Second Quarter 2020 Amid COVID-19: Investor and Audit Committee Considerations

Non-GAAP Measures: EBITDAC, or Not, Investor Be Aware

In an early April blog, “First Quarter 2020 Amid COVID-19: Non-GAAP Measures,” we included the following reminders:

We remind investors to consider the challenges we have previously communicated with respect to non-GAAP measures in our previous publications (Investor Uses, Expectations and Concerns on Non-GAAP Financial Measures, and Bridging the GAAP: Ensuring Effective Non-GAAP and Performance Reporting).

Investors should always consider potential abuses of non-GAAP measures, pandemic or not. These crises, however, put more pressure on such measures and investors must exercise a healthy degree of skepticism with respect to changes in existing measures or the creation of new metrics.

Although the aforementioned blog described the then–newly released SEC guidance allowing companies to reconcile to estimates of GAAP measures (i.e., because of expectations of potential impairments), the most salient point was the reminder that the pandemic would put pressure on non-GAAP measures.

Shortly after release of that blog, references to — and coffee mugs of —Earnings Before Interest Taxes, Depreciation, and Coronavirus (EBITDAC) began to emerge on social media.

In this blog, part of our continuing series Second Quarter 2020 Amid COVID-19, Investor and Audit Committee Considerations (Introduction, Cash Is Everything, Going Concern, Evaluating the Business), we highlight some of this publicity around EBITDAC and provide our take on the considerations for investors and audit committees.

THE HYPE

In May, articles began to appear in the Financial Times (“Pandemic Spawns New Reporting Term ‘EBITDAC’ to Flatter Books” and “Bond Investors Balk at Use Of ‘EBITDAC’ to Skirt Debt Restrictions”) on the topic of EBITDAC generated by the use of the term by companies to enhance earnings and ensure their ability to continue to borrow and meet debt covenants (“EBITDAC: How Companies May Seek to Increase Debt by ‘Adding Back’ Pandemic Losses”). The European Leverage Finance Association also published a letter highlighting such abuses.

Our Commentary

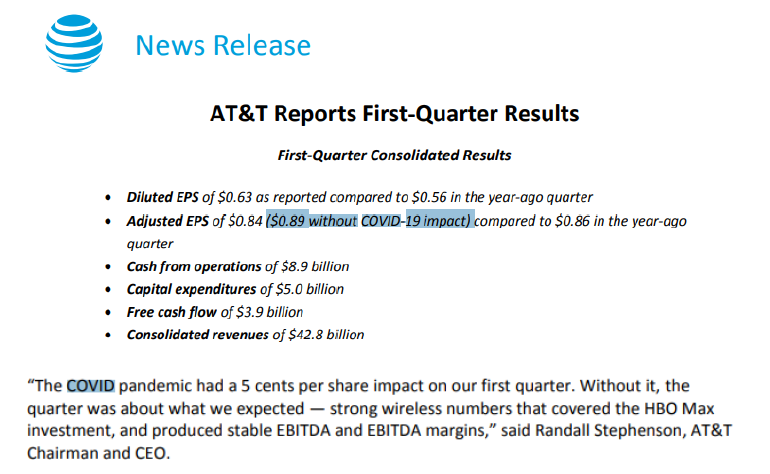

At CFA Institute we were called for comment in May on some interesting COVID-19 measures — we won’t call them non-GAAP as that might be a misnomer. We provided our comments in MarketWatch (“How Companies Are Becoming Creative with Accounting During the COVID-19 Pandemic”). One of the most interesting examples we were asked about was a disclosure made by AT&T. In a company press release, AT&T adjusted its adjusted earnings per share (EPS) to add back COVID expenses (see figure 1).

Figure 1. AT&T first-quarter results

In the second line of the press release, AT&T provides this double-adjusted EBITDA to add back COVID-19 costs, but later in the press release, the company says that it did not adjust for these COVID-19 expenses as they were expected to have a short-term impact (see figure 2). For investors, understanding the impacts in the segment information was challenging.

