Walking the Talk: Corporate Governance in Asia Pacific Is Improving but More Effort Is Needed

In early November, the Organisation for Economic Co-operation and Development(OECD) Asian Roundtable on Corporate Governance discussed the evolving roles and impact of Asia and technologies in global financial markets, the importance of sustainable investment, and updates on corporate governance development in the region.

In conjunction with this roundtable, the OECD released two reports. One of those reports, Flexibility and Proportionality in Corporate Governance, emphasizes the need for markets to adopt well-defined corporate governance regulatory frameworks, which also must be flexible and accommodative given the ever-changing business environment.

The Importance of Good Governance

An effective governance framework generally involves a regulatory regime and relevant market mechanisms designed to reconcile the roles of, and relations among, different stakeholders, including shareholders, boards of directors, management, and employees.

According to the International Finance Corporation (the World Bank’s private sector lending arm), corporate governance is defined as “the structures and processes by which companies are directed and controlled.” Similarly, The Governance Institute sees corporate governance as a set of tools that allows management and directors to effectively manage the operation of firms, while also ensuring that appropriate operating procedures and checks and balances are in place to address stakeholder interests.

The Institute of Directors, which has been publishing the Good Governance Index in the United Kingdom since 2015, broadly groups governance factors into five key categories: board effectiveness, audit and risk or external accountability, remuneration and reward, shareholder relations, and stakeholder relations.

Revised in 2015, the G20/OECD Principles of Corporate Governance provides an international set of competency assessment benchmarks for both emerging and industrial economies. These principles suggest that enhanced transparency and accountability brought about by good corporate governance standards would support sustainable and inclusive growth of societies. CFA Institute could not agree more.

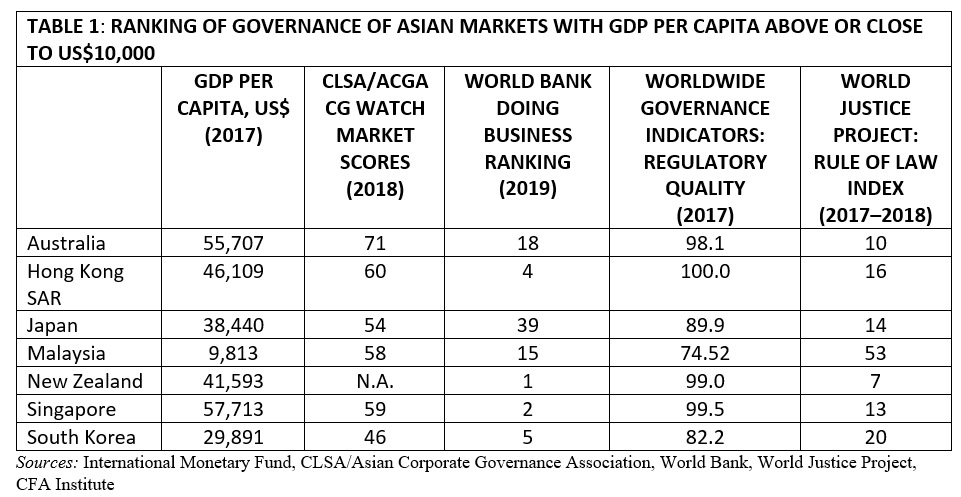

Take, for example, the top-ranked economies in the World Bank’s Doing Business 2019 ranking. These countries attained a high level of regulatory efficiency and quality. Well-defined and clear regulations mean businesses know what to expect in these economies, and this predictability makes them more attractive to foreign capital and investments.

Increasing Significance in Asia

Asia includes a hugely diversified mix of economies of different scales, levels of development, and corporate governance standards. Economies that have attained a higher level of GDP per capita, including Australia, Hong Kong, New Zealand, and Singapore, consistently score higher than their Asia-Pacific peers regardless of the governance-related metrics measured. This is reflected in studies conducted by international organizations, including the World Bank and the World Justice Project (see below).

Participants at the OECD Asian Roundtable noted that corporate governance in Asian markets has been transforming and improving, including better transparency and greater board diversity. In Japan, for instance, more constituent firms of the Nikkei Stock Average now have non-Japanese and female board members. These companies include Panasonic Corporation, which appointed Laurence W. Bates as its first non-Japanese board member, and Toyota Motor Corporation, which named Teiko Kudo as its first female board member. Such trends are expected to continue.

Historically, investors have been passive about voicing their opinions on Asian companies or their managements. But investor engagement has become more direct and open in recent years. In the 2018 report Shareholder Activism in Asia, J.P. Morgan suggests that regulators have played an instrumental role in the transformation by enacting reforms. It expects shareholder activism to continue gaining momentum in Asia, driving further improvements in corporate governance and evolving as a permanent investment strategy in the region. This expectation is in line with a strengthening of financial market structures in the region spearheaded by standard setters and regulators.

Existing literature also supports the thesis that good corporate governance practices would boost the operational efficiency of companies; lower the likelihood of mismanagement; and improve access to, as well as lower the cost of, capital. These are strong grounds for regulators pushing for change. For instance, the Securities and Exchange Board of India holds that good corporate governance would “generate significantly greater returns when compared to companies that exhibit poor corporate governance” and has been pressing for financial market reform over the past few years.

This support of corporate governance also may explain why key stock exchanges and financial regulators in the region have introduced and revised corporate governance and stewardship codes (see The Corporate Governance of Listed Companies, 3rd Edition). Although key markets, such as Australia, Hong Kong, and Singapore, have already adopted both corporate governance and stewardship codes, it is likely that other emerging financial markets, such as Vietnam, also may be introducing their own codes in the coming years to build sound financial systems.

The positive influence of corporate governance on company performance is not limited to industrial markets. Empirical studies indicate that effective corporate governance has a significant positive impact on the financial performance of companies in developing markets in Asia. In a 2018 study of the performance of companies listed on BSE SENSEX, Aswathy Mohan and S. Chandramohan find that good corporate governance practices have displayed a significant positive relationship with firm performance. In 2017, Mahboob Ullah, Nouman Afgan, Muhammad Hashim, and Muhammad Azizullah Khan report that corporate governance would have significant positive impact on company performance of cement firms listed on the Pakistan Stock Exchange. In a 2018 study on banks’ performance in Bangladesh, Syed Moudud-Ul-Huq, Changjun Zheng, and Anupam Das Gupta reconfirm that good corporate governance would benefit banks in the forms of cost management, value creation, efficiency enhancement, and risk reduction. Such findings suggest that more efforts to enhance corporate governance standards are warranted.

Conclusion

In CG Watch 2018, Charles Yonts, Jamie Allen, and Miriam Zhou suggest that “there has been tremendous change in Asia over the past 20 years, not only in regulation but also the quality of the work being done by the best companies, the most committed investors, the most thoughtful auditors, the sharpest journalists, and many other stakeholders.”This, in a way, shows that some improvement has been made to enhance corporate governance.

As Nobel laureate Oliver E. Williamson suggested in 1984, however, even if firms agree with terms and governance structures that would be sensible for general stockholders, they could subsequently be induced to adopt changes that hurt shareholder rights so as to be relieved from the monitoring pressures. This is exactly why regulators and standard setters have a key role to play in upholding market integrity and protecting the investing public from different forms of managerial entrenchment, such as nepotism and non-merit-based generational succession. Although Asian markets have made remarkable headway in strengthening corporate governance over the past few years, further effort is needed to ensure that the credibility and success of companies and markets can be sustained.

Image Credit: © Manu_Bahuguna