The Proposed Reverse Repo Facility: The Fed’s New Policy Tool?

The release of last week’s Fed minutes was received in typical fashion by the mainstream media. They spent most of the time analyzing any use of the word “taper”, a conversation that’s well exhausted itself by now.

More astute observers may have noticed a new paragraph discussing how the Fed is considering an overnight reverse repo facility. Shorter term rates spiked, and a large faction of market observers seemingly viewed this news as a signal related to the timing of a potential rate tightening.

The news doesn’t give insight into the timing of a potential tightening, but it does shed light on a new potential tool that may become instrumental in setting short term rates. Furthermore, it shows the Fed isn’t sitting back on its hands as it charts an eventual exit strategy from its current unprecedented balance sheet expansion.

In some respects, this program will be very similar to a “reverse LTRO”. Remember LTRO was a program where the ECB provided fixed rate term funding to banks in virtually unlimited quantities. Here the Fed will determine a rate in which it will borrow funds from counterparties, with the quantity being unlimited. As Barclays said, “Since the trade is fully collateralized and with the Federal Reserve, it will effectively establish the overnight risk-free rate for the economy”.

Now there are a couple of reasons why this type of program is necessary.

First, the amount of excess reserves in the system are mounting. Each month the Fed purchases securities in its QE program, reserves at banks grow and government bonds are removed from the system.

Secondly, and well documented of late, is that the recent changes to banks’ supplementary leverage ratio will mean a reduced willingness & ability to provide these type of repo transactions. The banks’ balance sheets aren’t big enough themselves to handle the amount of “reserve draining” that might need to take place in the future. There’s a thought by some observers that there would be a mass avoidance of repo transactions with banks, but this is likely misguided as the fed has only qualified certain institutions (the GSEs) to act as counterparties.

This is necessary to prevent dislocations from occurring in the fed funds market. Remember, the fed funds rate is the rate in which one bank lends to another overnight, with the effective Fed Funds rate currently at ~10bps. Now the GSE’s aren’t legally able to be paid interest on deposits at the Fed, so they typically lend some cash to receive compensation.

I believe the Fed wants to avoid a situation where the spread between the effective and target fed funds rate gets too wide. In the present regime, if the Fed raises the target rate by 25bps to 50bps, and IOR (interest on reserves) to 50bps, the GSE’s still would not able to receive IOR, and thus Fed Funds trades could conceivably still take place at 10-15bps, well below the new target rate of 50bps.

Should the reverse repo option be in place (let’s say at 25bps below IOR), a theoretical floor would be set at how low effective fed funds can trade.

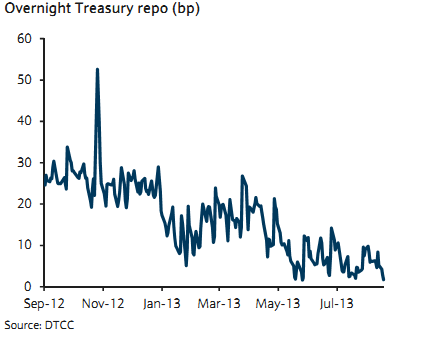

Additionally, this type of program would obviously solve the ever increasing problem of collateral shortage. With a high demand for general collateral repo, and a shortage of collateral available to lend, general collateral repo rates have trended down to roughly 1-2bps. A reverse repo program would immediately alleviate this shortage with the Fed lending out USTs at a pre-determined rate.

In summary, this type of facility appears to be a natural progression for the Fed as they work towards an eventual exit. The Fed could certainly begin to use their “target repo rate” as a policy tool instead of the Fed Funds rate. This makes sense as daily volumes in the cash secured repo market are significantly larger than in the unsecured Fed Funds market. As Credit Suisse noted today, “Other central banks already target repo rather than unsecured cash rates as their policy setting, so there is nothing operationally to stop the Fed from switching to a new target either, should it wish to do so”.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Thanks for this article. Why has it become acceptable in the first place to have the effective rate stray so far from target (ever since Lehman)? And if the reverse repo is supposed to make sure that discrepancy does not increase when target rates rise, why not set the repo floor equal to current target rate to test this method?