Is Audit Committee Transparency Improving? Not Really, Despite CAQ Report Headline

The Center for Audit Quality (CAQ) released its second annual Audit Committee Transparency Barometer on 3 November. The headline read: “Second Annual Audit Committee Transparency Barometer Reveals Encouraging Disclosure Trends for Public Companies of All Sizes.” The report would be better titled: “Second Annual Audit Committee Transparency Barometer Reveals Disclosures Continue to Leave Investors in the Dark.”

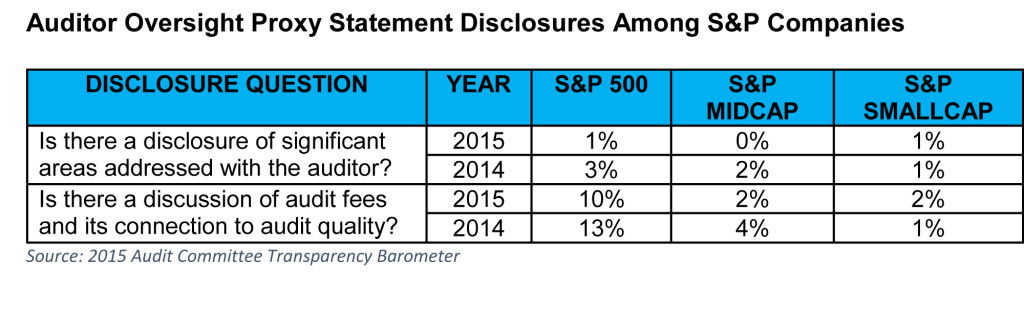

The CAQ report explains in detail the positive trends in what investors would see as the least informative disclosures around audit firm selection, compensation, evaluation/supervision, and selection of the audit partner. What the report doesn’t highlight, even though a part of the study, is that the most meaningful disclosures to investors show abysmal results and a downward trend. The table below extracts those statistics from the report.

The CAQ provides example disclosures from audit committee reports for the measures they choose to explain. Read the examples and ask yourself: Do these disclosures enhance your confidence in audit committees (the answer will probably be yes), and do the disclosures contain anything substantive (the answer will probably be no). The CAQ heralds the findings as a sign that audit committees are upping their game with respect to transparency. Unfortunately, investors may not share this perspective.

The two questions above — which get to the heart of audit quality — are poorly represented in audit committee reports. Investors value information that allows them to assess a company’s risks, audit work related to risk, how the audit committee addressed these risks with the auditor, and how they assessed the quality of the auditor’s work. These important questions, which were not discussed, speak more to the quality of audit committee transparency than mild improvements in other disclosures.

Investors have sought better transparency from audit committees for years. Recently CFA Institute issued a comment letter to the US Securities and Exchange Commission in response to its Concept Release Possible Revisions to Audit Committee Disclosures where we provide our perspectives on useful audit committee communications.

The CAQ report shows a positive direction. However, until audit committees provide entity-specific information, such as audit risks, investors won’t be lulled into thinking that audit committee transparency is improving in a meaningful way.

If you liked this post, consider subscribing to Market Integrity Insights.

Image credit: JDawnInk

As long as the audit committee members are appointed on the nominations of majority shareholders, which is mostly the case, the quality of audit committee performance would always be compromised. Changes need to be made to bring in at least majority members on the audit committee who do not represent or are nominated by majority shareholders.