Trials and Tribulations of Negative Enterprise Value Investing

About a month ago, I wrote about the attractive historical performance of negative enterprise value stocks. This week, I’d like to illustrate some of the challenges of investing in negative EV stocks by delving into some recent opportunities.

Negative EV stocks are almost definition unloved by the markets and discarded in the trash heap. As such, they are not easy to find. Most popular web-based screeners, such as Yahoo’s, Google’s and FinViz offer few fundamental screening criteria. The ones that do are usually limited to simple ratios such as price/book value. I could find no screener that offered enterprise value as a screening or sorting criteria. Even Bloomberg’s stock screening functionality (EQS), very popular among professional investors, is curiously stunted in this area, since the enterprise value field is only populated if it is positive. Negative enterprise values are shown as erroneous or ‘Not available’ and therefore can’t be easily employed as a criterion in a screen. I finally settled on a free screen provided by Old School Value which in turn is based on Portfolio123.

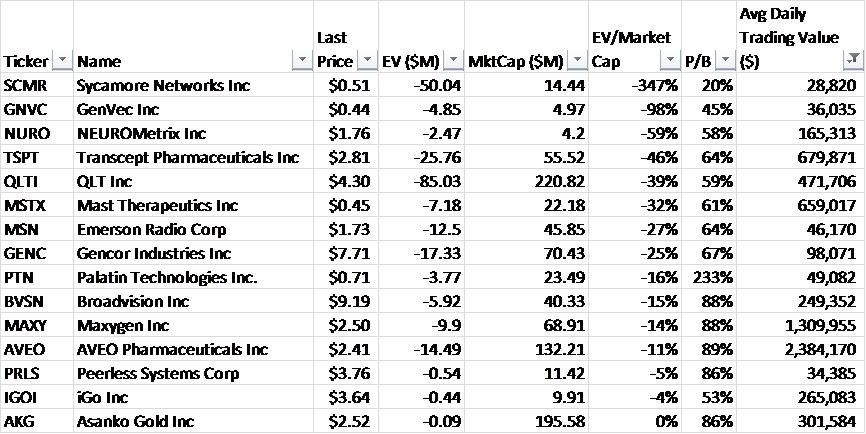

First, I will narrow down the list by liquidity: As noted in my prior article, searching for negative EV stocks is mostly a game for individual, not institutional investors. However, even individual investors will have their liquidity limits. If we require that each stock trade at least $25k worth per day, this will narrow our list from 50 to 15 stocks. Here they are sorted in ascending order by the ratio of EV to Market Cap:

Let’s dig into the four top names:

- SCMR: Sycamore Networks used to be a high-flying telecom company in the (first) dot com bubble. After returning a large amount of cash to shareholders, it decided to liquidate. OSV shows the company as having an eye-popping EV of -$50m. However, the most recent quarterly balance sheet from April 2013 shows cash of $20.6m and a liquidation reserve of $10.6m, so net cash is only $10m. This is significantly lower than SCMR’s market cap of $15m. In other words, SCMR’s EV is actually positive. When SCMR decided to liquidate, it switched its accounting from a “going concern” to a “liquidation” basis. The last “going concern” set of financials was filed in July 2012, over a year ago. I suspect that is the source of the discrepancy.

- GNVC: GenVec, a small biotech company, is another liquidation story: Genvec’s board voted to liquidate on May 24th, 2013 after the company’s experimental HIV vaccine failed in a clinical trial. GNVC’s last available balance sheet, from April 2013 (before the liquidation) shows $12m in cash and investment versus no long term debt. GNVC’s market cap is $5.7m, so its EV is about -$6m. However, GNVC has been spending about $3m per quarter on its research effort, and will have to spend some money to terminate employee, leases and contracts as it downsizes. If it can quickly ramp down spending and keep liquidation costs to a minimum, there may be some value in the stock, but it doesn’t seem like a bet with a large margin of safety.

- NURO: With a market capitalization under $3m, NeuroMetrix is too small for most investors out there. The negative EV reported by OSV seems to be correct, but NURO has been losing about $2m per quarter. If they continue, they will burn through their cash in about a year. Worse, NURO issued $4.5m in equity so far in 2013. This is a big red flag in my view: If management thought the stock was cheap and the spending could be curbed, they would be buying back shares instead.

- TSPT: Transcept makes Intermezzo, a new drug to treat insomnia. Intermezzo has not been selling well, which is one of the reasons the stock is cheap. TSPT’s latest quarterly report bears out the negative EV reported in OSV. However, TSPT lost over $17m in four quarters ending 2013Q1. At this rate, TSPT’s equity will last another 4-5 years, not bad. Further, there is some hope TSPT’s expenses moving forward may be lower than they were over the last year: It will probably not need to spend as much on clinical trials for Intermezzo, for one thing. The big concern with Transcept is corporate governance: If TSPT’s management were primarily concerned with shareholder value, they would simply liquidate the company and the stock would jump. Instead, they have recently voted for more generous compensation for themselves (in the form of better severance benefits). It appears they are looking for another drug or company to acquire with their excess cash, and their track record at TSPT is less than inspiring. TSPT was written up in January 2013 on ValueInvestorsClub.com, a prestigious online investment club. The writeup cited the stock’s negative EV. The stock has dropped 42% since that writeup. Nonetheless, I believe it is one of the more promising candidates on the list, well deserving of a second look.

I could go on, but the point is that each negative EV stock has something very wrong with it. Some only show up on the list because of a data error. Most are downright frightening once you start digging into them. This is why they available for sale for less than the cash on their balance sheets. However, despite the fear they inspire, and perhaps because of it, we know that – as a group and over time – they tend to generate highly attractive returns.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Hi Alon,

Thank you for using Old School Value for the screen.

One thing I want to point out is that the screen includes additional criteria to try and filter for value type ideas.

May be late, but I pulled out the latest list of purely negative EV stocks as of Aug 15. The list contains 104 stocks in the spreadsheet. If you wish, I will be more than happy to send it your way to post as a reference to this article.

Thank you,

Jae Jun | Old School Value

The list was scary to say the least. You need heart of steel to invest your hard owned money into such stocks. I have a gut feel that US may not be place for this investment idea unless you are in 2008-09 kind situation. I guess emerging markets that tend to be some what less efficient…and in even those…small cap universe may be target for this investment idea. But then liquidity can be huge issue. If it can be an issue in US then imagine in country like India what would be the problems. This strategy seems to be good for individual investors who want to keep aside part of their assets to generate alpha using this strategy.