of dependence on its creative leader, Edwin Land, may catch up to Apple without Steve Jobs. In short, we believe Apple’s success was a Steve Jobs story, not an Apple story. Apple can probably coast on the pipeline of Jobs’ genius for about two or three years, but future products are unlikely to be as transformative as the iStuff that has become ubiquitous across multiple generations.

What’s It Worth?

So where does that leave the stock today? Put simply, it is cheap and largely out of favor, with a number of high-profile hedge fund managers dumping shares in recent quarters. By contrast, the market’s new favorite to win the mobile war, Google, hit new highs this year, surpassing $800 per share. As a result, I recently sold our investment in Google and initiated a position in Apple for the first time. The bull case for Apple is (was) well documented, so we won’t waste time regurgitating it here. In short, even without Jobs, I think the company still benefits from strong barriers to entry in the form of high switching costs, which make Apple’s business much more defensible than those of its competitors. These costs are reinforced by strong network effects, which create competitive advantages on the demand side that are much more robust than supply side advantages, such as economies of scale. Understanding Apple Requires an Analysis of Fundamentals and Psychology, both of which were recently outlined in an Institutional Investor article, written by our friend Vitaliy Katsenelson. He also asks the question, How Much Would You Pay for the Apple Ecosystem?

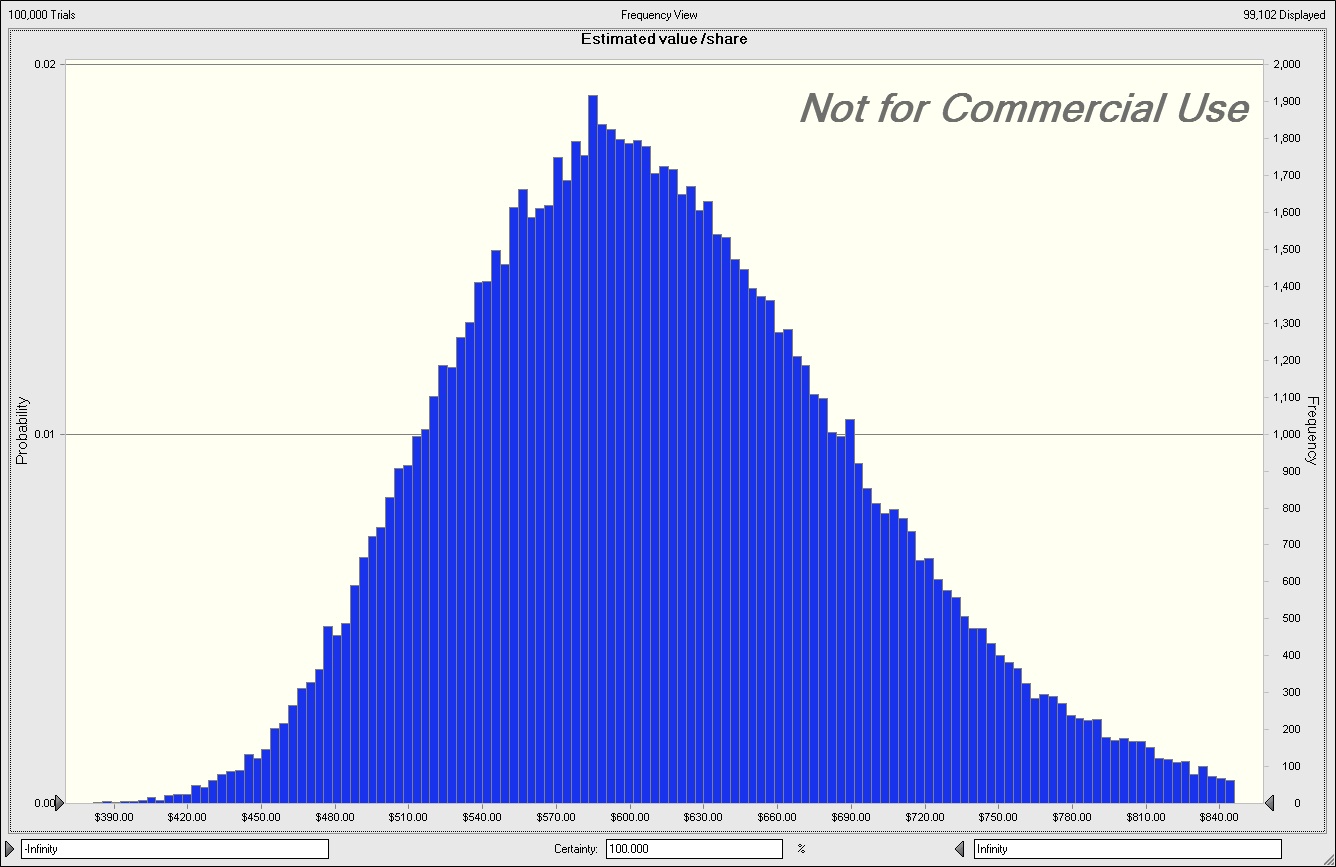

CFA charterholders might be interested to know that Aswath Damodaran recently addressed this query in a recent series of posts at Musings on Markets. Damodaran values the shares at $609, based on admittedly biased estimates, but at a recent price around $440, we think there is a considerable margin of safety in an investment today. Investors can access Damodaran’s model here. Perhaps more interesting is his sensitivity analysis, displayed below, which demonstrates that the market is currently valuing Apple at a price that assumes zero revenue growth, pre-tax operating margins of 25% (down from 40% plus one year ago) and a cost of capital at 15% (within the 97th percentile of domestic stocks). In other words, it is likely that the stock has already discounted the margin erosion that historically prevented me from owning Apple shares. With this risk largely priced in, and with a growing herd of analysts now focused on the competitive threat to Apple’s market dominance and leading profits, I am much more comfortable taking a position in the stock today.

Source: Musings on Markets

iCatalysts

Apple is currently trading at 6x downwardly revised forward earnings net of the cash on its balance sheet. For perspective, note that this is one multiple turn higher than that of Dell, a company that was left for dead until its founder recently stepped in with an offer to take it private. Although leadership in technology can change extremely fast, we think Apple is remarkably cheap for such a high-quality company with the brand recognition and customer loyalty it commands. Given the dramatic shift in sentiment and corresponding reduction in expectations, we think the stock offers investors a cheap option on continued innovation with a number of potential catalysts on the horizon that may trigger a turn in currently depressed sentiment and the stock’s equally depressed valuation. With the market now discounting zero earnings growth in the current year, upside surprises may come from new product cycles (i.e. iPhone, iPad, etc.), growing distribution (i.e. NTT Docomo, China Mobile, etc.) and expansion into untapped market niches (i.e. iTV, iWatch, etc.).

Finally, with one-third of its market value in cash, Apple can unlock value by deploying that cash productively, returning it to shareholders or lowering its cost of its capital. In the near term, we think this is likely to be an important catalyst in closing the gap between price and value, particularly with David Einhorn’s recent pressure on the company to issue perpetual preferreds or iPrefs. Greenlight’s full presentation on Apple’s capital allocation strategy is available here along with the full transcript, which is worth a read. Of course iPrefs would not, in theory, increase the intrinsic value of the company. But in practice, Apple would immediately reduce its cost of capital from the top quartile of the market, where it sits today, to the bottom quartile of the market, where it deserves to be. This shift would allow Apple’s shares to appreciate towards their intrinsic value, which Greenlight, coincidentally pegs at $600 per share, in line with the probability distribution above.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.