FASB Exposure Draft on Disaggregation of Income Statement Expense: A Glass Half Empty

On 31 July 2023, the Financial Accounting Standards Board (FASB) issued a long-anticipated exposure draft for a proposed standard that would require public companies to include disaggregated information about certain income statement expense lines in the notes to the financial statements.

Investors have been requesting disaggregated information broadly, and about income statement expenses specifically, for at least 15 years, ever since the FASB issued Preliminary Views on Financial Statement Presentation in 2008. Our 2007 publication A Comprehensive Business Reporting Model articulates investors’ need for disaggregated information and describes the shortcomings of the current financial reporting model, which aggregates dissimilar items into functional categories on the income statement.

After taking a preliminary look at the proposed standard, we are sharing our initial thoughts with CFA Institute members and with investors in general, explaining the new disclosures through a hypothetical example provided by the FASB. We will offer our full analysis in a public comment letter to the FASB and are interested in investors’ views to inform our response, so we encourage you to weigh in.

Overall, while the proposed partial disaggregation would be helpful to investors, we are disappointed by its limited scope after waiting so many years. We also have concerns as to what it implies about the financial reporting capabilities at for-profit companies relative to their not-for-profit peers.

The New Disclosures

The proposed standard would require public companies to accomplish the following four tasks in the notes to financial statements on a quarterly basis:

1. Identify Expenses on the Income Statement That Will Be Disaggregated

First, a company would identify on the income statement expense lines that contain any of the following:

- Inventory and Manufacturing Expense: This is similar to cost of goods sold but is a combination of two new terms: “inventory expense” and “manufacturing expense.” The FASB defines inventory expense as one resulting from the sale, consumption, or impairment of inventory, while leaving management to define “manufacturing expense.”

- Employee Compensation: This includes salaries, wages, retirement and health benefits, stock-based compensation, termination benefits, and other payments to employees for services.

- Depreciation

- Intangible Asset Amortization

- Depreciation, Depletion, and Amortization (DD&A) Recognized as Part of Oil- and Gas-Producing Activities.

Example of Expense Identification

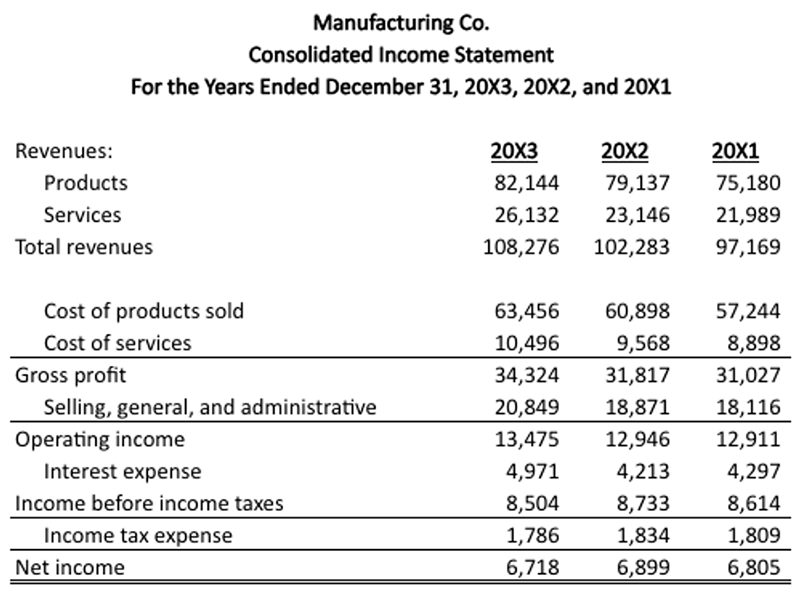

Manufacturing Co. is a hypothetical manufacturer with some service operations. The company’s consolidated income statement for the years ended 31 December 20X3, 20X2, and 20X1 is as follows:

Manufacturing Co. identifies cost of products sold, cost of services, and selling, general, and administrative expenses for disaggregation because they contain at least one of the following: inventory and manufacturing expense, employee compensation, depreciation, amortization, or DD&A.

The company does not identify interest expense or income tax expense for disaggregation because they do not contain any of the specified types of expenses.

2. Disaggregate the Identified Expenses

Next, the identified expense lines would be disaggregated into the five expense categories described above in tables in the notes to the financial statements.

Certain amounts that already must be disclosed under US GAAP would also be required to be broken out separately, subject to certain conditions. The FASB published a prescriptive list of expenses that fall into these categories in paragraphs 250-40-50-12 and 250-40-50-13 in the exposure draft.

