Mitigating Risk for Asset Owners — Claiming Compliance with the GIPS Standards

We’ve heard in recent weeks about the troubles at Pennsylvania Public School Employees’ Retirement System (PSERS), where potentially incorrect return calculations have real-world implications. What happened at PSERS? And would compliance with standards for calculating and presenting performance have been valuable in this situation?

What Happened at PSERS?

An incorrect return calculation for the $64 billion fund, which is significantly underfunded, has serious consequences for PSERS beneficiaries. PSERS has around 250,000 retired teachers and other school workers as beneficiaries, and it has just as many people currently working who are paying into the plan. In 2010, the state adopted a risk-sharing agreement requiring all employees hired after 2011, as well as their employers, to pay more into the plan if the average annual time-weighted rate of return on the market value of assets (the market return), net of fees, is below the actuarial value of assets (AVA) return over a specified period.

PSERS reported an average annual market return of 6.38% as of 30 June 2020, versus an AVA return of 6.36%, staving off an increase in contributions. Because the difference between these two returns was so small, PSERS hired an independent consultant to confirm that the market return of 6.38% was correct, and the consultant confirmed this return. On 12 March 2021, however, PSERS announced that the market return was incorrect and that employees should have been required to pay more into the plan.

To make matters worse for PSERS, it has been reported that the FBI is investigating the organization. PSERS now confirms that there is a federal grand jury probe but has offered no details yet as to what or who specifically is being investigated. In the coming weeks and months, we will learn whether the market return discrepancy was a tragic error or something more nefarious. Meanwhile, we have to try to learn from these mistakes and ask ourselves: Could this error have been avoided? And, how can an asset owner make sure its returns are accurate?

Although errors can always happen, adhering to global best practices for performance calculation and presentation is a good start.

Asset owners (e.g., pension plans, endowments, foundations, sovereign wealth funds, etc.) and their boards can mitigate risk by claiming compliance with the Global Investment Performance Standards (GIPS®). The GIPS standards are voluntary ethical standards for calculating and presenting investment performance based on the principles of fair representation and full disclosure. More than 1,800 organizations in 48 countries and regions have adopted the GIPS standards, which are considered industry best practice for investment performance calculation and presentation.

Asset owners benefit from complying with the GIPS standards in several ways:

- Compliance helps ensure that the asset owner’s investment performance is complete and fairly presented, regardless of whether assets are managed internally, externally, or both.

- Compliance requires the establishment of robust investment performance policies and procedures, increasing the asset owner’s confidence that any data presented to the oversight body is consistent and transparent.

- Compliance indicates a commitment to adopt the same performance standards often required of any external investment managers retained by the asset owner.

Asset owner oversight bodies also benefit when the asset owner complies:

- Compliance demonstrates to legislative bodies, oversight bodies, and the general public a voluntary commitment to follow ethical standards.

- GIPS Asset Owner Reports foster strong investment decision-making and governance.

- Compliance helps assure that the asset owner’s investment performance is complete and fairly presented, regardless of whether assets are managed internally, externally, or both.

- GIPS Asset Owner Reports aid in the evaluation of investment performance, facilitate the understanding of progress toward investment objectives, and provide critical inputs into allocation decisions.

Asset owners often choose to comply with the GIPS standards to help fill a void when no guidance exists for how performance should be calculated and presented. Asset owners that comply are required to establish policies and procedures for valuation and return calculation, and they must consistently follow those policies and procedures.

We are not definitively stating that this error would have been caught or prevented had PSERS claimed compliance with the GIPS standards. But we are saying that if PSERS had complied, it would have had a more solid foundation for calculating performance, and the guardrails of the GIPS standards could have helped to identify the error sooner or even prevent it altogether.

Do Asset Owners Find Value in a Set of Standards for Calculating and Presenting Performance?

The asset owner community is just beginning to widely consider complying with the GIPS standards. Fewer than 20 of the 1,800+ organizations claiming compliance are asset owners; it is, however, a meaningful group of asset owners that comply. Compliant organizations include California Public Employees’ Retirement System (CalPERS), Massachusetts Pension Reserves Investment Management (Mass PRIM), State Teachers Retirement System of Ohio (STRS Ohio), Saudi Central Bank (SAMA), Norges Bank Investment Management, Caisse de dépôt et placement du Québec (CDPQ), and AIA Group Limited.

The United States Investment Performance Committee (USIPC) is the GIPS Standards Sponsor of the GIPS standards in the United States. In conjunction with CFA Institute, the USIPC recently conducted a survey of asset owners in the United States. The survey aimed to determine asset owners’ familiarity with the GIPS standards, whether they plan to or already claim compliance with the GIPS standards, and if they require or inquire about GIPS compliance when selecting external managers.

Nearly 90% of survey respondents have some level of familiarity with the GIPS standards.

