What Happens to the Market if America goes to War?

The stock market hates uncertainty, and there is plenty of uncertainty with respect to the Middle East these days. With the stock market at an all-time high, we are frequently asked about the situation in Syria, and whether now might be a good time to beat a hasty retreat from stocks. To address these concerns, we reviewed historical capital markets performance during times of war.

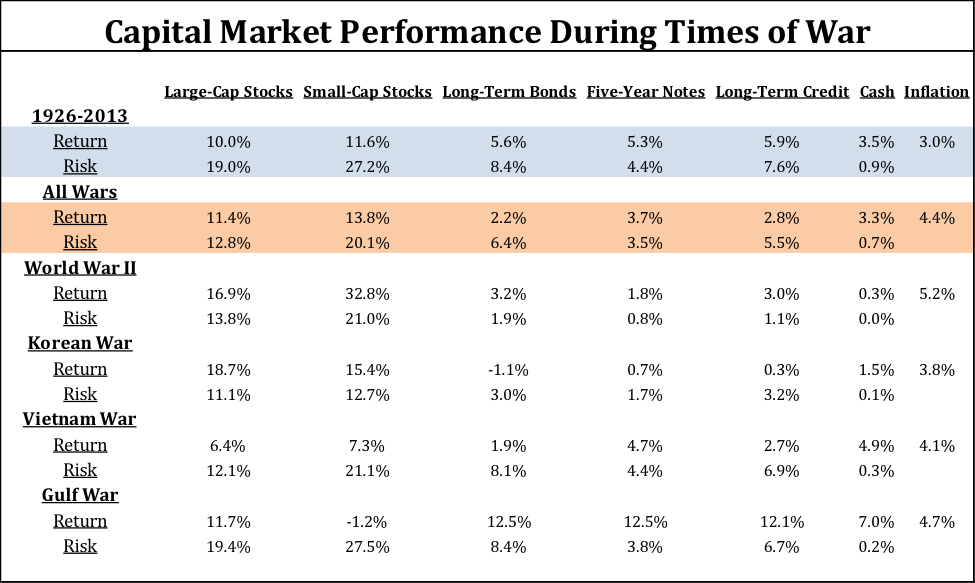

We looked at returns and volatility leading up to and during World War II, the Korean War, the Vietnam War, and the Gulf War. We opted to exclude the Iraq War from this group, as the Iraq War included a major economic boom, and subsequent bust, that had very little do with the nation’s involvement in a war.

As the table below shows, war does not necessarily imply lackluster returns for domestic stocks. Quite the contrary, stocks have outperformed their long-term averages during wars. On the other hand, bonds, usually a safe harbor during tumultuous times, have performed below their historic averages during periods of war.

The full period of study, 1926 through July 2013 is shaded in blue and provides a “control” group for comparison. Periods of war are highlighted in red. All of the individual wars we considered are listed below. Interestingly, both large-cap and small-cap stocks outperformed with less volatility during war times. The Vietnam War was the one exception, where stock returns were worse than the full period average. Even then, though, the returns were positive and above those of bonds and cash.

It is interesting to note that stock market volatility was lower during periods of war. Intuitively, one would expect the uncertainty of the geopolitical environment to spill over into the stock market. However, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average.

Capital market returns during the Gulf War were different from other wars. This war was very short, spanning less than a full year. This period also coincided with an oil price spike that helped push the economy into a brief recession. The idea of recession during war time was fairly new, and reflected the changing U.S. economy. During previous wars, the economy was more exposed to capital goods and natural resources, which experienced greater demand to feed the war. However, by the 1990s, the economy had shifted away from heavy industry and toward the current “knowledge-based” economy. Thus, military demand had less of an impact, for better or worse, on economic growth.

Bonds generally underperformed their historical average during periods of war. This is likely, at least in part, because inflation has been higher during war times. Bond returns have historically been negatively correlated with inflation. Another explanation is that governments borrow more during wars, thus driving bond yields up and bond prices down. With the higher inflation and increased government borrowing associated with war time, investors seeking safety may want to think twice before shifting assets from stocks to bonds.

There are many economic and fundamental factors that impact security prices. Occasionally, a single event is powerful enough to dominate these other factors to singly influence capital market returns. However, historically speaking, this has not been the case with wars. Economic growth, earnings, valuation, interest rates, inflation, and a host of other factors will ultimately decide the future direction of the stock and bond markets. While a knee-jerk decline is possible if the U.S. or another country attacks Syria, history suggests that any market decline should be short-lived.

Sources and Disclaimers:

The indices used for each asset class are as follows: the S&P 500 Index for “Large-Cap Stocks;” CRSP Deciles 6-10 for “Small-Cap Stocks;” Long-Term U.S. Government Bonds for “Long-Term Bonds;” Five-Year U.S. Treasury Notes for “Five-Year Notes;” Long-Term U.S. Corporate Bonds for “Long-Term Credit;” One-Month Treasury Bills for “Cash;” and the Consumer Price Index for “Inflation.” All index returns are total returns for that index. Returns for a war-time period are calculated as the returns of the index four months before the war and during the entire war itself. Returns for “All Wars” are the annualized geometric return of the index over all “war-time periods.” “Risk” is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

If you liked this post, don’t forget to subscribe to Inside Investing via Email or RSS.

One comment on “What Happens to the Market if America goes to War?”