How Do Firms Treat Errors in Investment Performance?

The following is derived from the “Survey Report of Firms on GIPS® Standards Error Correction Policies” from CFA Institute.

An error in investment performance can occur when a firm misstates or omits a return or other performance-related information. Such errors might result from incorrect, incomplete, or missing:

- portfolio returns

- composite returns

- asset values

- benchmark returns

- risk measures

- disclosures

There is minimal, if any, regulatory guidance for how firms should treat errors in investment performance that occur in marketing materials. The Global Investment Performance Standards (GIPS®), the voluntary investment performance reporting standards from CFA Institute, do address errors that occur in GIPS Reports. (A GIPS Report is a presentation for a composite or pooled fund that includes all of the information required by the GIPS standards.)

GIPS-compliant firms must provide the appropriate GIPS Report to all prospects. This requirement assumes that the GIPS Report includes correct information. When a firm determines that a GIPS Report has a material error, it must correct the error, disclose the error, and provide the corrected report to those who received the incorrect report.

In a recent survey conducted by CFA Institute of more than 100 GIPS-compliant firms, we learned that over half of the survey respondents apply either their GIPS Standards Error Correction Policy or a different error correction policy to errors in all marketing materials.

Materiality Thresholds Firms Use for Errors in Investment Returns

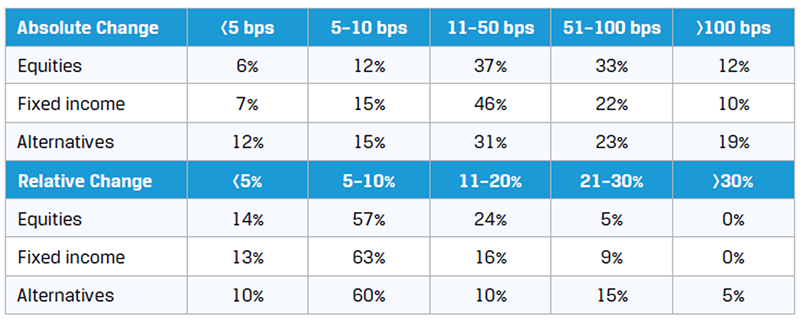

Our survey results showed that for errors in composite returns, most firms:

- Use a two-pronged materiality threshold that looks at both the absolute basis point (bp) change in returns and the relative change in returns. So, if the correct return is 2% and the incorrect return was 1.5%, the absolute change would be 50 bps, and if the correct return is 2% and the incorrect return was 1.5%, the relative change would be 33%.

- Set an absolute threshold between 11 bps and 50 bps and a relative threshold between 5% and 10%, regardless of asset class.

Materiality Thresholds for Errors in Investment Returns

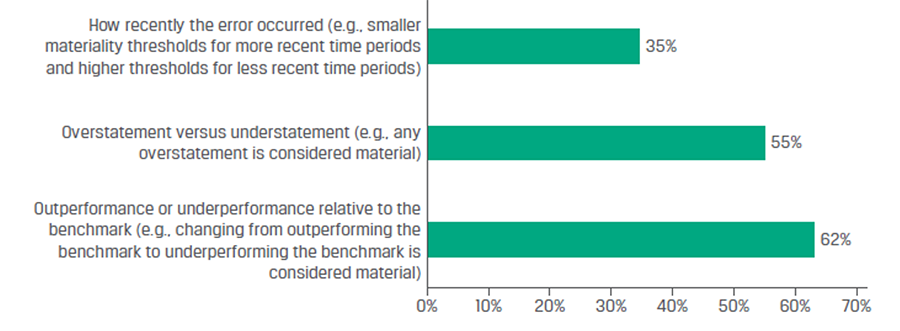

Qualitative Considerations for Material Errors

While quantitative thresholds help firms understand the magnitude of errors, quantitative information alone may not provide a complete picture. Many firms also consider qualitative factors when assessing whether an error would have an impact on the judgment of a reasonable person relying on the information. The survey asked firms whether their error correction policy includes qualitative factors when evaluating the materiality of errors. A majority of respondents include qualitative factors when defining material errors.

What Qualitative Factors Are Tracked?

We also asked firms to describe other factors they considered when assessing materiality. Some of these factors include:

- investor/shareholder perspective

- historical errors within the composite

- whether the GIPS Report was distributed externally

- facts and circumstances surrounding the error

- errors that result in a positive return changing to a negative return

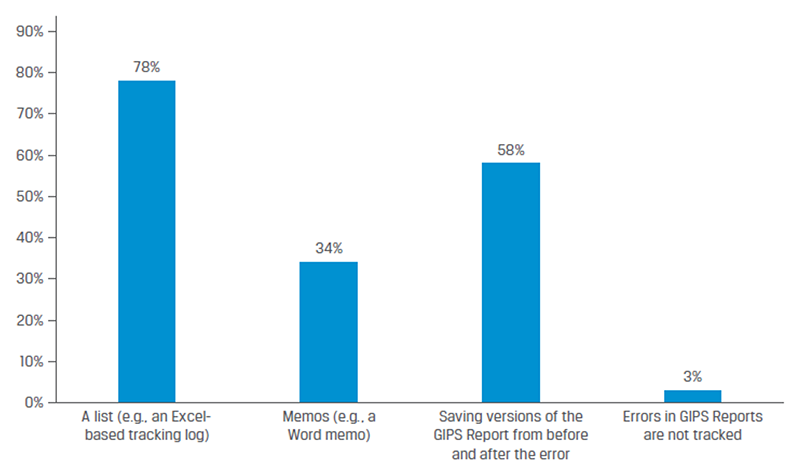

How Investment Managers Track Errors

To be able to provide prospects and clients with corrected performance, firms should adopt a best practice of tracking and documenting who received which marketing materials and when.

