Returns on Negative Enterprise Value Stocks: Money for Nothing?

Value investing is about finding and buying a bargain, a dollar selling for 70 cents or less. One of the most tantalizing apparent bargains offered by the stock market is the negative enterprise value (EV) stock: a stock that is trading for less than the net cash on the company’s balance sheet.1 Buying a negative EV stock seems like a no-lose proposition: Imagine a house selling for $1 million with a safe in the basement that contains $1.2 million in cash. Why would anyone offer up such a deal? If you find one, should you take it, or write it off as too good to be true?

To answer this question, I investigated the performance of all negative EV stocks trading in the United States between 30 March 1972 and 28 September 2012. I started with balance sheet data from Standard & Poor’s Compustat database and merged these data with price data from the database maintained by the Center for Research in Security Prices (CRSP). I then calculated historical enterprise values for every company every month, as well as matching forward 12-month returns. For example, Microsoft’s enterprise value on 31 August 2011 was $182 billion, and MSFT’s 12-month forward return from 31 August 2011 to 31 August 2012 was 19%. This is a total time-weighted return, including dividends and price appreciation. The enterprise value is based on Microsoft’s 2011 Q4 report, which was released on 21 July 2011, making it 41 days old on 31 August 2011. The merging process ensures that all fundamental data have been published to the market at least five days before they are used in EV calculations so as to minimize look-ahead bias. After this math was done, I filtered the dataset to include only negative EV stocks.

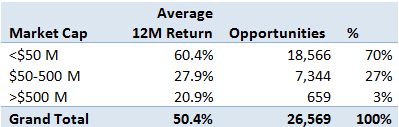

I found 2,613 stocks that at one point or another traded at a negative enterprise value between 1972 and 2012 (Microsoft, unfortunately, was not among them). The list has one entry per stock-month. That is, a stock that has traded at a negative enterprise value three months in a row will appear on the list three times. Each time is a different investment opportunity with its own forward 12-month return. The average stock spent 10.17 months (not necessarily consecutive) in negative EV territory. Thus, the list shows a total of 26,569 opportunities to invest in negative EV stocks.

The average return across all 26,569 opportunities was 50.4%. That is, if you had diligently watched the market over the last 40 years and invested $1,000 into each negative EV stock each month, your average investment would be worth $1,504 after holding that investment for one year, not including trading costs, taxes, and so on. Not bad!

As it turns out, this strategy works much better for individual than larger institutional investors because most of the investment opportunities are in micro-cap stocks with limited liquidity:

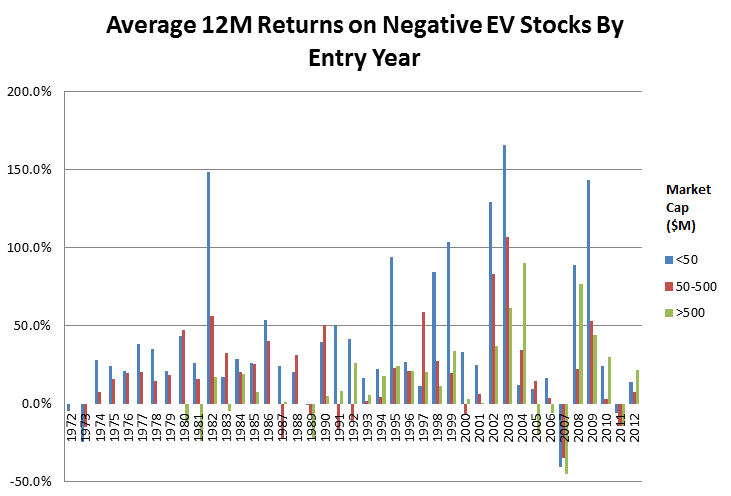

Only about 3% of the investment opportunities are in stocks with a market capitalization of half a billion dollars or more. These opportunities have come up with some regularity and have usually provided attractive returns but have on occasion lost a great deal as well:

In the chart above, the date axis shows the year of entry. Negative EV stocks bought in 2007 and held through 2008 lost 35–45%, doing just as poorly as or worse than the S&P 500 Index.

