The First Republic Takeover: What Happened?

First Republic’s investment of its significant uninsured deposits in jumbo loans left it illiquid in a rising interest rate environment. And so commenced the second largest bank failure in US history.

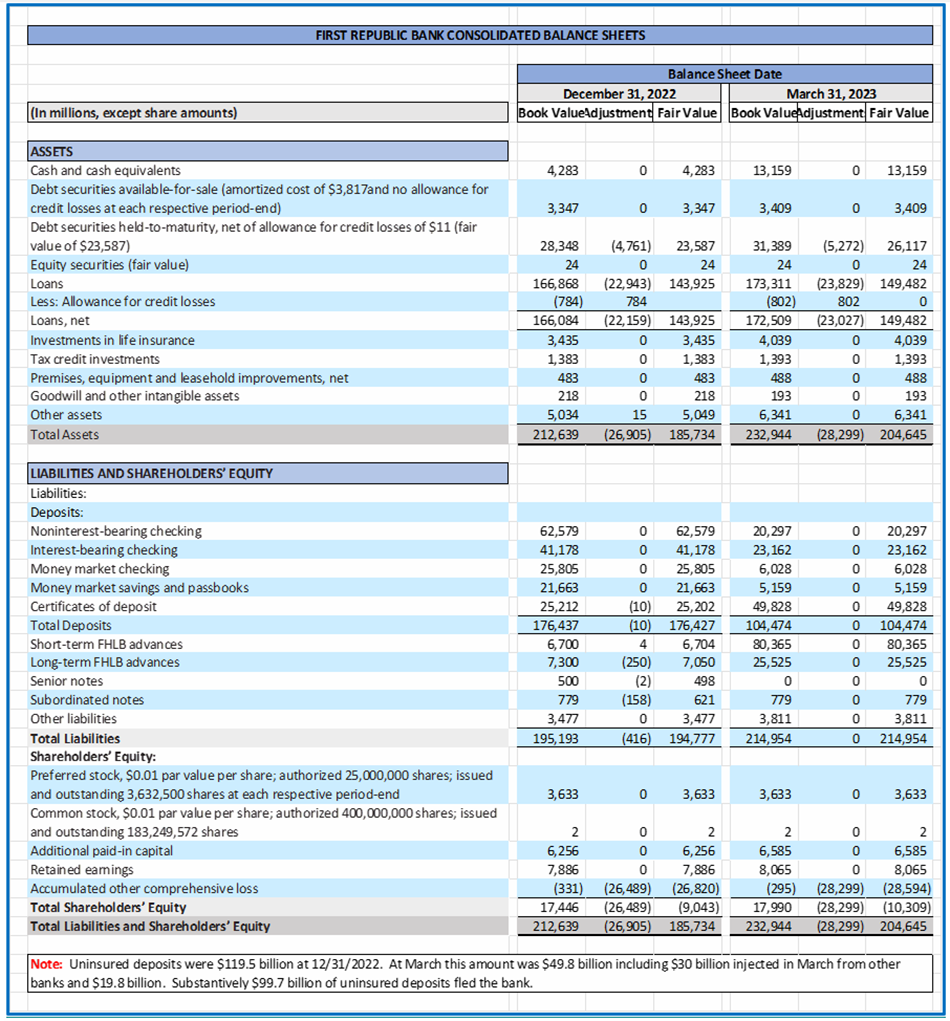

A Bloomberg article, “First Republic’s Jumbo Mortgages Brought On Bank’s Failure,” by Hannah Levitt, Jennifer Surane, and Sonali Basak, inspired me to revisit First Republic’s recent difficulties. So, I looked at the press release the bank issued 24 April 2023 and updated the fair value balance sheets as of 31 December 2022 to one that I crafted as of 31 March 2023.

The First Republic press release includes a balance sheet but fair values weren’t among the data provided. Since interest rates have not changed substantially since year-end — likely a slight improvement in fair value due to a decline in rates — I used an estimated allocation of fair value based on fair values at 31 December 2022 and multiplied by the 31 March 2023 book value balances to arrive at an estimate of fair value. I passed on this analysis for the liabilities given the adjustments were small at 31 December 2022.

The 31 March 2023 balance sheet demonstrates that additional borrowings of $90 billion from the federal government, along with $30 billion of uninsured deposits from other banks in March 2023, supported the reduction (withdrawal) of uninsured deposits from $119.5 billion at 31 December 2022 to $19.8 billion at 31 March 2023.

First Republic had limited cash and saleable assets of $7.6 billion and $119.5 billion in uninsured deposits, as the 31 December 2022 balance sheet noted. The vast majority of assets at year-end 2022 were loans and held-to-maturity securities with a total $22 billion unrealized loss. Selling those would make the bank insolvent. While there were $14.4 billion of saleable assets and $19.8 billion of uninsured deposits at 31 March 2023, in substance the federal government, through its borrowings, owned the bank by quarter’s end — and made the decision to sell last week.

As the Bloomberg writers observe, the bidders simply outwaited the federal government.

For more insights from Sandy Peters, CPA, CFA, check out “The SVB Collapse: FASB Should Eliminate ‘Hide-‘Til-Maturity’ Accounting.”

If you liked this post, don’t forget to subscribe to Market Integrity Insights.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Image courtesy of Sarah Stierch (CC BY 4.0)e/cropped

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Market Integrity Insights. Members can record credits easily using their online PL tracker.

Would like to subscribe the series. Thanks.