The survey asked firms how they track and document errors. Most respondents (78%) said they use an Excel-based error-correction log that summarizes past errors.

How Do Investment Managers Track and Document Errors?

Best Practices for Firms to Follow

Firms should consider implementing the following error correction best practices:

1. Create an Error Correction Policy

CFA Institute and its volunteer committees developed a sample error correction policy to help GIPS-compliant firms design policies and procedures for handling errors in GIPS Reports. While the sample is geared toward GIPS-compliant firms, it can serve non-GIPS-compliant firms as well.

2. Establish an Oversight Committee

Error correction policies are generally multi-faceted and often include both quantitative thresholds and qualitative considerations, which require judgment and assessment of the facts and circumstances surrounding the errors. When making decisions regarding the materiality of errors, firms should seek input from all departments within their organization to gain a comprehensive understanding of the error and its potential impact. GIPS-compliant firms often create an oversight committee that is responsible for making these decisions.

The survey asked respondents whether their firm has an oversight committee that is responsible for reviewing errors that occur. A majority of respondents (59%) said they have such a committee. An additional 11% noted that while a formal committee does not exist, informal meetings of firm personnel are held to discuss errors associated with the GIPS standards as they occur. They said these discussions include representatives from the portfolio analytics, portfolio management, risk management, legal, operations, compliance, marketing, performance, and GIPS standards reporting departments, as well as verifiers.

How Firms Handle Errors in Disclosures

The survey asked participants to explain how their firms determine what is considered to be a material error for disclosures. While the responses varied widely, some commonalities emerged. Many firms handle errors in disclosures on a case-by-case basis, and they bring in the oversight committee or multiple departments, such as portfolio management, compliance, legal, marketing, and performance, that are responsible for determining the materiality of errors.

Numerous respondents described a policy that can be summarized as follows:

A disclosure error is considered material if the firm determines that it is reasonably likely that such an error would have misled a prospect or impacted their decision to invest.

Many respondents said that any missing required disclosure is considered material. A few survey participants said that no disclosure error is considered material at their firms. Additionally, some said their firms will consult their verifier when determining whether a disclosure error is material.

Survey respondents offered examples of specific topics for which their firm considers any disclosure error to be material. The topics they mentioned are:

- fundamental changes to the strategy description

- material use of leverage and derivatives

- omitted disclosure of non-compliant periods

- linked performance

- omitted portability disclosure

- incorrect benchmark identification

- incorrect labeling of gross or net returns

- missing disclosure for the total percentage of fair valued securities in a composite when the value exceeds the firm’s materiality threshold for disclosure

- items required to be disclosed by law or regulation

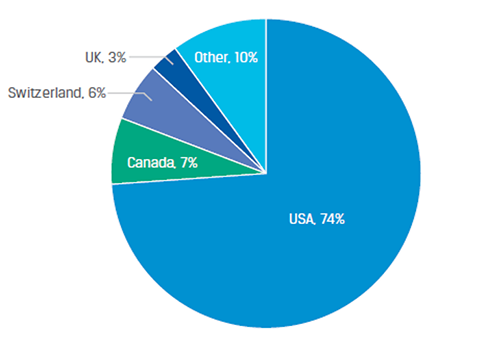

About the Survey Respondents

Survey respondents hailed from 14 countries and represented 146 firms, all of which claim compliance with the GIPS standards. US participants predominated.

Survey Participants by Country

Respondents represented firms of all sizes, with those from larger firms of US$20 billion or more in assets under management (AUM) comprising the largest survey cohort.

Survey Participants by Assets under Management (AUM)

The overwhelming majority of respondents indicated that their firm manages a mix of asset classes. In total, 91% of respondents said that their firms manage equities, 77% manage fixed income, and 54% manage alternative investments.

Conclusion

Even with the tightest of controls, errors in investment performance will occur. Given the robust policies and procedures that GIPS-compliant firms are required to establish, all firms can look to them to identify best practices.

The results of the 2022 survey, along with the Sample Error Correction Policy, will help firms better develop and assess their error correction policies.

For more on the GIPS standards, visit the GIPS standards website and register for the 27th Annual GIPS Standards Conference on 17–18 October 2023 in Chicago.

If you liked this post, don’t forget to subscribe to Market Integrity Insights.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Image credit: ©Getty Images/ Wirestock

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Market Integrity Insights. Members can record credits easily using their online PL tracker.