A Look at the Cash Conversion Cycle

How many days does it take a company to pay for and generate cash from the sales of its inventory?

This is what the Cash Conversion Cycle or Net Operating Cycle tells us. It gives us an indication as to how long it takes a company to collect cash from sales of inventory. Often a company will finance its inventory instead of paying for it with cash up front. This means they owe someone money which generates “Accounts Payable”. Many times they will turn around and sell that inventory on credit without getting all the cash at the time of the sale. This means people owe them money and generates “Accounts Receivable”. The formula for the Cash Conversion Cycle is:

CCC = Days of Sales Outstanding PLUS Days of Inventory Outstanding MINUS Days of Payables Outstanding

or

CCC = DSO + DIO – DPO

The entire CCC is often referred to as the Net Operating Cycle. It is “net” because it subtracts the number of days of Payables the company has outstanding from the Operating Cycle. The logic behind this is that Payables are really viewed as a source of operating cash or working capital for the company. By contrast, Receivables, or cash the company has not received yet, decreases working capital available to the company to finance operations.

Days of Sales Outstanding

Days Sales Outstanding or DSO can be described as average Accounts Receivable divided by Revenue per day.

As a reminder, whenever we use ratios that mix Balance Sheet numbers (Accounts Receivable) with Income Statement numbers (Revenue) we should average the Balance Sheet numbers from the beginning and end of the period. This is because the Income Statement measures activity that takes place over the entire period, whereas a Balance Sheet is the valuation of the various accounts on a particular day (usually the end of the period).

Average Accounts Receivable would be Accounts Receivable at the beginning of the period plus Accounts Receivable at the end of the period divided by two. Similarly, Revenue per day would be Revenue for the year divided by 365. The complete formula therefore would be:

DSO = [(BegAR + EndAR) / 2] / (Revenue / 365)

To make a long story short, DSO tells you how many days after the sale it takes people to pay you on average. You want to get paid by your customers quickly, so a lower number is better but as always this needs to be taken in context. You don’t want to make your customers pay so quickly that they buy from someone else with less aggressive collection policies.

Days of Inventory Outstanding

Days of Inventory Outstanding, or DIO, is similar to DSO but instead of comparing Sales per day relative to average Receivables it looks at Cost of Goods Sold per day relative to average Inventory levels. The formula would look like this:

DIO = [(BegInv + EndInv / 2)] / (COGS / 365)

DIO, sometimes referred to Days of Inventory on Hand and abbreviated DOH (Homer Simpson), tells you how many days inventory sits on the shelf on average. For the most part, you want to see your inventory flying off the shelves, so again a lower number is better, but not so low that you don’t have sufficient inventory and are missing potential sales.

Operating Cycle

The first two components of the CCC, DSO namely DIO are what is called the Operating Cycle. This is how many days it takes for a company to process raw material and/or inventory and collect cash from the sale.

Operating Cycle = DSO + DIO

Basically the Operating Cycle tells you how many days it takes for something to go from first being in inventory to receiving the cash after the sale. You want this number to be low meaning that merchandise isn’t sitting on shelves too long and customers are paying relatively quickly.

Days of Payables Outstanding

Days of Payables Outstanding or DPO is the final component of the Net Operating Cycle and it gets subtracted from the Operating Cycle (hence the “net”). It measures the number of days of Accounts Payable the company has outstanding relative to their purchases of inventory or COGS. The formula is:

DPO = [(BegAP+EndAP) / 2] / (COGS / 365)

Days of Payables Outstanding tells you how many days the company takes to pay its suppliers. Unlike the other two numbers that make up the Operating Cycle, the company wants to stretch out how long it takes to pay for its inventory. In reality it is a form of free vendor financing and free is good! But once again, this is within context of each specific company. The company, for instance, wouldn’t want to take so long to pay that it missed out on big discounts for paying early or incentives offered if there are any.

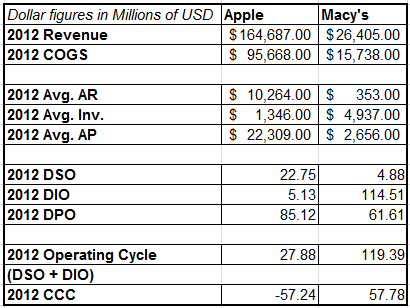

Let’s take a look at these figures for two different companies, Apple and Macy’s using figures from their most recently filed Annual Reports.

That’s incredible! Apple has a “NEGATIVE” cash conversion cycle. That basically means they are getting paid by their customers long before they pay their suppliers. Essentially this is an interest free way to finance their operations by borrowing from their suppliers.

They both take two months or more to pay the Accounts Payable they have and Macy’s gets paid by customers very quickly, mainly because people pay cash or use Visa or Mastercard. The big difference is inventory management. Not surprisingly things sit on Macy’s shelves longer than Apple’s, but Apple’s inventory turnaround is nothing short of outstanding! They hold inventory for on average about 5 days. That’s practically building to order! Granted, the nature of Macy’s business is very different from Apple’s (Apples and oranges?) and it isn’t fair to compare what is essentially a manufacturer to a consumer retailer. But still, a negative cash conversion cycle is nothing to sneeze at!

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

How do you calculate the cash conversion cycle for a company that has no inventory? With no inventory, you can’t compute days inventory outstanding (DIO), and without cost of goods sold, you can’t compute days payables outstanding (DPO).

My thought is that the DIO would be 0 days.

For DPO, rather than using COGS, I should use the total expenses that gave rise to the payables (e.g., G&A, advertising, rent, etc.). Any thoughts?

Thanks.

Hello Phil,

What you typically do in a service industry (I assume that’s what you’re in since you have no inventory) is that you have a position cost of services rendered. In a manufacturing organization you see items like direct materials, direct labor, etc. in your COGS. In case of a service company, you still capture direct labor, which gives you a figure to work with for your DPO. Don’t treat your cost of services rendered the same as e.g. G&A or advertising or rent.