2014 Market Outlook: Reason for Optimism, but Worries over Asset Bubble

As 2013 draws to a close, CFA Institute members are looking forward to the New Year with renewed optimism for economic growth. That’s one of the key findings of the just-released 2014 Global Market Sentiment Survey. The Global Market Sentiment Survey is conducted annually by CFA Institute, and is unique in the marketplace in offering the insight of investment professionals from around the globe who are involved in virtually every facet of investing. This year’s survey reflects over 6,500 member responses.

Some 63% of our members feel that the global economy will grow in 2014 — a far more robust expression of confidence than when the question was asked last year, when only 40% could muster that positive outlook. The rise in optimism is uniform across regions, and is consistent with growth in the number of members who see brighter economic prospects for their home markets. Indeed, a majority of survey respondents in the Americas, Europe, Middle East, and Africa (EMEA), and Asia Pacific all predict economic growth in their home markets for the coming year.

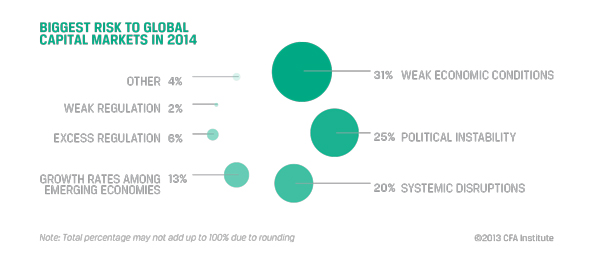

Members are less definite about potential risks to global capital markets performance. Thirty-one percent of the survey’s respondents felt that continued weak economic conditions would pose risks, while 25% cited political instability and 20% identified systemic disruptions as the most significant potential risks. Fully 68% of the members completing the survey identified the end of central bank “quantitative easing” as the most significant potential negative impact on their local market’s performance.

CFA Institute members once again predict that equities will be the asset class with the highest return in global capital markets in 2014. More ominously, a majority of survey respondents anticipate some financial bubble in 2014, but there is no consensus on which asset class will become so overvalued — with the exception of respondents in Asia Pacific, where a majority feel a real estate bubble will be in evidence in 2014.

Rating Regulatory Reform

Along with members’ outlook on economic and market issues, we asked about the state of integrity in both global and local capital markets. Perceptions remain virtually unchanged from last year’s survey. When asked about the regulatory action most likely to improve market integrity, 29% chose improved regulation and oversight of global systemic risks, ahead of better financial reporting transparency (21%), improved corporate governance (17%), and better enforcement of existing regulations (16%.) Our members reported market fraud and integrity of financial reporting as the most serious ethical issues for global capital markets in 2014.

We also asked members about regulatory reforms that have potential for positive effect as well as unintended negative consequences. Fully 73% of the survey’s respondents identified requiring banks to impair troubled credit holdings on a more consistent, timely basis as helping to prevent future crises, with only 16% anticipating negative consequences from such reform. This is in contrast to policy initiatives like designating “too big to fail” institutions for closer monitoring, which only 49% felt useful for preventing future crises and 34% felt would have negative consequences.

We’ll be exploring more of the survey results here in the next few days with particular focus on perspectives from EMEA, Asia Pacific, and the Americas.

If you liked this post, consider subscribing to Market Integrity Insights.

In the Asia-Pacific region, Real Estate market is still shaky and is showing signs of a downturn.

The Political scenario and Central Banks will play a huge role to play in the year 2014

Year 2014 Real Estate Market will be satiable….!!

Year 2014 Currency Market Remain Downside Because of weak economic conditions….!!

Year 2014 Metals can maintain upward Trend…..!!

Year 2014 Energy Market shaky and trend will be downward…..!!