The FASB would also require that some outlays — warranty expenses, impairment charges, and exit/disposal costs, for example — be broken out separately. Others, such as operating lease costs, would only have to be broken out if they are contained solely in one expense line. If they are in multiple expense lines, disaggregation would not be required. The FASB provided no rationale for this beyond cost reasons, which we find vexing.

Any remaining amounts in identified expense lines after disaggregation into the specified categories would be grouped into “other,” which is described qualitatively.

Example of Expense Disaggregation

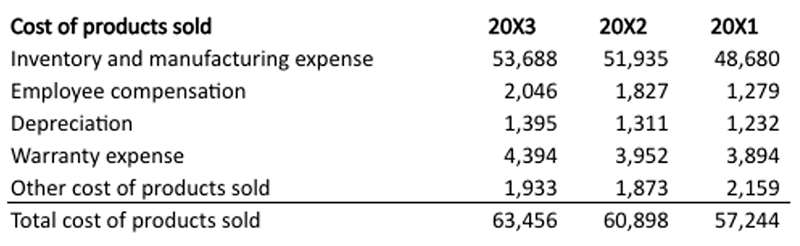

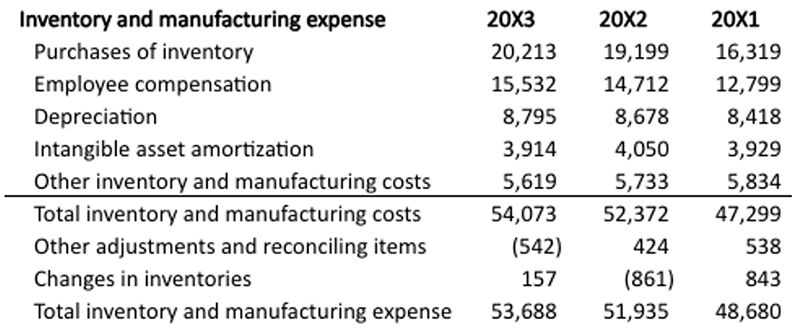

In the notes to the financial statements, Manufacturing Co. discloses the following disaggregation tables for cost of products sold, cost of services, and selling, general, and administrative expenses.

Other cost of products sold consisted primarily of amounts paid to carriers for freight services related to contract fulfillment for the years ended 31 December 20X3, 20X2, and 20X1.

Other cost of services consisted primarily of operating lease and travel costs for the years ended 31 December 20X3, 20X2, and 20X1.

Other SG&A consisted primarily of professional services fees, operating lease expense, and the costs paid to third parties for printing, publications, and advertising for the years ended 31 December 20X3, 20X2, and 20X1.

“Other” in this example ranges in materiality by expense line. In 20X3, “other cost of products sold” represented 3% of cost of products sold, while “other SG&A” represented 25% of total SG&A. Because the FASB has specified only five categories to disaggregate expenses into, in practice, “other” lines may be large, which limits the disaggregation’s utility.

3. Further Disaggregate Inventory and Manufacturing Expense

The FASB would require companies to provide another table in the notes to the financial statements that further disaggregates inventory and manufacturing expense. This is a combination of two new terms: “inventory expense” and “other manufacturing expense.” The FASB defines inventory expense as one resulting from the sale, consumption, or impairment of inventory and defers to management to define “other manufacturing expense.”

Inventory and manufacturing expense are disaggregated into the following categories of costs incurred: purchases of inventory, employee compensation, depreciation, intangible asset amortization, and DD&A.

Costs incurred would include those that are either capitalized to inventory or directly expensed during the current period. On an annual basis, the company would disclose its definition of other manufacturing expenses.

Example of Inventory and Manufacturing Expense Further Disaggregation

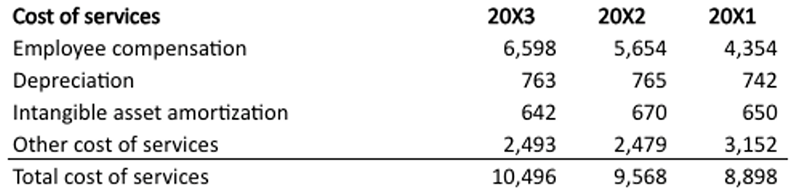

Manufacturing Co. discloses the following additional table in the notes to the financial statements:

The FASB has chosen a “costs incurred” approach for this disaggregation. The components of inventory and manufacturing expenses broken out here are inventory purchased/produced in the period, not the cost of inventory recognized as cost of products sold in the period, which may contain inventory costs capitalized in prior periods. Therefore, the FABS uses a reconciling item, “change in inventories,” for balance, capturing differences in the amount of inventory purchased/produced vs. inventory sold in the period.

