Volcker Rule: Gauging Its Impact on Global Debt, Currency, Derivatives Markets

The International Organization of Securities Commissions’ (IOSCO’s) annual Securities Markets Risk Outlook lists investors’ search for yield and the return of leverage as the primary risks facing global financial markets in the near term. These trends bode ill because when rates start to climb and investors try to sell, there will be fewer big dealers willing to make markets thanks to the Dodd-Frank Act and the Volcker Rule it created. The rule, which sought to disabuse banks of the practice of using insured deposits to fund proprietary trading, was certainly worthy and needed, but there is concern that the rule may have created significant difficulties for investors down the road. To gauge concern among investors, we recently asked readers of the CFA Institute Financial NewsBrief whether they had noticed any changes in liquidity as a result of the Volcker Rule.

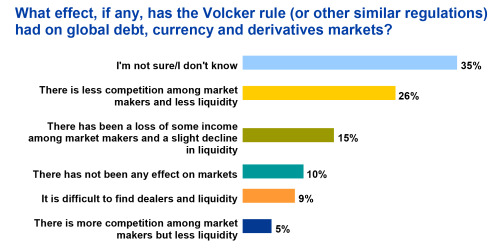

A plurality (35%) of the 431 respondents weren’t sure, and just 10% said there had been no change. By comparison, 55% said there was less liquidity, with the most frequent response (26%) being that there is less competition and less liquidity than before. Investors never know how much liquidity there is for something until they test the market. In light of IOSCO’s findings, the concern is whether investors could test the market too much.

If you liked this post, consider subscribing to Market Integrity Insights.

Photo credit: iStockphoto.com/EdStock