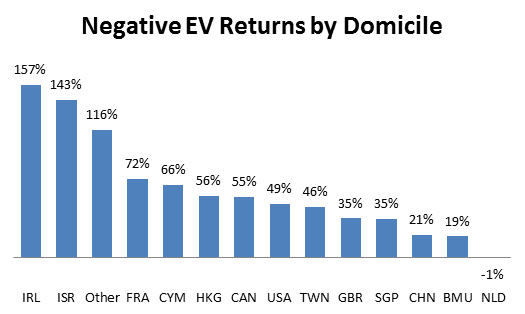

If you are undeterred by such drawdowns, you may be able to further improve your odds by looking at the country where the company is headquartered (see country codes here):

Negative EV stocks domiciled in Taiwan and especially China have done substantially worse than average (although still quite well), most likely dragged down by frauds. This effect may be magnified for smaller-cap companies.

In summary, negative EV stocks have offered attractive returns over the past 40 years and may be well worth a look, provided you can stand the volatility.

1. Enterprise value is defined (EV) as follows:

EV =

Common equity at market value (this line item is also known as “market cap”)

+ Preferred equity at market value

+ Minority interest at market value, if any

+ Debt at market value

+ Unfunded pension liabilities and other debt-deemed provisions

– Associate company at market value, if any

– Cash and cash-equivalents.

A negative EV stock is one where the cash exceeds all other factors in the equation. In practice, “cash” may be defined to include marketable securities. In that case, the marketable securities themselves may be over- or undervalued.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Great info – especially the due diligence on how it breaks down by domicile. I can’t believe the returns are as good as they are in countries with weaker oversight.

Fantastic work. A lot of data crunching went into this. Do the negative EV stocks on average, beat the market over the time period you would have invested? For example, is it just that after the 2008 bear market, lots of stocks were negative EV, so you would have been heavily invested for the recovery? Or do they outperform the relevant index?

Also, is there a correlation between the degree of negativity (EV/market cap) and subsequent performance? What does the scatter plot look like?

Thanks Fred! I appreciate the feedback. You ask good questions that I don’t have the answers to quite yet. My hunch is that the negative EV stock does outperform the S&P 500 on average, and there is an additional timing benefit from having more neg-EV opportunities when the market is cheap (BTW, right now by that metric the market is quite expensive). Haven’t checked the EV/MCap factor, but it would make sense… perhaps in a followup blog post.

Alon,

Do you have a chart that shows the size of the portfolio?

How are the returns affected with a concentrated portfolio of 25-50 equities?

Did you filter out stocks with incredibly low volume?

Thanks.

Here is my concern with your analysis, the universe you found is un-investable. There is not adequate liquidity to build a position. I think when you do a lot of this back testing they miss the liquidity issue. Moreover, I would be concerned that your holding period return was accurate. Many analysts have found errors i in the very small company universe. Regards HL

Thanks for the interesting post, Alon. Can you explain in detail how you defined the following (components of EV)?

– Debt at market value

– Unfunded pension liabilities and other debt-deemed provisions

– Associate company at market value, if any

– Cash and cash-equivalents.

Thank you.

Did you account for survivorship bias? In other words, what about all the stocks that had negative EV and went bankrupt and were subsequently delisted?

Great work! How do you take care of pension liabilities? Does EV take that into account? Also, how about insurance companies that make the list. Are insurance liabilities counted in EV?

regards

Great stuff.

I’m wondering if you publish a list of the companies that pass this test periodically and, if so, how I can get on the mailing list to receive it.

Thanks so much for your work.

Great write up. Do you have data on the volatility of these picks? Thanks!

Nice post. I like it. This is helpful for me.

how would we know it’s a fraud company or not? ADR stocks with negative enterprise value, such as ZA, should comply with US rules, right?

Umm, you avoid Negative Enterprise Value stocks in places like Nigeria, Mozambique, and most of the rest of the world, including China.

You also avoid those companies that are not current with their filings with the SEC.