Differences in inventory purchased/produced vs. inventory sold in the period, or inventory builds and burns, occur due to changes in customer demand, inflation, and inventory obsolescence, among other reasons.

Why did the FASB choose the “costs incurred” approach, rather than requiring a disaggregation of actual costs of goods sold (capitalized costs)? Because companies said that disaggregating capitalized costs would be prohibitively expensive, citing the use of standard costs and cost flow assumptions and because some costs may have been capitalized to inventory many years ago.

4. Define and Disclose Selling Expenses

A definition and disclosure of selling expenses in the notes to the financial statements would be the final new disclosure requirement. The FASB leaves it to management to define selling expenses, so different companies would use different definitions, which would be subject to change. Management would not be required to disclose the location of selling expenses on the face of the income statement, but presumably it is within SG&A, which may allow investors to calculate G&A.

Neither the FASB nor SEC defines SG&A (or selling, general, or administrative expenses individually) today, but we view the FASB’s decision to defer to management as a missed opportunity that would challenge comparability in practice. That said, we expect the disclosure of selling expenses to be useful for investors, as selling expenses should be more variable with respect to sales volume than G&A.

Example of Selling Expense Definition and Disclosure

During the years ended 31 December 20X3, 20X2, and 20X1, Manufacturing Co.’s selling expenses, which include those related to marketing, promotional activities, and client relationship management, were $13,425, $12,123, and $11,585, respectively.

Our Take on the New Disclosures

Overall, while the new disclosures represent incremental information to investors that may help in modeling and valuation, we are discouraged on several fronts.

Insufficient Disaggregation

We expect a high percentage of disaggregated expenses to wind up in “other” buckets in practice just as “other” accounted for 24% and 25% of Manufacturing Co.’s cost of services and SG&A. “Other” is not disaggregated but only described qualitatively.

“Other” will include professional services fees, costs paid to third parties for information technology, rent, utilities, regulatory and licensing fees, advertising costs, and other common expenses.

This is a result of the FASB choosing a partial disaggregation approach by requiring only a handful of categories into which expenses must be disaggregated.

Investors sought a full disaggregation of expenses, but companies told the FASB that to prepare and disclose for cost of goods sold would be prohibitively expensive and “potentially impracticable”:

“When the project was originally added to the Board’s agenda, the Board considered whether to require disaggregation of functional expense captions, such as cost of sales and SG&A, into their natural components (for example, compensation, utilities, and rent). While feedback from investors indicated that this type of disaggregation would yield decision-useful information, preparers expressed concerns that a requirement to fully disaggregate functional expenses by nature would be very costly and potentially impracticable for cost of goods sold.” (Emphasis added.)