Figure 2. AT&T treatment of COVID-19 expenses.

But even more interesting than the press release was the table included in the investor briefing (see table 1). Read it. Confused? So were we. The bottom half of the table shows the COVID-19 expenses addressed in the press release, which were included in the GAAP earnings and adjusted to arrive at the aforementioned adjusted-adjusted EPS. Most confusing is the first half of the table. The lead-in is not clear, but what we have discerned is that the first half of the table represents estimated revenue not earned because of COVID-19 and its impact on EBITDA. The truly interesting part is that the loss of revenue for Warner Media and Wireless Equipment actually results in an increase in EBITDA. So, not earning the revenue resulted in a net benefit to shareholders. This is the story of the revenue that never happened. Interesting. Although not labeled EBITDAC, AT&T has made adjustments to add back costs and to provide numeric measures of lost revenue and EBITDA.

Table 1. AT&T 2020 earnings

Credit Rating Agencies Comment

Following this publicity, credit rating agencies, such as Moody’s (“Accounting Spotlight: Beware EBITDAC and Other Reporting Terms Linked to COVID-19”) and Fitch (“EBITDAC Is No Substitute for Through-The-Cycle Analysis”), published pieces highlighting the nature of these measures and warning debtors of their potential for abuse.

The Dialogue Continues

Throughout June and July, a variety of articles debated the nature of EBITDAC. We found these articles to be interesting and worth a read. See the Bloomberg pieces “Senators Stock Trades Make Trouble,” “Would You Like Those Earnings With or Without COVID?” and Thomson Reuters “Relax, Investors; There Is No EBITDAC Pandemic,” “Moody’s Warns Companies Not to Fudge Financial Results with Creative Metrics,” and “Loan Investors Raise Concerns Over EBITDAC.”

Looking at the Data

Using Calcbench, Olga Usvyatsky, a Boston College doctoral candidate, dug into the data for some additional insight, including “Looking at EBITDAC,” a summary of which is highlighted on Calcbench’s website, “Adjusting for COVID: Introducing EBITDA-C.”

US Creditors Weigh In

As reported in Bloomberg in late July, “‘Unreliable’ COVID Math Is Distorting Reality, Bondholders Warn,”a major bondholder industry group has asked regulators and auditors to “carefully scrutinize” an approach to coronavirus-era accounting that the group said should be of great concern. As noted in the Bloomberg piece, the Credit Roundtable indicated in a letter to the SEC that EBITDAC distorts and misrepresents companies’ earnings.

Regulators Outside the United States React to Half-Yearly Results

Following the aforementioned SEC release in April, and the media attention of late, global regulators have addressed such measures in a release by the International Organization of Securities Commissions. European regulators have issued guidance through the European Securities and Markets Authority and, in the United Kingdom, the Financial Reporting Council has provided its perspectives.

OUR TAKE

That’s the backstory on the emergence of the hype on this “catchy” acronym, EBITDAC. Here’s our take:

- First Quarter Saw Limited COVID-19 Impacts: Second Quarter Likely to Provide More Adjustments — Most of the “talk” about EBITDAC preceded the release of the second quarter and half-yearly results. The first quarter had only limited impacts of COVID. The second quarter presents the most significant impact of COVID. The likelihood of measurements that exclude costs or include revenues to provide the “normalized” earnings is a trend that likely will only increase in the second quarter and for the rest of 2020.

- EBITDAC May Not Be the Label, But EBITDAC May Be the Result — EBITDAC may peak people’s attention because it is “catchy,” but the reputation EBITDAC has gained in these few short months may make it less likely to be used because of the attention it has garnered. As a result, measures are likely to add back COVID-19 expense, or to add in revenues not occurring as a result of the pandemic, that are not labeled EBITDAC but that do the same thing. For example, as noted earlier, AT&T did not use the term EBITDAC but adjusted their adjusted EBITDA for COVID-19 expenses. Investors need to look beyond the EBITDAC “moniker” to see what is being adjusted and why.