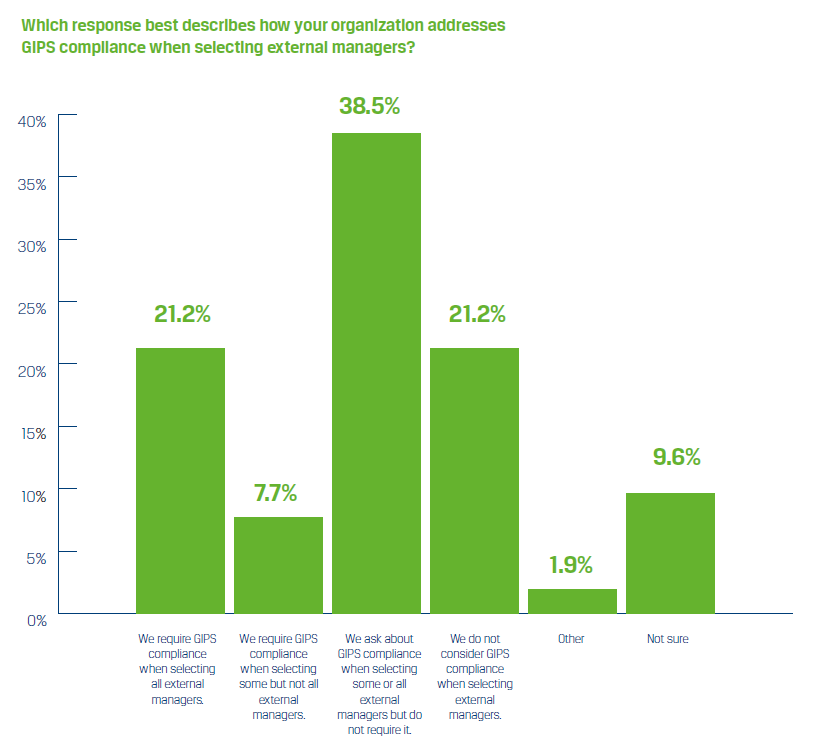

We also learned that many asset owners see the benefit of the GIPS standards when selecting their external managers. Almost 30% of survey respondents require external managers to claim compliance for either all or some searches, and another 39% ask about GIPS compliance when selecting external managers.

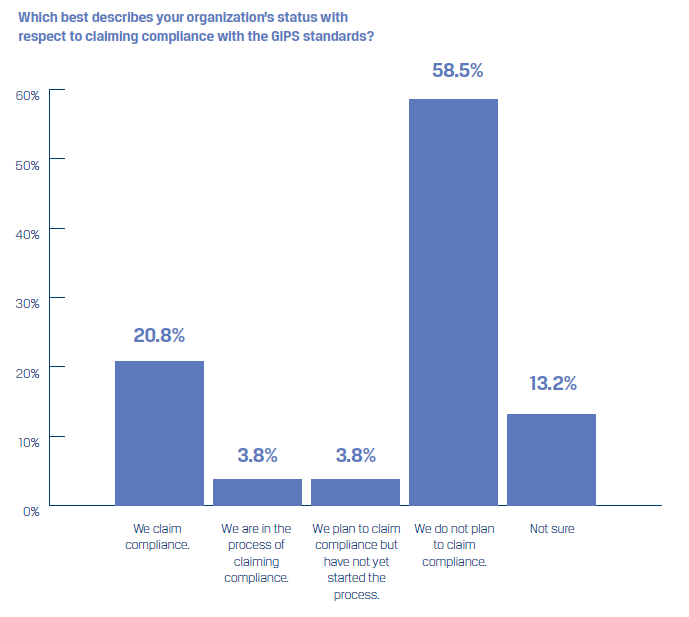

In terms of asset owners that themselves claim compliance with the GIPS standards, almost 21% of survey respondents currently claim compliance with the GIPS standards and another 7.6% either are in the process of claiming compliance or plan to comply. Although this number may seem low, we were pleased to see this many respondents who claim compliance or are in the process of claiming compliance, given that the GIPS Standards for Asset Owners are quite new.

Conclusion

Although errors can always happen, the GIPS standards provide a framework for developing a robust set of investment performance policies and procedures, allowing an asset owner to be confident in the data it presents to its oversight body. We cannot say for certain that the PSERS error would have been avoided, but our experience of hearing from other asset owners who have come into compliance is that the benefits far exceeded initial expectations.

According to the case study describing AIA’s journey to GIPS compliance, “The value of compliance is not only in being able to tick the box but also in revealing new ways of doing things. What started merely as an exercise to become compliant has resulted in a more efficient process that embeds the performance standards deeply into the operational, investment, and governance infrastructure. It has become the means, rather than the end, making compliance part of ’who we are and what we do.’”

If you would like to learn more about compliance with the GIPS standards, visit the GIPS standards website. There you’ll find tools and resources for asset owners, including a short video introducing the GIPS standards. We are happy to answer any questions you may have. Feel free to contact us at the GIPS standards Help Desk.

Photo Credit @ Getty Images / TarikVision