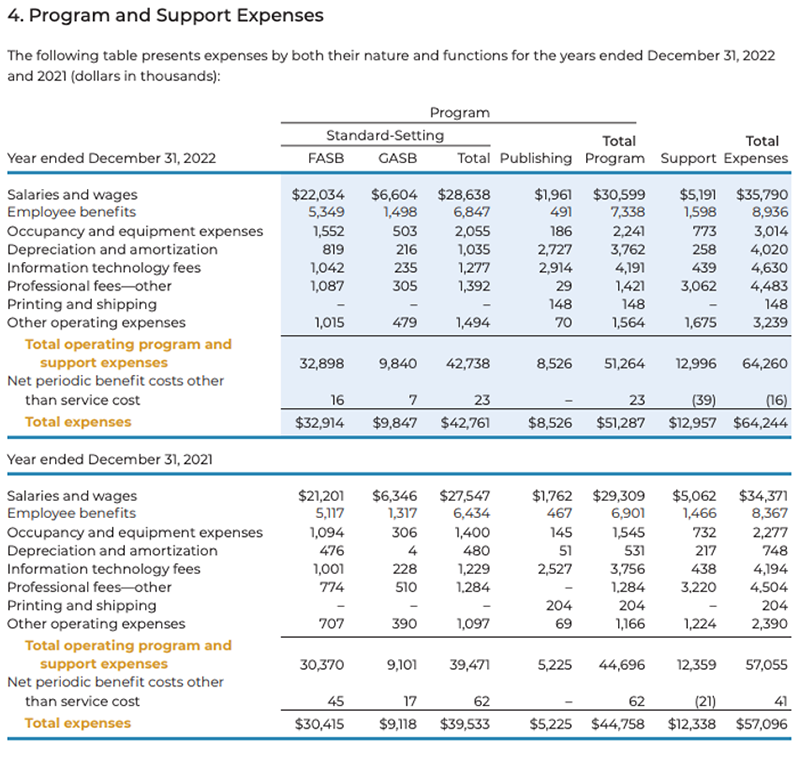

This stands in stark contrast to US GAAP reporting requirements for not-for-profits. Since 2016, all not-for-profits must disaggregate income statement expenses by the type of program activities they support (which resembles a break down by segment) and the nature of the expense, which is not arbitrarily limited to several categories. The breakdowns of expenses by program activities and nature reconcile with the expenses reported on the face of the income statement.

For example, in its 2022 annual report, the FASB’s not-for-profit parent organization, the Financial Accounting Foundation, broke down its income statement expenses according to their nature and activity in the notes to the financial statements. This is far more granular than what would be required of public, for-profit companies in the proposed standard.

Financial Accounting Foundation Income Statement Expenses

The FASB may have information that suggests financial reporting capabilities have deteriorated since 2015. In the exposure draft introducing full disaggregation of expenses by all not-for-profits that year, the FASB observed:

“Information about expenses by their nature also can be useful in distinguishing relatively fixed costs from variable or discretionary costs, which can be useful in assessing an entity’s sustainability. In addition, the [FASB] observed that because substantially all entities track and manage their expenses by natural classifications, the cost to provide that information is minimal. As a result, the [FASB] decided to extend to all NFPs the requirement to report operating expenses by both their nature and their function (and nonoperating expenses by nature with function permitted).” (Emphasis added.)

This is hard to believe. Information technology has kept advancing, especially since the COVID-19 outbreak led many companies to accelerate their “digital transformations.” With the latest accounting software from Oracle and SAP, for example, users can drill deep into the data, from financial statements to individual transactions.

Additionally, we wonder about companies’ comments to the FASB. Management teams often discuss the composition of expenses and their drivers on earnings calls and in the MD&A section of 10-Ks and 10-Qs. Are these comments not substantiated by data?

Does Not Work with Segment Disclosures

As we describe in detail in “Segment Disclosures: Investor Perspectives,” segments are crucial to investor models and valuations because the consolidated financial statements aggregate multiple businesses with different fundamental drivers, prospects, and risk factors. Segment disclosures can materially affect valuations. The superlative example is Amazon’s initial segment disclosure for Amazon Web Services (AWS), later called the “AWS IPO,” which caused a re-rating of Amazon shares as investors began to value the company differently.

Unfortunately, the FASB’s proposed standard on income statement expense disaggregation does not work with segment disclosures for the following reasons:

- Only consolidated income statement expenses, not segment expenses, qualify for disaggregation.

- Income statement expenses are disaggregated by nature, not segment.

- “Significant expenses,” the new type of segment expense the FASB will require in its new segment reporting standard, are defined by management and do not reconcile with expenses on the face of the income statement or with the expenses reported in the disaggregation footnote. Adding to confusion, management may use the same captions for segment and disaggregated income statement expenses with different definitions.

Investors are left to reconcile the consolidated income statement, segment disclosures, disaggregated income statement expense footnote, and related non-GAAP measures with one another. Management has the reconciliation but its disclosure will be voluntary, unless the FASB changes its mind.

Again, this all stands in contrast to requirements for not-for-profits under US GAAP since 2016.

Public vs. Private vs. Not-for-Profit

Private, for-profit companies are scoped out of the proposed standard, and they have always been scoped out of segment disclosures entirely. If the proposed standard (and the proposed segment standard from earlier this year) are issued as written, the landscape for expense disaggregation by entity type will be:

| Entity Type | Income Statement Expense Disaggregation Disclosures | Reporting Segment Disclosures |

| Not-for-Profit | By nature and type of program activity Disaggregation by nature is not limited to certain categories | (Not-for-profits do not report segments but do report distinct program and support activities, which are similar) Expense disaggregation by program activity and nature, reconciled with expenses reported on the face of the income statement |

| Public, for-Profit | By nature Disaggregation by nature is limited to five specified categories | “Significant expenses” for each segment are defined by management and disclosed No reconciliation with income statement expenses |

| Private, for-Profit | None | None |

The FASB appears to have information that suggests for-profit companies do not have the same degree of financial reporting sophistication as not-for-profits:

“The [FASB] has previously considered requiring that business entities disaggregate certain functional expenses fully by nature, similar to the existing requirements for not-for-profit entities. However, business entity preparers have communicated repeatedly that the full disaggregation of functional expenses by nature would be prohibitively costly. Specifically, many preparers explained that their systems are not configured to disaggregate functional expenses by nature and that doing so would require extensive and costly changes to systems, processes, and controls. . . Requiring the disaggregation of fewer natural expense categories, while potentially still costly, would be less costly than requiring the full disaggregation of functions by nature.” (Emphasis added.)