- Beware of Non-GAAP Measures Not Labeled as Such — EBITDAC measures not only are not labeled as such, but non-GAAP measures of other kinds also may not be labeled as such. Consider, for example, gross margin without COVID-19. Although not labeled a non-GAAP measure, and without a reconciliation included, Boston Beer — as discussed in the aforementioned MarketWatch article — included gross margin without addressing the effects of COVID-19. This, too, is a non-GAAP measure. If investors see traditional financial statement ratios or measures that include non-GAAP items in their numerator or denominator, they should be seeking a reconciliation.

- Revenue and Earnings Adjustments: Fiction or Non-Fiction? Non-GAAP Measures or Alternative Performance Measures? More Detailed Information Than Segment Level Data? — Add backs of revenue that would have happened if not for the pandemic are works of fiction, as noted in many of the articles published in May and June. Investors need to decide whether the story being told has any elements of truth according to the measures and whether the measure they arrive at have informative content.

It is also important to remember that such adjustments do not meet the definition of a non-GAAP measure. A non-GAAP measure adjusts items included within the GAAP measure but that are removed to arrive at a non-GAAP measure. These “lost revenues” are not included in the GAAP measure. As such, these measures really are alternative performance measures — more akin to a projection or forecast of more normalized revenues or earnings — rather than non-GAAP measures. Investors need to keep this in mind as they look at these measures.

Another point of interest about these measures is that they show management (as in the case of AT&T) has more detailed information that they review and analyze in running the business than they traditionally say is available when determining the segment information or revenue disclosures. The pandemic has highlighted to investors that management has more detailed information than traditionally is considered to be available in making revenue and segment disclosures, and isolation of such information shows they are using it to manage the business. An important learning for standard setters and regulators when considering segment disclosures.

- Expense Adjustments:

- Understand the What, Where, and Why— It is important to understand the nature of the expense adjustments being made. Specifically, this includes the type of cost, for example, personal protective equipment (PPE) or more office space, and whether it is truly related to the pandemic. First-quarter expenses likely will be different than second-quarter costs, which also are likely to be more significant. The first quarter may include costs such as PPE, whereas the second quarter may include a panoply of costs or unusual items that include not only PPE and office space but also furlough and restructuring costs, supply chain costs, rent concessions, impairments, and possible government assistance. Investors need to understand the nature of the costs being adjusted and even those not being adjusted. If, for example, rent concessions reduce GAAP expenses, investors need to understand whether they are being added back to arrive at the more normalized non-GAAP rent expense. Furthermore, we understand anecdotally that some companies are isolating or segregating expenses that are not incremental and are adjusting for them. For example, fixed costs resulting from idle or excess capacity may be added to show an improved gross margin.

When expenses are added back to arrive at non-GAAP measures, we have found them to be difficult to trace back to the segments and financial statement line items they effect. This makes understanding the effects more challenging. Investors need to be able to understand the location (i.e., financial statement caption or segment) of an adjustment to truly understand its effects.

Investors not only need to look closely at the nature of the costs but also understand why they are being adjusted and their persistency. Non-GAAP measures are meant to exclude nonrecurring items, but these new costs may not be nonrecurring. Said differently, they may not have been normal relative to the past, but they will be part of the new normal for the foreseeable future. This actually may make them recurring rather than nonrecurring items — and thus not really meeting the definition for non-GAAP measurement presentation. More on that to follow.

- Impairments: Consider Their Information Content — The SEC, in their release, provided the capacity for companies to reconcile from estimates of GAAP measures because of the potential for impairments and the time to compute them, but these didn’t materialize in the first quarter. Investors may want to keep their eyes peeled for these types of measures as well as the traditional exclusion of impairments to arrive at non-GAAP measures. Impairments have information content. We specifically call them out in the context of the pandemic because they provide insight into, and demonstration of, the fact that management has an outlook for the future that may not be as optimistic as before. Impairments require consideration, and a quantitative articulation, of management’s future outlook. For that reason, investors need to pay attention to and consider these carefully.

- Beware of the Kitchen Sink — Investors need to be cognizant of the “everything but the kitchen sink” potential of this, and coming, interim periods. Believing investors will ignore this interim period’s awful results, companies may use this quarter, and coming quarters, as an opportunity to clean up the balance sheet and toss everything in but the kitchen sink. These items may or may not be “adjusted” depending on the attention management wants to draw, or not draw, to them. Investors should be mindful of this potential and make their own decision as to the treatment of these expenses.

- Questions to Consider Regarding the New Non-GAAP or Alternative Performance Measures — As we consider the adjustments included in arriving at these non-GAAP measures or alternative performance measures, we believe the adjustments may include more information content than the non-GAAP measure derived by their subtraction or addition. Although investors should keenly watch the development of these measures and their construction, it is also necessary to consider a few questions regarding the measures, including the following:

- Why the Need for a New Measure? — Investors should consider whether the new measure is truly necessary. This is particularly true if the measure is more than just an isolation of COVID-19-related incremental costs and is the creation of a new non-GAAP measure, key performance indicators, or alternative performance measures of some type. Investors need to inquire as to why such a measure is really necessary now, discuss the measure with management, and make their own decision. The complaint of many lenders and credit associations is that many of these measures are being created to ensure compliance with debt covenants and to allow additional borrowings. This may be true for some, but not all, entities. For that reason, investors need to evaluate whether the measure helps them better understand the business or is being done to reflect a more positive view of the business and then should decide for themselves if the new measure is meaningful.

- Do the Adjustments Arrive at a More Normalized Measure? — Many non-GAAP adjustments and the resulting measures of EBITDA are done to arrive at more meaningful or normalized measures of income and cash flows, but amid the pandemic, investors need to consider whether this is the case with the new measure. Consider for example: What is normal or normalized earnings or cash flows amid this pandemic? Do these measures really result in a more normalized measure? Is normalizing the abnormal that will continue to be abnormal even meaningful? Won’t some of the adjustments actually reoccur and be a part of the new normal?

- How Useful Is the New Measure Going Forward? — Investors also need to evaluate whether the new measure is meaningful in considering the future. Said differently, is the measure truly more forward-looking?

- Will These Affect Compensation? Although not always top of mind in the discussion of these metrics, they generally are integral to management compensation. For that reason, investors need to understand whether any new non-GAAP measures are going to be used to determine compensation at year-end. Compensation committees may use such adjusted measures to isolate the items management has the ability to control and to measure their performance. If they are to be used for compensation, a reconciliation is needed, and the compensation committee needs to explain why this is a better measure of management performance. In a 2019 letter to the SEC, we highlighted the importance of this issue to the SEC supporting the Council of Institutional Investors’ petition that would require such reconciliations as part of the proxy.

- What Is the Comparability of the Measures? — As investors receive such measures, it is also important for them to be cognizant that they will lack comparability not only between companies but also between periods for the same company. As such, they may need to dissect the measures for the nuggets of information they find most useful.

- What is Management Communicating About Themselves? —The position of CFA Institute has been that non-GAAP measures communicate information not only about the results of the business but also about the nature and behavior of management. These measures reflect how management tells the company’s story and the extent to which adjustments will be made to narrate that story. Investors should keep this top of mind as they review non-GAAP measures during the 2020 pandemic.

INVESTORS BE AWARE

A plethora of non-GAAP and alternative performance measures will arise throughout 2020 to explain the effects of the COVID-19 pandemic. Investors need to be aware of the variety of measures and critically evaluate the nature of the adjustments, what the resulting measure is meant to communicate, why the new or revised measure is being presented by management, and why the measure is a better or more meaningful measure. Investors should be cognizant of the story being told by the non-GAAP or alternative measure and the adjustments. This information should be used as a jumping-off point for a conversation with management. In short, investors should be aware and employ critical thinking skills as they evaluate such measures.

Image Credit @ CFA Institute 2020