Given the advances in information technology since the 1980s, as well as public companies’ financial reporting and internal controls requirements under the Sarbanes-Oxley Act of 2002, we find all this disconcerting.

Not-for-profit entities and their stakeholders are important, but millions of retirees are not invested in their equity as they are in that of public companies and of the many private companies owned by pension funds and other institutions. It is simply outrageous that for-profit companies cannot comply with the same standards as not-for-profits.

Prospective vs. Retrospective Adoption

The FASB did not announce an effective date, as there are several more deliberative steps in the standard-setting process after receiving public comments on the proposal, which are due on 30 October.

The FASB proposed that the standard be adopted on a prospective basis from the effective date and that it would not require issuers to provide disclosures for prior periods, including those presented for comparative purposes in new filings. If, for example, the effective date is 1 January 2025, an issuer would make these disclosures for 1Q 2025 in its 10-Q but is not required to do so for 1Q2024 even if 1Q2024 information is included in that same 10-Q. Unless an issuer voluntarily applies this standard to prior periods, it will take years for investors to accumulate comparative information from which to observe trends and draw inferences.

How Will This Work with Non-GAAP Financial Measures?

Virtually all large public companies report at least one non-GAAP financial measure, such as adjusted earnings, expenses, and constant currency growth rates.

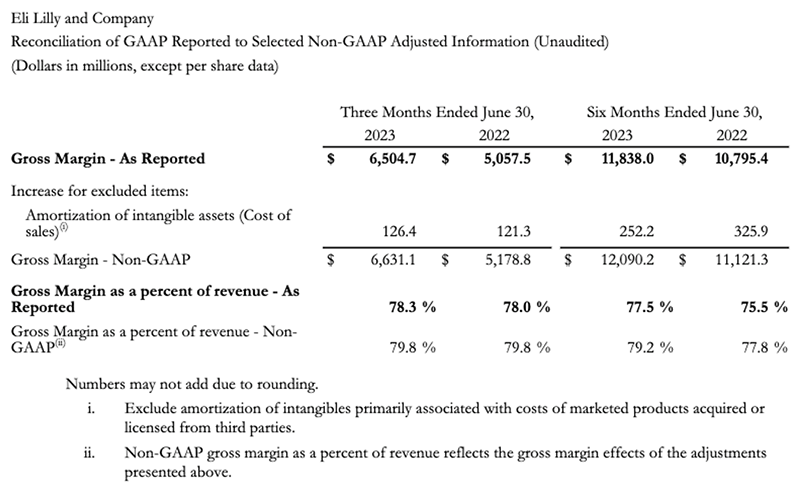

One function of non-GAAP financial measures is disaggregation. For example, Eli Lilly breaks out certain items — as defined and selected by management — within GAAP income statement expense lines to calculate adjusted, non-GAAP measures. Eli Lilly adds back amortization of certain intangible assets (related to acquired or licensed products) to cost of sales to arrive at non-GAAP gross margin.

Source: Eli Lilly and Company

If the FASB’s proposed standard is implemented, Eli Lilly will be required to provide a disaggregation of cost of sales that will include amortization of intangible assets, but in total, not specifically for acquired or licensed products.

Will companies modify their non-GAAP financial measures to align with the new disaggregation footnote, change the captions to avoid confusing investors, or do away with certain non-GAAP measures if they are redundant with the disaggregation footnote? We think the last option is unlikely because non-GAAP measures allow management flexibility in reporting numbers as they like, but it remains a possibility.

In summary, while investors stand to gain from proposed partial disaggregation, we feel the new standard has not been worth the wait. We are also worried about the apparently dismal state of financial reporting capabilities at for-profit companies vs. not-for-profits.

The deadline for comments on the FASB’s exposure draft is 30 October 2023. We will respond with a comment letter on behalf of CFA Institute and would like your input. Please share your thoughts below or write to the author at [email protected].

If you liked this post, don’t forget to subscribe to Market Integrity Insights.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Image credit: ©Getty Images / Brooke Pennington

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Market Integrity Insights. Members can record credits easily using their online PL tracker.